- Primal Thesis

- Posts

- Macro Volatility, Earnings Resilience

Macro Volatility, Earnings Resilience

📊 Mixed Macro Data: CPI, PPI, Retail Sales

🪙 Analysis of Circle’s First Earnings

📉 No Impact on Earnings Growth

📈 Calm Treasury Markets

🏔️ Jackson Hole Next Week

💵 One-Time Price Adjustment Coming

⚡ One Lesson from Coinbase Earnings

QUOTE OF THE WEEK:

“I think it's been a strong second quarter. I think the S&P 500 earnings were up around 13% and that's following on first quarter up 16%. So the estimates for 2025 now are still in that 12 to 13% range. And what's exciting about that too is we've seen a broadening out of the companies that are contributing to those earnings. We are optimistic about the market continuing to go higher.” Jeremiah Buckley, Portfolio Manager - Janus Henderson

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

EOD CNBC 15th Aug

WEEKLY MARKET WRAP:

Good Afternoon. A positive week for the markets, with decent earnings and mixed macroeconomic data.

Below are the key things to note this week:

Mixed Inflation: Two key data points related to inflation were released this week, giving a mixed picture.Consumer Price Index: On Tuesday, the CPI report came in better than expected, leading markets to rally. U.S. consumer prices rose 0.2% in July, matching expectations, leaving headline CPI at 2.7% year-on-year. Core CPI climbed 0.3%—its largest monthly gain since January—lifting the annual rate to 3.1% from 2.9%.

Producer Price Index: On Thursday, the PPI readings were surprisingly high, raising concerns. Producer prices jumped 0.9% in July, the biggest monthly rise since March 2022 and far above forecasts. Back in March 2022, CPI inflation was running at a scorching 13% annualized pace and 8.5% y/y, near the peak of the pandemic shock.

Source: Reuters

With better CPI numbers, the September rate cut was a done deal, but PPI numbers dented some of that sentiment. Key takeaways from these reports for me are -The Fed’s official inflation measure, the PCE, is scheduled for release later this month. Based on the CPI data, most forecasts predict a rate of 2.6% for the headline PCE and 2.9% for Core PCE. If the actual numbers stay close to this, markets won’t be surprised later this month.

Primary concerns are the Core CPI and PPI numbers and their potential impact on the next month’s data. Core metrics are considered better predictors of future inflation because they're more sticky (Fed Chair Jerome Powell has also talked about FOMC focusing on core PCE in his press conferences for this very reason). Additionally, PPI indicates that producers are charging higher prices for goods, and it is considered a leading indicator of consumer inflation.

As Core CPI and PPI numbers are both elevated, it will be crucial to keep a close eye on the inflation reports next month. As discussed multiple times in this newsletter, a one-time increase in headline PCE is expected by the end of this year (~3%), which means core PCE and CPIs can go up to 3.5%. This one-time price adjustment is expected to be normalized by 2026, with the headline PCE projected to return to the mid-2% range.

In short, the one-time minor price adjustment is expected in the coming months due to tariffs. Unless inflation reports (CPI & PPI) are terrible next month, the September rate cut is still expected, with CME FedWatch showing a probability of ~85%. The two reports below are expected to be released before the next FOMC meeting on September 17th:

Retail Sales: Consumer spending rose in July, matching expectations and underscoring the resilience of households despite uncertainty. Retail sales increased 0.5% from June, slower than June’s upwardly revised 0.9% but still signaling solid momentum. On an annual basis, sales climbed 3.9%.

I won't even waste time discussing the other two so-called key metrics released this week, namely the University of Michigan consumer sentiments and inflation expectations. It is better to ignore soft or sentimental data that is consistently wrong. This highlights the fact that people often say one thing but do something different.

No Impact on Earnings: At the start of this year, the US analysts’ consensus forecast for earnings was 12%. Many institutions lowered their projections to 0-4% after the tariff announcement. However, these projections are not holding, as the current earnings season is reporting growth of 13%. This means for the whole year, US companies are still on track to deliver 12-13% EPS growth as projected initially. Earnings are most important for the stock prices and should continue to support current valuations.

Jackson Hole Next Week: The annual Jackson Hole symposium is scheduled for next week. The Fed chair and other central bankers will gather to discuss topics from monetary policy to the economy. The commentary emerging from Jackson Hole will be essential to monitor and can cause short-term volatility in the markets. I will cover the highlights in next week’s newsletter. The Fed chair may use this event to provide a hint at the September meeting.For the week:

The S&P 500 is up 0.94%, the Nasdaq is up 0.81%, and the Dow 30 is up 1.74%.

Barchart

CNN's Fear & Greed Index now stands at 64 (Greed) out of 100, up 5 points from last week. Details here

The top five trending stocks on Reddit are UnitedHealthcare, Opendoor, SPY, Intel, and Nvidia. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for Sept. 17th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Lesson from Coinbase Earnings:

Coinbase shares have corrected by nearly 20% since the earnings announcement, as the results fell short of the “explosive” growth analysts had expected. The culprit is subdued crypto volatility: while Bitcoin and other tokens have rallied this year, the one-way move higher hasn’t spurred trading activity—the lifeblood of Coinbase’s fee revenue. With institutional adoption, the volatility in Bitcoin is expected to come down, which is not good news for Coinbase.

For years, I viewed Coinbase as a reasonable proxy for the crypto market. This quarter underscores that there is no substitute for Bitcoin itself. MicroStrategy and similar vehicles may appear to offer exposure, but investors ultimately pay a steep premium for the same underlying asset while assuming additional business risks. In short, crypto-linked equities may capture some upside, but real exposure requires holding Bitcoin—or other coins—directly, not through proxies.

Coinbase, on the other hand, can provide broader exposure to the cryptocurrency market, particularly with its early investment in Circle, which has created a significant revenue stream. For instance, in Q2 (second quarter), USDC reserve interest netted $151 million, making up approximately 23% of Coinbase’s net revenue.Circle’s first earnings as a public company:

Circle reported its first earnings since its initial public offering. The company talked about multiple new initiatives that will help Circle create new revenue streams and become the center of a new crypto-based payment system. The company mentioned on the call that it's a winner-takes-all market situation in the stablecoin space, and I agree with that assessment. I discussed the strategic advantage USDC enjoys in this newsletter, as well as in a detailed blog on my website.

Below are the key highlights:USDC circulation reached $61.3B, now at $65.2B (+90% YoY)

USDC on-chain volume grew 5.4× YoY to nearly $6T

Launched Circle Payments Network (CPN) and Arc Layer-1 blockchain. This will generate an additional revenue stream by earning gas fees (transaction fees in crypto)

Expanded partnerships with Binance, OKX, Stripe, Corpay, FIS, and Fiserv

Expanded network to 8 new blockchains, which continue to make USDC the most liquid on-chain stablecoin

Continue to expand core banking and liquidity capabilities, including with major GSIBs

The company plans to expand CPN from cross-border money movement into consumer, B2B, capital markets, and corporate treasury payments

USDC is emerging as the first-ever general-purpose architecture for money movement

The stablecoin market remains massive—dollar stablecoins account for just 1% of the U.S. M2 supply

In July, we launched Circle Gateway to simplify USDC use across blockchains and wallets, streamlining usability and speeding transactions

Calm Rates and Credit Markets:

Treasury volatility has collapsed, with the MOVE index down to 76.77—its lowest since early 2022 and half April’s peak—despite inflation pressures, record issuance, and policy uncertainty. The efficient functioning of treasury markets is essential for the health of all other financial markets; hence, this is excellent news. There have been multiple efforts by agencies to improve the functioning of the US Treasury markets, and it appears these efforts are showing some success. I covered this topic in my blog last year - Treasury Market Resilience: Key Developments and Future Outlook.

At the same time, US credit spreads have narrowed to 0.75 percentage points over Treasuries, the tightest since 1998, after a sharp rally fueled by easing trade tensions and heavy corporate issuance.

Together, these moves highlight an unusual calm across both rates and credit markets.

Source: Financial Times

FRONT PAGES:

OpenAI’s New Valuation: OpenAI plans a $6B secondary sale valuing it near $500B, with employees selling shares to SoftBank, Dragoneer, and Thrive. The launch of GPT-5, its most advanced model, has encountered a bumpy rollout, with users reporting loss of access to older models. Read

Intel in News: The Trump administration is in talks to take a stake in Intel, aiming to support its delayed Ohio factory hub. The move follows Trump’s call to oust CEO Lip-Bu Tan, citing conflicts of interest stemming from his past China ties. Read

Bridgewater Exit Chinese Stocks: Bridgewater Associates exited U.S.-listed Chinese stocks in Q2, reflecting a retreat amid geopolitical tensions and fading confidence in China’s economy. Its 13F filing showed closed positions in Baidu, Alibaba, JD.com, PDD Holdings, Nio, Trip.com, Yum China, Qifu Technology, and Ke Holdings. Read

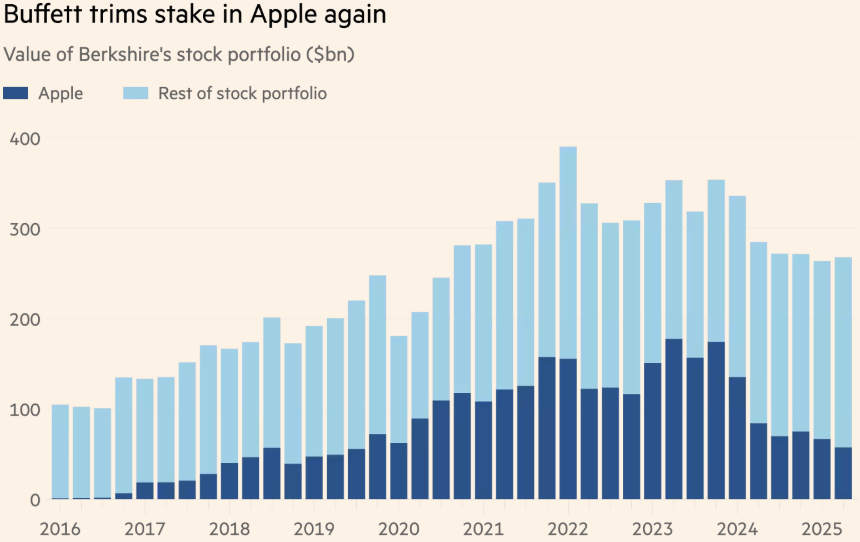

Buffett Trims Apple Position: Warren Buffett’s Berkshire Hathaway sold $4bn of Apple shares in Q2, offloading 20mn shares and trimming its stake to 280mn, worth $57.4bn. These are the first sales since Q3 2024, when Buffett cut his Apple position by over two-thirds. Read

EARNINGS UPDATE:

Coreweave Mixed: CoreWeave posted Q2 revenue of $1.21B, topping the $1.08B estimate, with adjusted operating income at $199.78M versus $162.8M expected. The company reported an adjusted loss per share of $0.60, wider than the $0.49 consensus.

Sea Ltd. Mixed: Sea’s revenue rose 38.2% year-over-year to $5.3B, with net income climbing to $414.2M from $79.9M a year earlier. E-commerce revenue grew 33.7% to $3.8B, while Digital Financial Services surged 70% to $882.8M. GMV increased 25% in the first half, with growth momentum expected to continue into Q3.

Circle Beat: Circle posted Q2 revenue of $658M, above estimates and up from $579M in Q1 and $430M a year ago. USDC circulation rose to $61.3B, from $60B in Q1 and $32.2B last year, while onchain volume held at $5.9T. Wallets grew to 5.7M from 4.9M in Q1. Costs increased to $407M vs. $348M in Q1. Circle projects USDC to grow 40% CAGR, other revenue of $75M–$85M in 2025, margin of 36%–38%, and expenses of $475M–$490M.

Cisco Beat: Cisco posted Q4 FY25 results with revenue of $14.7B, up 8% YoY and above estimates. Adjusted EPS was $0.99 vs $0.98 consensus; GAAP EPS $0.71 vs $0.66. Product revenue rose 10% to $10.78B, led by networking at $7.34B. Services contributed $3.79B. Adjusted gross margin was 68.4%, slightly above expectations.

Applied Materials Beat: Applied Materials beat Q3 estimates with EPS of $2.48 vs. $2.36 expected and revenue of $7.3B vs. $7.21B. However, it reduced Q4 guidance, projecting revenue of $6.2B–$7.2B (midpoint: $6.7B vs. $7.32B expected) and EPS of $1.91–$2.31 (midpoint: $2.11 vs. $2.38 expected), citing macroeconomic and policy challenges, including those in China.

Deere Beat: Deere posted Q3 EPS of $4.75, topping estimates of $4.58. The issue was guidance: management cut its 2025 net income outlook to a midpoint of $5B, down from $5.15B in May. The downgrade wasn’t a shock—2025 has been difficult—but expectations now hinge on a rebound in 2026.

NetEase Miss: NetEase Q2 Non-GAAP EPADS was $2.09. Revenue rose 9.4% Y/Y to $3.9B. Games revenue grew 13.7% to RMB22.8B ($3.2B). Youdao rose 7.2% to RMB1.4B ($198M). Cloud Music fell 3.5% to RMB2.0B ($275M). Innovative businesses declined 17.8% to RMB1.7B ($237M).

Nu Holding Mixed: Nu Holdings’ Q1 earnings included a $42M one-time benefit from deferred tax assets. Without it, net income would have been $515M, missing consensus by 10% vs the reported 3% miss, and down 7.7% Q/Q. Citi’s Gustavo Schroden highlighted this adjustment and maintains a Sell rating on the Brazilian digital bank.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

18-Aug | PANW | Palo Alto Networks Inc | After Close |

19-Aug | HD | Home Depot | Before Open |

19-Aug | MDT | Medtronic Inc | Before Open |

20-Aug | ADI | Analog Devices | Before Open |

20-Aug | LOW | Lowe's Companies | Before Open |

20-Aug | TJX | TJX Companies | Before Open |

21-Aug | BABA | Alibaba Group Holding ADR | -- |

21-Aug | INTU | Intuit Inc | After Close |

21-Aug | WDAY | Workday Inc | After Close |

21-Aug | WMT | Walmart Inc | Before Open |

25-Aug | BHP | Bhp Billiton Ltd ADR | -- |

25-Aug | PDD | Pdd Holdings Inc | -- |

26-Aug | BMO | Bank of Montreal | Before Open |

26-Aug | BNS | Bank of Nova Scotia | Before Open |

VIDEO’s OF THE WEEK:

6 free tools to communicate better at work

Smart Brevity is built to fix inbox — and information — overload. Its science-backed methodology can take any communication from confusing to clear.

Unlock our free resources on the communication…

Method that makes work more efficient

Tactic that hooks busy readers

Format that structures sharper updates

Start making every word work harder so your readers don’t have to.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.

F