- Primal Thesis

- Posts

- Good Week For Banks

Good Week For Banks

📈 S&P 500 and Nasdaq Hit All-Time High

🏦 Fed Kick-Off Process To Ease eSLR

✅ All 22 Banks Pass Fed’s Stress Test

💹 Slightly Higher PCE Inflation

🧠 AI Dashboard Use Case

📊 Neutral Rate And Term Premium

🏗️ AI Data Center Growth

QUOTE OF THE WEEK:

“The stress test results signal that the Fed is not only going to be accommodative in the banking industry, but it wants to spur the banks to lend. So the reality is that bank loan demand is somewhat tepid. It's about 1.3 and 1.4% year to date. I think we'll see a little bit better in the second half as we have some uncertainty cleared as we get into the fall.” Chris Marinac, Director, Research - Janney Montgomery Scott

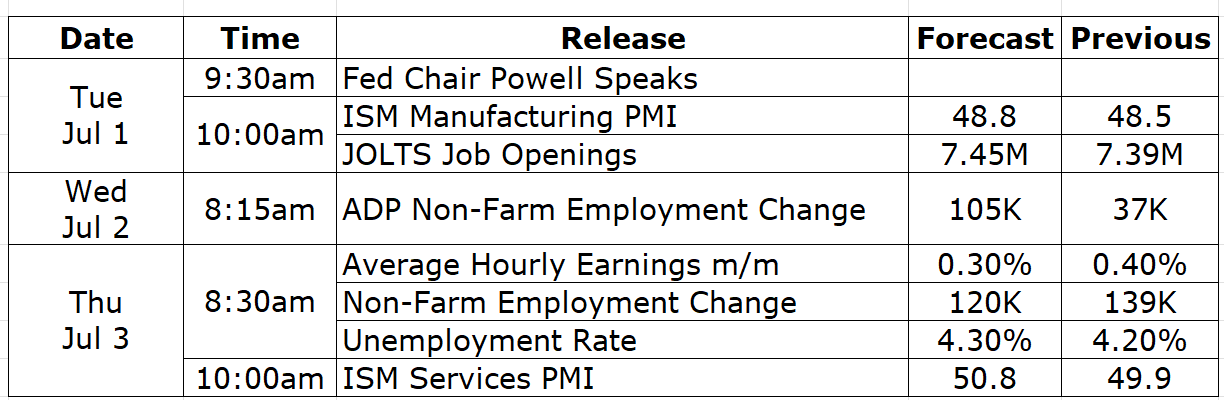

KEY US ECONOMIC EVENTS NEXT WEEK:

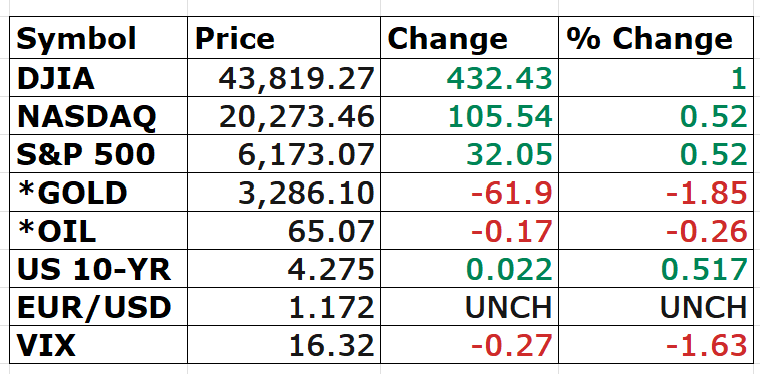

MARKET CLOSE:

CNBC EOD June 27th

WEEKLY MARKET WRAP:

Good Afternoon. The Nasdaq and S&P 500 both hit all-time highs this week, thanks to multiple positive developments on the trade front and overall liquidity.

Below are the key things to note this week:

US-China Trade Deal:

In the continued progress on the trade front, China reported positive outcomes on the trade deal with the US. China will greenlight eligible export licenses under its control rules, while the U.S. will drop a range of existing restrictions in return.

Positive Week for Banks:eSLR Relief:

The Federal Reserve took the next step to provide long-awaited relief for the supplementary leverage ratio requirements. The Fed proposed a significant overhaul of the amount of capital that large global banks need to hold in low-risk assets, such as Treasury securities, aimed at encouraging deeper participation in U.S. debt markets. Large U.S. global banks can expect as much as $6 trillion in additional balance sheet capacity and billions in freed-up capital under a Federal Reserve plan to relax leverage rules, Wall Street brokerages estimated on Thursday.

Fed Stress Test Results:

All 22 Banks Pass the Fed stress test, paving the way for more buybacks and dividends. “Large banks remain well capitalized and resilient to a range of severe outcomes,” said Michelle Bowman, the bank’s vice chair for supervision, in a statement. This will also help to increase the bank lending in the second half.

PCE Inflation Data:

The Fed’s preferred inflation gauge, the PCE index, rose 0.1% in May, bringing annual inflation to 2.3%. Core PCE came in slightly hotter at 0.2% for the month and 2.7% year-over-year, above expectations. Consumer resilience is showing some weakness — spending decreased by 0.1% and personal income declined by 0.4%. The annual PCE growth of 2.3% indicates that the effect of tariffs is still not evident in the data, suggesting that the impact is less than initially expected.Conclusion:

All the above developments this week are good news for the equity markets.Improved bank lending post stress test results and possible eSLR relief will enhance overall liquidity, which is beneficial for markets and will also help bring down treasury yields.

The subdued impact of tariffs on inflation, with continuous progress on trade deals, gives more confidence that the worst is behind us.

The final confirmation will come if the soon-to-start earnings season pans out well.

For the week:

The S&P 500 is up 3.44%, the Nasdaq is up 4.25%, and the Dow 30 is up 3.82%.

Barchart

CNN's Fear & Greed Index now stands at 65 (Greed) out of 100, up 10 points from last week. Details here

The top five trending stocks on Reddit are SPY, Palantir, Tesla, Nvidia, and Circle. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for July 30th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

AI Use Case:

The Fed released its bank stress test results this week. Someone on LinkedIn posted about the Gemini Canvas dashboard he created to analyze the results within a few hours after the results were posted. I am unable to find the person who posted this, so I cannot give them due credit here, but I still wanted to share this dashboard to demonstrate how AI can help create something quickly and improve efficiency. Below is the dashboard link.

Federal Reserve CCAR Stress Test Results DashboardPIMCO on Neutral Rate:

Former Fed Vice Chair Richard Clarida explains the relationship between term premium and neutral rate. According to him, the neutral rate has remained relatively stable or even fallen over the years, despite a rise in nominal rates. This shows the underlying strength of the economy.

There has been a steady rise in the term premium over several years, suggesting an orderly repricing of risk. For fixed income investors, active portfolio management can help navigate.

AI Data Center Growth:

The below graph shows how rapidly AI data centers are growing.

Source: Chartr

FRONT PAGES:

Trade Deal: The U.S. and China have confirmed a trade framework that eases tech curbs and resumes rare earth exports, according to China’s Ministry of Commerce. China will review export applications under control rules, while the U.S. will lift several restrictions on Beijing, the ministry said without providing details. Read

Major Win for AI: A federal judge ruled Anthropic didn’t violate copyright law by using purchased books to train its Claude AI, even without the authors’ permission. The decision applies narrowly to certain works and methods, but marks a courtroom win for fair use in AI training. Judge Alsup called the training “extremely transformative” under federal law. Read

Banks Pass The Fed Stress Tests: All major banks passed the Fed’s annual stress test, but this year’s version was less stringent than in the past. All 22 firms remained solvent and above the minimum thresholds even after absorbing $550 billion in hypothetical losses. Read

eSLR Relief: The Fed proposed easing eSLR rules for U.S. GSIBs, replacing the 3% floor + 2% buffer with a new threshold tied to 50% of the G-SIB Method 1 surcharge, bringing U.S. rules closer to Europe. Read

All Time High: The S&P 500 and Nasdaq hit record highs Friday, fueled by renewed AI optimism and hopes of looser monetary policy driving a rebound from a prolonged selloff. Read

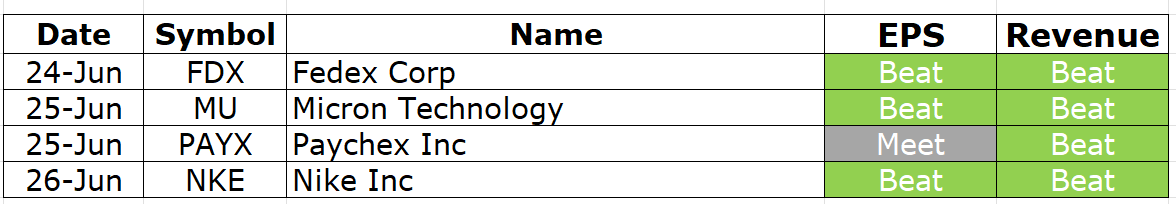

EARNINGS UPDATE:

FedEx Beat: FedEx warned of weaker-than-expected profits this quarter and pulled full-year guidance, highlighting the ongoing hit from Trump’s trade war. Read

Micron Beat: Micron forecasts Q4 revenue above Wall Street estimates, driven by strong demand for its HBM chips powering AI data centers. HBM sales jumped nearly 50% in Q3, with continued investment planned. Read

Paychex Mixed: Paychex beat estimates with a strong full-year outlook, but Q4 profits were impacted by its $4.1B acquisition of Paycor. Read

Nike Beat: Nike’s fiscal Q4 was weak but not as bad as expected. Sales dropped over 10% YoY, and the company flagged $1B+ in added costs from tariffs this year. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

1-July | STZ | Constellation Brands Inc | After Close |

VIDEO’s OF THE WEEK:

Outsmart college costs

Ready for next semester? June is a key time to assess how you’ll cover college costs. And considering federal aid often isn’t enough, you might have to consider private student loans.

You’re just in time, though—most schools recommend applying about two months before tuition is due. By now, colleges start sending final cost-of-attendance letters, revealing how much you’ll need to bridge the gap.

Understanding your options now can help ensure you’re prepared and avoid last-minute stress. View Money’s best student loans list to find lenders with low rates and easy online application.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.