- Primal Thesis

- Posts

- $650bn AI Capex

$650bn AI Capex

📈 Dow Hits 50,000 For The First Time

🚀 SpaceX Acquires xAI in Largest Merger in History

🏭 ISM Manufacturing PMI Rises To Highest Level Since 2022

🤖 Hyperscalers Plan $650Bn in AI Capex

💰 Strong Earnings Momentum Continues

QUOTE OF THE WEEK:

“The market wants to see a bit of a ‘show me’ moment—show me the productive uses of this AI Capex, show me how people are actually using it. We’re using it to reduce what we call “no-joy work,” but the bigger question is whether it will displace us or simply disrupt us. That’s what the market is trying to figure out, and we’re not going to get answers quickly. This is a generational transformation, and we’re going to be living through a bumpy ride.” - Priya Misra, Portfolio Manager at JPMorgan

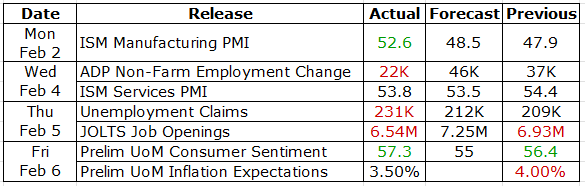

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC EOD 2/6

WEEKLY MARKET WRAP:

Good Afternoon. Dow hit 50k fr the first time this week, thanks to rotation out of tech. Nasdaq dropped ~2% amid concerns about AI capex and also investors’ sudden reassessment of disruptive potential following Anthropic’s Feb 5 release of Claude Opus 4.6. Earnings remain strong, and eventually, stocks follow earnings. Macro data indicated a softening labor market, but the manufacturing PMI was strong, and services have been doing well for a while.

Below are the key things to note this week:Selloff in enterprise software and SaaS stocks:

The selloff in enterprise software and SaaS stocks—erasing billions for incumbents like Salesforce, Workday, and Thomson Reuters—erupted after Anthropic's February 5 launch of Claude Opus 4.6, which showcased agentic AI capabilities (autonomous coding, multi-step orchestration, seamless tool integration) and Claude Cowork plugins tailored for finance, legal, and marketing workflows, directly threatening to automate or erode the human-assisted moats of legacy tools. Investors, already jittery from earnings season, saw this not as vague hype but as a credible, scalable path to revenue cannibalization—e.g., AI agents handling comprehensive legal research or end-to-end financial modeling—prompting a rapid "wake-up call."

Manufacturing Resurgence:Manufacturing PMI rebounded to 52.6 in January from 47.9, marking a return to expansion and extending overall economic growth to a 15th month. New Orders surged to 57.1, the strongest reading since February 2022, while Production rose to 55.9, its highest level since early 2022. Prices remained elevated at 59; Backlogs turned expansionary for the first time since August 2022, at 51.6; and Employment improved but remained in contraction at 48.1.

For the week:

The S&P 500 is down 0.10%, the Nasdaq is down 1.84%, and the Dow 30 is up 2.50%.

Barchart

CNN's Fear & Greed Index now stands at 45 (Neutral) out of 100, down 13 points from last week. Details here

The top five trending stocks on Reddit are Microsoft, SPY, Reddit, MicroStrategy, and Amazon. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Operations: The New York Fed’s standing repo operation (primarily reflecting SRF take-up) as of Feb 6th is zero.

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for March 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

AI Race Intecifies:

Primal Thesis

The massive wave of AI-related capital expenditures announced this week—totaling roughly $650 billion across Alphabet, Amazon, Meta, and Microsoft for 2026—represents an unprecedented build-out of data centers, servers, and compute capacity to fuel the next phase of artificial intelligence. While hyperscalers bear near-term cash-flow pressure and investor skepticism (as evidenced by share-price reactions), the clearest and most immediate beneficiaries are suppliers in the AI infrastructure supply chain.

NVIDIA stands out as the dominant winner in AI accelerators, capturing the lion's share of GPU demand for training and inference workloads. Broadcom benefits strongly from networking gear, custom silicon (including ASICs for hyperscalers like Google's TPUs), and interconnects that keep massive GPU clusters running efficiently. Taiwan Semiconductor Manufacturing (TSMC) serves as the foundational "pick-and-shovel" play, fabricating the advanced chips for Nvidia, Broadcom, AMD, and others, with its foundry dominance ensuring it captures a large slice of the spending cascade. Other downstream players—such as memory providers, server assemblers, and even power/cooling specialists—will see gains as well, but the semiconductor ecosystem (particularly Nvidia, Broadcom, and TSMC) is positioned for the most direct, high-margin upside from this multi-year infrastructure sprint. In summary, while the Big Tech spenders are betting on long-term AI dominance, the real near-term cash flows flow upstream to the companies building the picks and shovels.

FRONT PAGES:

Bank Merger: Banco Santander is acquiring Webster Financial in a $12.3B cash-and-stock deal, accelerating its push to scale in the U.S. The transaction positions Santander to compete with large regional banks and meaningfully strengthens its U.S. franchise. Webster, with over $80B in assets and a strong Northeast branch network, anchors the expansion strategy. Read

OpenAI-Amazon Deal: Amazon is in talks to invest up to $50B in OpenAI, marking a major bet on the AI leader, according to people familiar with the matter. OpenAI is seeking up to $100B in new funding, a round that could value the company at as much as $830B, according to a report from The Wall Street Journal. Read

SpaceX-xAI Merge: SpaceX has acquired xAI in a landmark deal valuing the combined entity at $1.25 trillion, according to confirmation Tuesday from CNBC’s David Faber. This record-setting transaction is the largest merger in history. According to documents reviewed by CNBC, the deal values SpaceX at $1 trillion and xAI at $250 billion. Read

Anthropic’s Funding Round: Anthropic PBC is finalizing a funding round expected to exceed $20 billion, with a potential close as early as next week. Initially targeting $10 billion, the raise has more than doubled amid strong investor demand, valuing the company at nearly $350 billion. The round would nearly double Anthropic’s prior valuation just five months after a $13 billion raise, underscoring investor enthusiasm driven by rapid revenue growth. Read

EARNINGS UPDATE:

Primal Thesis

Disney Mixed: Revenue rose 5% YoY to $26.0B, while income before taxes was roughly flat at $3.7B. Diluted EPS was $1.34, and adjusted EPS was $1.63. Total segment operating income declined 9% to $4.6B. Entertainment revenue grew 7%, with operating income of $1.1B; SVOD delivered $450M at an 8.4% margin. Sports operating income fell to $191M, down $56M YoY, reflecting an estimated $110M impact from the YouTube TV suspension. Experiences posted record revenue of $10.0B and operating income of $3.3B, with domestic operating income up 8%.

Palantir Beat: U.S. commercial revenue surged 137% y/y to $507M, while U.S. government revenue rose 66% to $570M. Total revenue increased 70% y/y to $1.407B, with customer count up 34%. TCV hit a record $4.262B (+138% y/y), including $1.344B in U.S. commercial TCV (+67%). Rule of 40 reached 127%. GAAP net income was $609M (43% margin); adjusted EBITDA totaled $805M (57% margin).

AMD Beat: Q4 revenue hit a record $10.27B, up 34% Y/Y and 11% Q/Q. Data Center revenue reached $5.38B on strong EPYC and Instinct demand, while Client and Gaming totaled $3.94B, up 37% Y/Y. Results included a ~$360M MI308 reserve release and ~$390M in MI308 China sales. Adjusted non-GAAP gross margin was ~55% excluding MI308 items. Non-GAAP EPS came in at $1.53 versus $0.70 expected, with revenue also beating estimates.

Abbvie Beat: Q4 revenue was $16.6B, up 10.0% YoY reported and 9.5% operational. Immunology grew 18.3% to $8.6B, led by strong gains in Skyrizi and Rinvoq, partially offset by a 25.9% decline in Humira. Neuroscience rose 17.9% on Vraylar and Botox Therapeutic, while Oncology declined 1.5% despite growth in Venclexta and Elahere. GAAP gross margin was 72.6% (83.6% adjusted) and operating margin 27.3% (38.3% adjusted). FY2026 adjusted EPS guidance is $14.37–$14.57, excluding acquired IPR&D and milestones.

Google Beat: Q4 revenue came in at $113.8B, up 18% YoY, with EPS of $2.82. Results exceeded expectations, with EPS beating consensus by $0.29 and revenue ahead by nearly $10B. Google Cloud delivered $17.7B in revenue (+48% YoY) and $5.31B in operating income. YouTube's annual revenue crossed $60B. AI traction remains strong, with Gemini scaled to 750M+ monthly active users. A quarterly cash dividend of $0.21 per share was declared.

Eli Lilly Mixed: Q4 2025 revenue rose 43% to $19.3B, driven by Mounjaro and Zepbound volumes. GAAP EPS was $7.39 (+51% YoY) and non-GAAP EPS was $7.54 (+42% YoY). FDA milestones included tirzepatide KwikPen approval, Jaypirca label expansion, and orforglipron submissions. Pipeline progress included Taltz+Zepbound, oral GLP-1 or forglipron, and retatrutide Phase 3 studies for obesity and OA pain. The company also reached an agreement with the U.S. government to expand access to obesity drugs. 2026 guidance calls for $80–$83B revenue and non-GAAP EPS of $33.50–$35.00.

Amazon Beat: Net sales rose 14% to $213.4B (+12% ex-FX). AWS revenue grew 24% to $35.6B with operating income of $12.5B. Net income was $21.2B, delivering diluted EPS of $1.95. North America sales increased 10% to $127.1B, while International rose 17% to $50.7B. Operating income totaled $25.0B, or $27.4B excluding special charges. Advertising services reached $21.3B in Q4, up 22% YoY.

Linde Mixed: Sales reached $8.8B, up 6% YoY, with underlying growth of 3% driven by 2% pricing and 1% volume. Adjusted EPS rose 6% to $4.20, beating consensus by $0.21. Operating cash flow increased 8% to $3.0B, with free cash flow of $1.6B. Adjusted operating profit grew 4% to $2.6B, though margin slipped 40 bps to 29.5%. Americas led growth at 8%, followed by EMEA at 6% and APAC at 3%, while Engineering declined 2%. Total backlog stood at $10.0B, and $2.1B was returned to shareholders in Q4.

Philip Morris: Q4 net revenues were $10.4B, up 6.8% reported and 3.7% organic YoY. Adjusted diluted EPS came in at $1.70, up 9.7% YoY versus $1.55 last year. FY2025 revenues totaled $40.6B, with the smoke-free business contributing $16.9B (41.5%). A $1.47 quarterly dividend was declared. 2026 adjusted EPS is guided at $8.38–$8.53, with reported EPS of $7.87–$8.02.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

10-Feb | GILD | Gilead Sciences Inc | After Close |

10-Feb | AZN | Astrazeneca Plc | Before Open |

10-Feb | KO | Coca-Cola Company | Before Open |

11-Feb | CSCO | Cisco Systems Inc | After Close |

11-Feb | TMUS | T-Mobile US | Before Open |

11-Feb | SCCO | Southern Copper Corp | -- |

11-Feb | MCD | McDonald's Corp | Before Open |

12-Feb | AMAT | Applied Materials | After Close |

12-Feb | ANET | Arista Networks Inc | After Close |

18-Feb | ADI | Analog Devices | Before Open |

VIDEO’s OF THE WEEK:

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.