- Primal Thesis

- Posts

- IPO Resurgence

IPO Resurgence

📈 IPOs are Back

📘 Analysis of the Fed Beige Book

🤖 No More Friends? Trump vs. Elon

🏦 Potential Easing of Bank Rules

🧾 Earning Season Recap

📉 Borrowing Costs Have Surged

QUOTE OF THE WEEK:

“Whether you agree with it or not, this bill is going to pass in D.C. in some form or fashion, and the net result is going to be more money printing. I don't think increasing debt is smart, but it's going to add fuel to an economy that doesn't need it. So when you look at the debt, you look at the consumer, and you look at the labor market, it's really hard to find a case as to why you would short this market or bet against this economy right now.” - Eddie Ghabour, Owner - Key Advisors Wealth Management.

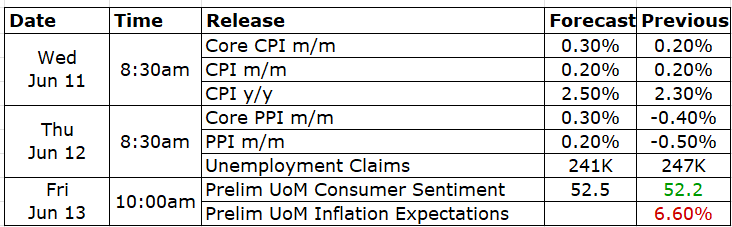

KEY US ECONOMIC EVENTS NEXT WEEK:

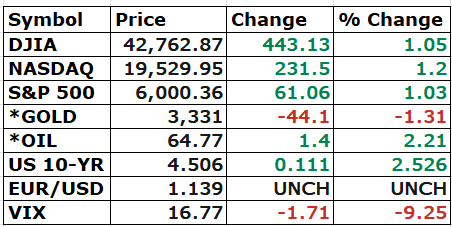

MARKET CLOSE:

CNBC EOD June 5th

WEEKLY MARKET WRAP:

Good Afternoon. Another positive week for the markets. Macro data is softening but still good, and earnings released this week were ok too—detailed analysis of earnings in the next section.

Below are the key things to note for the week:

IPOs are Back:

IPOs are back after a prolonged break. The stablecoin firm Circle had an excellent IPO performance this week, with the stock price increasing almost four times in two days. Another IPO of a small healthcare company, Omada Health, got off to a good start.Slowing but Strong Labor Market: There is news that crypto exchange Gemini (backed by the Winklevoss brothers) also filed for the IPO. All these are positive signs that the tariff fears are abating, and companies are willing to proceed with IPO plans that have been shelved for quite some time.

Elon vs. Trump:

Surprisingly, the bromance between Elon and Trump ended this week over differences on the tax bill, with both accusing each other of nasty things. I had posted a video of NYU Prof. Aswath Damodaran a few weeks ago in this newsletter, in which he discussed selling all his Tesla stock. His reason was different; he thought he was going too close to Trump, and it’s not good for any business to offend half of the customer base, who believe in another ideology. I had limited exposure to Tesla, but luckily, I sold all my Tesla stock after listening to that interview. Whatever the reason may be, Prof. Damodaran proved to be right.

Potential Easing for Bank Rules:The Senate confirmed Federal Reserve Governor Michelle Bowman to the Fed’s top regulatory role, where she’s expected to push for looser bank rules. The first item on the list will be the long-standing demand for SLR relief, which will help lower the treasury yield by tens of basis points, according to Treasury Secretary Scott Bassent. Treasury yields fell this week, and upcoming changes to the SLR are expected to help them as well. The improved functioning of the treasury markets is crucial, and it will also benefit the equities market.

The Fed Beidge Book:

The beige book painted a weak picture of the economy this week, with only three districts reporting growth. Still, with multiple factors, such as tax and banking relief, in play, and tariff deals expected, it’s unclear if this weakness will translate into hard macro data. So it's better to wait, as some of these measures can more than offset this weakness.

For the week:

The S&P 500 is up 1.50%, the Nasdaq is up 2.18%, and the Dow 30 is up 1.17%.

Source: Barchart

CNN's Fear & Greed Index now stands at 63 (Greed) out of 100, down 1 point from last week. Details here

The top five trending stocks on Reddit are Tesla, SPY, Hood, UnitedHealth, and Lululemon. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for June 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Long-term Borrowing Costs Have Surged:

Reminder that the era of low interest rates is over. The image below shows that long-term borrowing costs for major economies have increased significantly.

The record bond issuances since the COVID-19 pandemic have led to an excess supply of debt, leading to a higher term premium.

This makes the planned reforms in the Supplemental Leverage Ratio (SLR) in the US super important. The relief to the banks is expected to increase their participation in the US Treasury markets and lower the yield by tens of basis points. At least this will have a one-time benefit in the short to medium term. Still, ultimately, Governments will have to reduce debt and become more prudent in fiscal deficit management to control the long-term borrowing costs.Earnings Recap:

The earnings season is almost over, and below is the summary of this quarter. For the S&P 500 companies, there is a minor slowdown in earnings and revenue growth, but it’s nothing unusual after back-to-back good quarters. The companies beating consensus estimates increased compared to the last quarter.

Source: LSEG

The story with small caps, though, is different, with companies reporting a significant slowdown compared to the previous quarter. In Q4 2024, small caps received a significant boost due to rate cuts. However, with the Fed now on pause and tariff uncertainty primarily affecting smaller firms, a slowdown is expected. In short, it’s still better to stick with large caps.

Source: LSEG

FRONT PAGES:

xAI Fund Raising: Elon Musk’s xAI is raising $300mn at a $113bn valuation, as he refocuses on his business empire and the AI race. Read

Bank Oversight Overhaul: Michelle Bowman, confirmed as the Fed’s Vice Chair for Supervision, stated that the central bank will reassess how it crafts and enforces rules for the largest banks, arguing that the post-2008 regulatory surge warrants a fresh examination. Read

Blockbuster IPO: Circle Internet surged 48% Friday, extending gains after its NYSE debut. Shares hit $123.49—nearly 4x the $31 offer—valuing it at $32.1B fully diluted. Read

US-China Trade Talks Continue: Treasury Secretary Scott Bessent, along with Commerce Secretary Howard Lutnick and U.S. Trade Representative Jamieson Greer, will meet Chinese officials for trade talks in London on Monday, President Trump said. Read

New Capital Rules in Switzerland: UBS Switzerland plans to tighten capital rules, requiring UBS to hold $26B more in core capital, fully capitalize foreign units, and scale back buybacks. The Swiss National Bank backs the move, citing stronger resilience. Read

Fed Survey Results: Businesses are raising prices even on goods unaffected by tariffs, according to Federal Reserve surveys and anecdotes released on Wednesday. Read

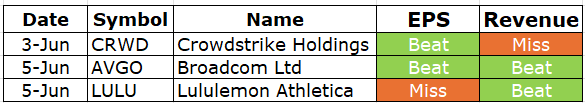

EARNINGS UPDATE:

CrowdStrike Mixed: CrowdStrike shares fell after the company’s revenue forecast missed estimates, its first update since announcing a 5% workforce reduction. Read

Broadcom Beat: Broadcom forecast Q3 revenue above Street estimates, driven by strong demand for networking and custom AI chips. Read

Lululemon Mixed: Lululemon shares experienced their steepest drop in five years after reporting a second consecutive weak quarter, raising concerns that competition, tariffs, and shifting consumer trends are threatening its growth story. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

12-Jun | ADBE | Adobe Systems Inc | After Close |

11-Jun | ORCL | Oracle Corp | After Close |

VIDEO’s OF THE WEEK:

The easiest way to stay business-savvy.

There’s a reason over 4 million professionals start their day with Morning Brew. It’s business news made simple—fast, engaging, and actually enjoyable to read.

From business and tech to finance and global affairs, Morning Brew covers the headlines shaping your work and your world. No jargon. No fluff. Just the need-to-know information, delivered with personality.

It takes less than 5 minutes to read, it’s completely free, and it might just become your favorite part of the morning. Sign up now and see why millions of professionals are hooked.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.