- Primal Thesis

- Posts

- Back To Normal

Back To Normal

📅 Schwab Launches National Investing Day

👋 Warren Buffett to Retire After Six Decades

📈 Longest Winning Streak Since November 2004

🏛️ FOMC Meeting Next Week

🌍 Interesting Fact on Bilateral Trade Deficit vs Capital Flows

QUOTE OF THE WEEK:

“I spend more time looking at balance sheets than I do income statements. Wall Street really doesn't pay much attention to balance sheets, but I like to look at balance sheets over an 8 or 10 year period before I even look at the income account because there are certain things it's harder to hide or play games with on the balance sheet than you can with the income statement. Neither one gives you the total answer on anything, but you still ought to understand what the figures are saying and what they don't say.”

- Warren Buffett

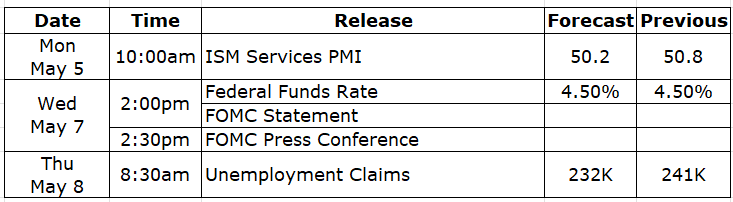

KEY US ECONOMIC EVENTS NEXT WEEK:

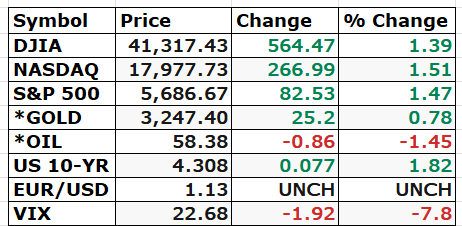

MARKET CLOSE:

THE WEEKLY MARKET WRAP:

Good Afternoon. Markets recouped all the losses since the liberation day with the S&P 500 rising for nine consecutive days, recording the longest winning streak since November 2004. This is a surprise for many, and the Financial Times even had a premium blog article two days ago titled Surprise US market comeback. However, if you recall my tariff analysis on April 6th, I had mentioned that markets are overreacting and recovery will be faster when clarity comes, and also why I think the full-fledged tariff war is unlikely. In the curated insights section below, I have listed one more positive fact related to the tariff impact.

Below are the key highlights for the week:

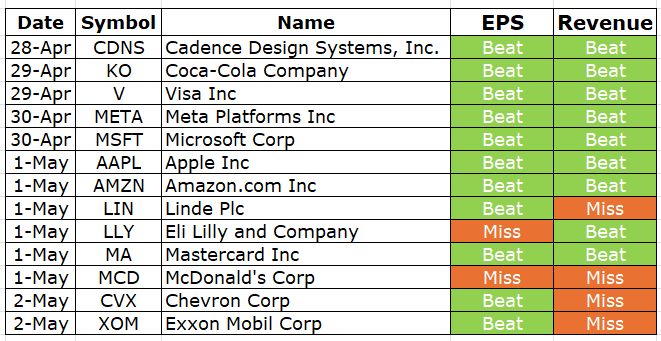

Overall Strong Earnings:

Multiple important companies reported earnings this week, including four Mag 7s. Overall earnings continue to be strong as the tariffs did not impact this quarter's earnings. Oil companies reported weak earnings, mainly due to falling oil prices. Also, McDonald's missed earnings and revenues show that the lower-income consumers are feeling the effects of uncertainty.

Source: Bloomberg

Mixed Macro Data:As expected, March PCE headline inflation came down to 2.3%, and core PCE was at 2.6%. This is excellent progress towards the Fed's 2% target, but starting next month, the effects of the tariff will start reflecting in the data, and it will be critical to see the real effect of the trade war on inflation.

April payrolls rose 177K, topping expectations by 33%, but marked a slowdown from March’s revised 185K. The unemployment rate was at 4.2%, and remained unchanged.

US GDP fell by 0.3%, the first drop since Q1 2022. This was mainly due to increased imports due to tariff fears, which shot up the US trade deficit by 41%. Hence, this fall in GDP does not show any negative underlying trend.

Source: Financial Times

Recession Expectations Still Low:

Bloomberg reported that the survey results were conducted between April 25 and 30, and they showed that the number of economists with negative sentiments increased. Still, only 26% of the respondents expect a recession in the next 12 months. I generally don’t believe in surveys as sentiments shift with the current news flow, which may not reflect in the hard data. As mentioned above, this quarter's negative GDP was due to technical factors rather than underlying economic issues. Hence, we only need one more quarter of negative growth to meet the definition of recession. However, the tariff impact is very uncertain, and hence, even if we meet the definition of a recession next quarter, I am not sure if it can be considered a typical recession. Hence, it will be important to follow the hard macro data on a weekly basis and track the developments on tariff deal front.

Good News on Tariff:

In yet another good news on tariffs, China expressed willingness to negotiate with the US for the first time, paving the way for the two largest economies to start working towards resolving the trade issues.

Next Week:The most important event for the next week will be the FOMC meeting scheduled on May 7th. The Fed is expected to leave the Fed funds rate unchanged as the hard macro data is still strong, and financial markets seem to be getting back to normal. The CME Fed Watch tool is showing 97%+ probability of no change in rates. It will be interesting to see the changes made to the FOMC statement and the press conference commentary.

For the week:

The S&P 500 is up 2.92%, the Nasdaq is up 3.42%, and the Dow 30 is up 3.00%.

Source: Barchart

CNN's Fear & Greed Index now stands at 43 (Fear) out of 100, up 8 points from last week. Details here

The top five trending stocks on Reddit are SPY, Tesla, Palantir, Reddit, and DTE Energy. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for May 7th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

One More Interesting Fact On The Tariff Saga:

The Brookings Institution published an analysis highlighting an essential fact about the tariff situation. The U.S. trade and financial accounts balance globally by design, but not bilaterally. While trade deficits have been widest with China, the most significant capital inflows have come from Europe. This is important as the countries that invest in the US will be easy to deal with from a trade deal perspective. It’s important to note that asset prices will remain stable if the countries that invest in the US largely stay on course or avoid conflict with this administration.

US Stock Market Dominance:

The visual below, reported by Financial Times, shows the stark difference between the US market share in the global MSCI ACWI index and the US global GDP share. The US share in global markets is far above the share in global GDP. Ruchir Sharma (Rockefeller International) mentions this difference multiple times as unsustainable.

However, I don’t think this is a significant issue for two reasons. First, it’s not the proper comparison. The GDP is comprised of many items that are not part of equity markets. For example, the US equity market premium is mainly driven by its tech sector, which is over 30% of the S&P 500 index or over 40% if we add communication services. However, the share of tech in the US GDP is only ~9%. Second, as calculated by Soc Gen, the US's global earnings share is around 55%, which is not that far from the equity market share shown above.

FRONT PAGES:

Buffett on Volatility: Warren Buffett dismissed recent market swings, calling the past 30–45 days “really nothing” at Berkshire Hathaway’s annual meeting. Read

Buffett to Retire: Warren Buffett signaled the end of an era in Omaha, announcing he’ll recommend Greg Abel as Berkshire Hathaway’s CEO by year-end. Read

Large Bank Rating Review: The Fed’s incoming top banking supervisor plans to review confidential health ratings of large banks, after noting that two-thirds were rated unsatisfactory last year. Read

IBM Investment: IBM plans to invest 150% of its current five-year U.S. outlay to strengthen the domestic economy and cement its position as a global computing leader. Read

Crypto Trading Boost: Morgan Stanley is working on adding crypto trading to its E*Trade platform—a significant move by a US bank to bring the asset class to retail investors since regulatory barriers began easing under the Trump era. Read

China Evaluates Trade Talks: China is evaluating trade talks with the U.S., following multiple outreach attempts by senior U.S. officials, according to its Commerce Ministry. While Beijing signals its willingness, analysts warn that a full deal will be complex and slow-moving. Read

Crypto News: Deribit, the world’s largest crypto options exchange, is considering a US entry, citing a more favorable regulatory outlook under Trump, per Financial Times. Read

EARNINGS UPDATE:

Cedence Beat: Cadence raised its annual revenue and profit forecast, driven by strong demand for its chip design tools amid the AI boom. However, rising tariff risks in China remain a headwind. Elevated AI workloads continue to fuel demand for its complex semiconductor design software. Read

Coca-Cola Beat: Coca-Cola beat revenue and profit estimates this quarter, driven by strong demand and price increases. However, it flagged potential headwinds from U.S. tariffs, which could raise costs and dent consumer sentiment. Read

Visa Beat: Visa's fiscal Q2 earnings beat estimates, with payment volumes holding strong despite macro uncertainty. Read

Meta Beat: Meta's ad sales eased Wall Street's trade war worries, with Q1 revenue surpassing estimates by over 3%. Read

Microsoft Beat: Microsoft beat expectations on sales and profit, signaling resilient demand for cloud services despite tariffs and macro headwinds. Revenue rose 13% in FY Q3. Read

Apple Beat: Apple slightly beats estimates despite tariff overhang. Production shifts to India to offset risk. Cook flags higher US expansion costs. Buyback cut by 8% due to trade tensions. Read

Amazon Beat: Amazon’s Q1 revenue rose 9%, with profits beating estimates. Q2 guidance was solid but seen as cautious amid tariff uncertainty. AWS grew by nearly 17%; it was just shy of expectations. Read

Mastercard Beat: Mastercard beat Q1 estimates as consumer spending remained resilient, despite macro uncertainty driven by Trump’s trade war. Read

McDonald’s Miss: McDonald’s US sales dropped sharply in Q1, signaling weakening consumer sentiment and growing pressure on restaurants to attract diners. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

5-May | PLTR | Palantir Technologies Inc Cl A | After Close |

5-May | VRTX | Vertex Pharmaceutic | After Close |

6-May | AMD | Adv Micro Devices | After Close |

6-May | ANET | Arista Networks Inc | After Close |

6-May | RACE | Ferrari N.V. | Before Open |

7-May | APP | Applovin Corp Cl A | After Close |

7-May | DIS | Walt Disney Company | Before Open |

7-May | UBER | Uber Technologies Inc |

VIDEO’s OF THE WEEK:

The easiest way to stay business-savvy

There’s a reason over 4 million professionals start their day with Morning Brew. It’s business news made simple—fast, engaging, and actually enjoyable to read.

From business and tech to finance and global affairs, Morning Brew covers the headlines shaping your work and your world. No jargon. No fluff. Just the need-to-know information, delivered with personality.

It takes less than 5 minutes to read, it’s completely free, and it might just become your favorite part of the morning. Sign up now and see why millions of professionals are hooked.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.