📉 Softer CPI As Retail Sales Stalls

💼 Payroll Surprise To Upside

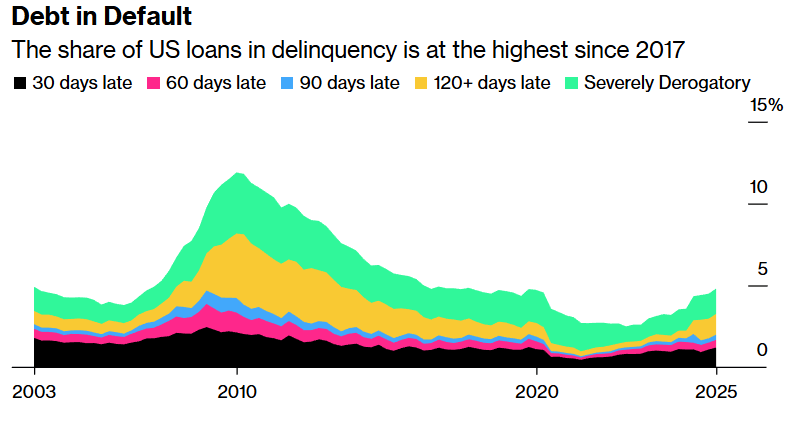

⚠️ US Consumer Delinquencies Rise

🤖 Anthropic Winning Enterprise AI Race

🚀 Matt Shumer Highlights AI’s Rapid Trajectory

QUOTE OF THE WEEK:

“If you look at the tech basket relative to the rest of the market, its earnings are on fire, and multiples are down roughly 20% versus the broader market. The group looks incredibly attractive. If there’s one segment that stands out, it’s the semis — the semiconductor names like Broadcom and Nvidia. The growth they’re delivering, the magnitude of upside revisions, and how inexpensive they are relative to that growth make them particularly compelling.” - Jonathan Golub - Seaport Research Partners

KEY US ECONOMIC EVENTS NEXT WEEK:

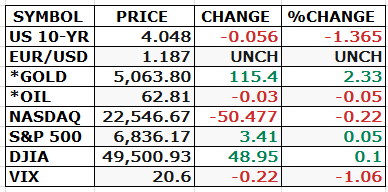

MARKET CLOSE:

CNBC - EOD 2/13

WEEKLY MARKET WRAP:

Good Afternoon. It's a down week for the markets, especially for the tech stocks. Wall Street is turning increasingly jittery as AI disruption risks spread across a broader set of industries. Earnings remain strong, and macroeconomic data are mostly positive.

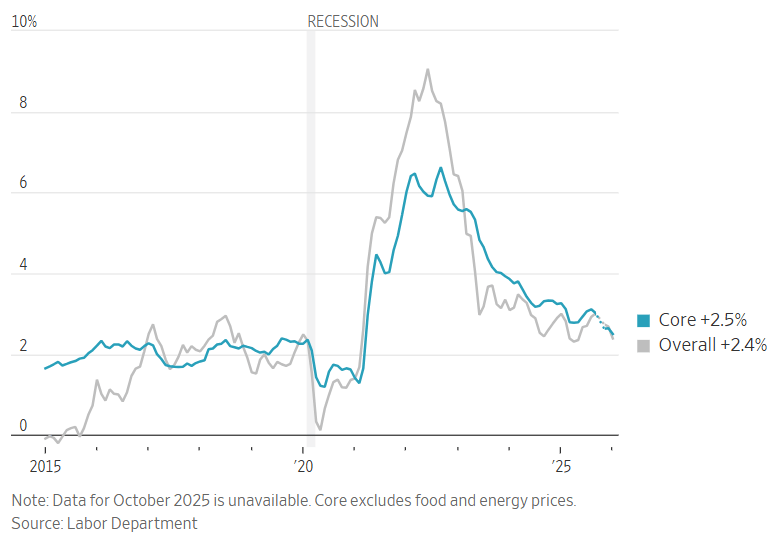

Below are the key things to note this week:Softer CPI:

WSJ

January CPI came in better than expected, extending the Treasury rally and bringing Fed rate cuts more firmly into play this year. Headline inflation rose 0.2% m/m, driven by softer gasoline and a rare decline in electricity costs. Annual CPI eased to 2.4%, the lowest since last spring.Food prices rose a modest 0.2% m/m, with grocery inflation normalizing to 2.1% y/y. Shelter cooled to 0.2% m/m as rent pressures eased. Used-car prices fell for a second consecutive month, while new-vehicle prices remained contained, signaling limited tariff impact. Core goods were flat for a second month, trimming the annual rate to 1.1% despite dollar weakness.

Core CPI rose 0.3% m/m, slightly firmer but largely in line with expectations given recurring January seasonality distortions.

Retail Sales Stall:U.S. retail sales growth stalled in December as consumers hit the pause button. Retail sales were virtually unchanged following an unrevised 0.6% gain in November—an unwelcome stumble for consumers that started the holiday season at a solid pace. The consensus forecast was expecting a far stronger 0.4% gain.

Strong Non-Farm Payroll:

January payrolls surprised to the upside, with 130K jobs added—nearly double Bloomberg’s 68K estimate and well above December’s downwardly revised 48K.

The data suggests labor market resilience despite recent soft reports. The unemployment rate edged lower to 4.3% from 4.4%.

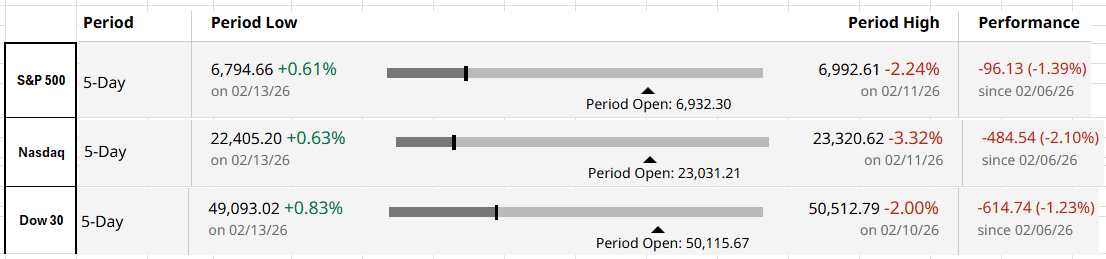

For the week:

The S&P 500 is down 1.39%, the Nasdaq is down 2.1%, and the Dow 30 is down 1.23%.

Barchart

CNN's Fear & Greed Index now stands at 36 (Fear) out of 100, down 9 points from last week. Details here

The top five trending stocks on Reddit are SPY, Amazon, Microsoft, QQQ, and NVIDIA. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Operations: The New York Fed’s standing repo operation (primarily reflecting SRF take-up) as of Feb 13th is zero.

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for March 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Viral Blog on AI -

Matt Shumer published a piece on AI's trajectory last week that quickly went viral (over 110K likes and 82M+ views). Written originally for his parents, he lays out what he sees as the unfiltered reality: AI progress is moving far faster than most people realize, and the safe, incremental narrative understates the disruption ahead.The core message is blunt: many white-collar jobs (especially knowledge work) will face significant displacement sooner than expected —not because AI is "magic," but because capability leaps are compounding rapidly. He urges readers to take this seriously: learn to use frontier tools aggressively, build curiosity and systems-thinking habits (especially for students), and consider personal financial hedges, such as owning AI-related stocks, to offset potential career risk.

It's not doom-and-gloom; it's pragmatic urgency. Shumer emphasizes agency—adapt now, experiment with agents and workflows, stay ahead of the curve—while acknowledging that even coders (who see gains first) are still underestimating how quickly non-technical fields will catch up this year.

In short: the AI wave isn't coming in 5–10 years; it's already reshaping what's possible, and the people who treat it like a serious force multiplier (rather than a toy) will be the ones who come out ahead. I truly believe that people who can use AI effectively will replace those who do not.

Anthropic Winning Enterprise AI Race:

Anthropic’s latest funding round puts its valuation at ~$400 bn. Still, less than half of OpenAI’s valuation. However, I think Anthropic has a clear advantage: it's winning the enterprise AI race decisively, while OpenAI faces tough competition from Gemini in the consumer AI space.

Just three years after earning its first dollar, Antghropic reached a $14 billion annualized revenue run rate, growing over 10x in each of the past three years. Claude Code alone now does $2.5 billion in annualized revenue, more than doubling since January 2026. Enterprise drives the bulk: over 500 customers spend $1M+ per year (including 8 of the Fortune 10), with high-spend accounts growing 7x in the past 12 months.This focus on safety-first, predictable models via Constitutional AI has won trust in regulated sectors where OpenAI's flashier consumer tilt and occasional governance noise create hesitation. Result: Anthropic captures roughly 40% of enterprise LLM spend (up sharply), while OpenAI's share has slipped to ~27%.

The latest validation came on February 12: a $30 billion Series G round at a $380 billion post-money valuation— the second-largest private tech raise ever. Investors (GIC, Coatue, others) are betting big on the enterprise moat: sticky coding dominance (Claude Code authoring ~4% of GitHub public commits), seamless workflow integrations, and a path to cash-flow positivity by 2027.

OpenAI still leads overall revenue (~$20B+ ARR) thanks to massive consumer scale, but its heavier losses and ad experiments highlight the contrast. Anthropic's restraint — no ads, no founder drama, pure enterprise obsession — has become the accelerator.

In the B2B AI arena, playing it safe is winning.

FRONT PAGES:

Anthropic at $380bn valuation: Anthropic closed a $30B funding round at a $380B post-money valuation — marking the second-largest private tech raise on record, behind OpenAI’s $40B+ round last year. The round was led by Coatue and GIC, with participation from Microsoft and Nvidia.

Bank CEO Compensation: CEOs of the largest U.S. banks collectively earned $258 million in 2025, as a resilient economy and strong Wall Street activity drove their institutions to record performance. Read

Rising Electric Bill: Electricity prices rose 6.9% YoY in 2025—more than double the 2.9% headline inflation rate, per Goldman Sachs. The bank expects continued growth through the end of the decade, with data centers accounting for 40% of demand growth. Higher power costs will erode disposable income, weigh on consumer spending, and modestly slow economic growth. Read

Asset Managers Merger: Schroders agreed to a £9.9bn takeover by a US investor, ending over 200 years of family control at the historic UK asset manager. Chicago-based Nuveen will acquire the firm, creating one of the world’s largest fund managers with ~$2.5tn (£1.8tn) in AUM. Read

U.S. Consumer Delinquencies Rise: Delinquency rates rose to 4.8% of outstanding U.S. household debt in Q4, the highest since 2017. Mortgage stress in lower-income zip codes and student-loan defaults drove the increase. Total household debt climbed 1% QoQ to $18.8T, while the share of credit-card balances 90+ days past due jumped to 12.7%. Read

Source: NY Fed, Bloomberg

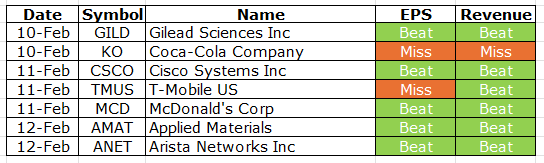

EARNINGS UPDATE:

Primal Thesis

Gilead Beat: Q4 revenue rose 5% YoY to $7.9B, with ex-Veklury product sales up 7% to $7.7B. HIV sales increased 6% to $5.8B, driven by Biktarvy (+5% to $4.0B) and Descovy (+33% to $819M) on higher pricing and PrEP demand. Liver Disease grew 17% to $844M, led by Livdelzi. Veklury declined 37% to $212M amid lower COVID hospitalizations. Cell Therapy fell 6% to $458M, with Yescarta and Tecartus both down.

Coca-Cola Miss: Q4 net revenues rose 2% to $11.8B, with organic growth of 5%. Comparable operating margin expanded 48 bps YoY to 24.4%, while currency-neutral comparable operating income increased 13%. GAAP operating income declined 32% due to a $960M BODYARMOR trademark impairment. GAAP EPS was $0.53 (+4%), and comparable EPS reached $0.58 (+6%). The company gained value share in global NARTD beverages for both Q4 and the full year.

Cisco Beat: Record revenue of $15.3B with double-digit revenue and EPS growth, exceeding guidance. Product orders rose 18% YoY, with networking orders accelerating above 20%. GAAP gross margin was 65.0% (67.5% non-GAAP). GAAP operating margin reached 24.6% (34.6% non-GAAP), above the high end of guidance. AI infrastructure orders from hyperscalers totaled $2.1B. Dividend increased to $0.42 per share.

T-Mobile Mixed: Revenue increased 11% YoY to $24.3B, with service revenue up 10% to $18.7B. Diluted EPS was $1.88, including a $0.26 severance impact. Q4 postpaid net adds reached 2.4M; broadband adds were 558K, including 495K from 5G. Earned first-ever J.D. Power top network quality ranking in five of six U.S. regions. Q4 Core Adj. EBITDA was $8.4B; Adj. FCF $4.2B. 2026 guides Core Adj. EBITDA of $37.0–$37.5B and Adj. FCF of $18.0–$18.7B.

McDonald’s Beat: Q4 global comparable sales rose 5.7%, with positive guest counts across all segments. Revenue increased 10% to $7.0B (+6% constant currency). Diluted EPS was $3.03; adjusted EPS was $3.12, excluding restructuring. Systemwide sales grew 11% in Q4, with full-year sales surpassing $139B. Quarterly dividend increased 5% to $1.86. Loyalty sales reached nearly $37B, with ~210M 90-day active users at year-end.

Applied Materials Beat: Revenue was $7.01B, down 2% YoY, with GAAP gross margin at 49.0% and non-GAAP at 49.1%. GAAP EPS rose 75% YoY to $2.54, while non-GAAP EPS was flat at $2.38. Semiconductor Systems posted a record in DRAM revenue, and Applied Global Services achieved a record in services and spares revenue. Operating cash flow was $1.69B, with $702M returned to shareholders ($337M buybacks; $365M dividends).

Arista Networks Beat: Q4 revenue rose to $2.49B, up 7.8% QoQ and 28.9% YoY, with non-GAAP operating margin at 47.5%. The company launched its R4 AI/data center series, acquired Broadcom’s VeloCloud SD-WAN portfolio, surpassed 150M cumulative ports shipped, and delivered over $1B in quarterly non-GAAP net income.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

17-Feb | CEG | Constellation Energy Corp | -- |

17-Feb | MDT | Medtronic Inc | Before Open |

17-Feb | PANW | Palo Alto Networks Inc | After Close |

18-Feb | ADI | Analog Devices | Before Open |

18-Feb | BKNG | Booking Holdings Inc | After Close |

19-Feb | DE | Deere & Company | Before Open |

19-Feb | MELI | Mercadolibre Inc | -- |

19-Feb | NEM | Newmont Mining Corp | After Close |

19-Feb | SO | Southern Company | Before Open |

19-Feb | WMT | Walmart Inc | Before Open |

VIDEO’s OF THE WEEK:

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.