- Primal Thesis

- Posts

- Markets Eye Gold, Fed, & Big Tech Week

Markets Eye Gold, Fed, & Big Tech Week

🟡 Gold Futures Pricing Above $5,000

📉 In Line PCE Inflation

🚀 Fastest Quarterly GDP Growth In Two Years

🏦 The Fed Expected To Keep Rates Unchanged Next Week

💻 Major Tech Earnings Next Week

🧾 Top IPOs To Watch In 2026

📊 Operating Margin Expansion Driven By Tech

QUOTE OF THE WEEK:

“You got to ignore the macro and buy the micro. And I just think we're going to continue to see earnings come in. Intel aside—earnings come in very strong. And so if you look at what's happening from the micro level, earnings are strong. And then the macro level—we know GDP is strong. And even though yields have gone higher not only in the US but globally, small caps continue to march higher, which tells me that investors are thinking the real economy is going to continue to grow, and the stock market will continue to broaden out this year.” - Bryn Talkington, founder and Managing Partner of Requisite Capital Management

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC - 1/23

WEEKLY MARKET WRAP:

Good Afternoon. A volatile week for markets amid geopolitical news, strong earnings, and decent macro data. All major indices recorded minor losses and ended almost where they started the week. FOMC rate cut decision and major tech earnings will be the focus for next week.

Below are the key things to note this week:In line PCE: The Fed’s preferred inflation gauge, the PCE price index, came in at 2.8% for both headline and core, matching consensus. October was revised at 2.7% on both measures, with monthly inflation running at a steady 0.2%; the BEA released October and November data together due to disruptions from the government shutdown.

Highest GDP in two years: Inflation-adjusted GDP was revised up to a 4.4% annualized pace, the fastest in two years, driven by stronger exports and investment that more than offset a slight downgrade to consumer spending. The revision itself was immaterial, with growth edging up just 0.03pp from an unrounded 4.34% to 4.37%.

FOMC Next Week:

The Fed is expected to keep the rates unchanged next Wednesday. The CME FedWatch probabilities stand at ~96%.

Reuters Poll

Gold - All Time High:

15 months ago, on September 1st, I wrote how Gold was the best-performing asset for 2024. The Gold price on that day was $2502. I was sure the Gold would continue to surge amid the looming geopolitical uncertainties, but even I never imagined it would rise at this pace.Just three months after breaching $4,000/oz, gold is now flirting with $5,000. January futures jumped 8.5% this week to a record $4,976, marking the largest weekly dollar gain ever and the biggest percentage surge since the March 2020 Covid panic. Gold is up over $650 this month, driven by tariff fears and rising concern over Federal Reserve independence, with longer-dated futures already pricing above $5,000.

The rally is being powered by a mix of structural and cyclical factors:

Safe-haven demand & macro uncertainty

Investors are piling into gold amid geopolitical tensions, tariff/policy risk, and market volatility — classic risk-off buying.Monetary policy / lower yields

Expectations of future Fed rate cuts and lower yields reduce the opportunity cost of holding a non-yielding asset like gold, making it more attractive.Weak dollar & currency concerns

Fears about U.S. dollar strength and fiscal policy uncertainty are prompting both investors and central banks to hedge with gold.Equity market caution/alternative to stocks

Elevated valuations in equities — especially in tech — have pushed some risk capital into alternatives such as gold.Supply constraints

Gold supply is relatively inelastic: new mining adds only a few percent annually. When demand surges — from investors and official buyers — there’s limited displacement by producers.

Major Tech Earnings Next Week:

Four out of seven Mag 7 stocks are scheduled to report earnings next week. These will be crucial for the market, along with the FOMC press conference. The market will look to hear more about the AI Capex plans and ROI updates.For the week:

The S&P 500 is down 0.42%, the Nasdaq is down 0.12%, and the Dow 30 is down 0.70%.

Barchart

CNN's Fear & Greed Index now stands at 52 (Neutral) out of 100, down 10 points from last week. Details here

The top five trending stocks on Reddit are SLV, SPY, Intel, ICE, and enCore Energy. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Operations: The New York Fed’s standing repo operations (primarily reflecting SRF take-up) as of Jan 23 is zero.

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for Jan 28th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Top IPOs to watch in 2026:

After a slow start in public markets over the past few years, the IPO pipeline is heating up — and 2026 may mark the strongest year for public listings since 2021, driven by improving macro conditions, narrowing valuation gaps, and a backlog of mature private companies under pressure to exit.

1) AI & Enterprise Software DominateOpenAI may target a $1T+ valuation, leveraging ChatGPT-driven growth, with late-2026 or early-2027 timing possible.

Anthropic is advancing toward an IPO as early as 2026 or 2027, backed by a ~$350B funding round and enterprise-focused AI products.

Databricks — now ~ $134B post-funding — is a top candidate in the data and AI stack space.

Cohesity and Cerebras Systems are also on the IPO radar as they scale cybersecurity and AI compute platforms, respectively.

Canva, with a ~$42B valuation, could pivot from consumer to enterprise and list in 2026.

2) Fintech & Crypto Listings Gain Traction

Stripe continues to expand beyond payments into being a financial OS, shaping expectations for a major listing.

Kraken and BitGo are preparing to go public, reflecting rising interest in regulated crypto infrastructure.

3) Aerospace & Global Market Players

SpaceX remains a headline potential IPO — possibly the largest ever — with current private valuations near $800B and targets above $1T.

Reliance Jio could deliver one of India’s largest tech floatations, with analysts valuing the telecom powerhouse well into the double-digit billions.

Shein, with a ~$66B valuation and backed by global banks, remains a marquee retail opportunity despite geopolitical hurdles.

Why Tech Deserves Higher Valuations:

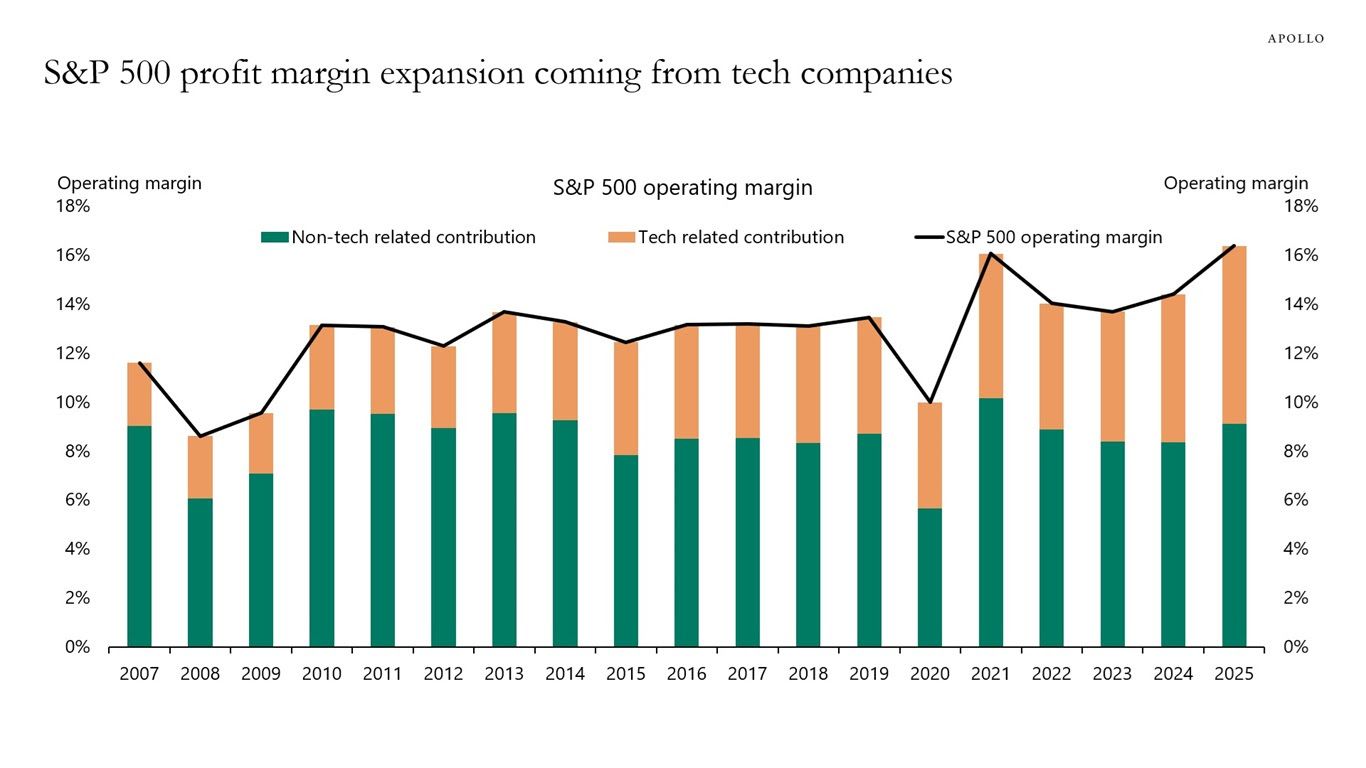

Great insights from Apollo this week. Operating margin reflects the percentage of revenue left after operating costs, such as wages, materials, and overhead. Over the past 20 years, the entire expansion in S&P 500 operating margins has been driven by tech-related sectors, while non-tech companies’ margins have remained broadly flat at around 9%.

Apollo

FRONT PAGES:

Another piece of good news for Crypto: The US Securities and Exchange Commission plans to drop its 2023 lawsuit against Gemini Trust Co., which alleged that the firm illegally raised billions through an unregistered crypto-lending program. Read

Cap One Scoops Brex: Capital One Financial agreed to acquire fintech Brex for $5.15 billion in a cash-and-stock deal, strengthening its push into corporate clients. Founded nearly a decade ago, Brex provides technology for managing corporate cards, expenses, and rewards, and oversees about $13 billion in deposits across partner banks and money-market funds. Read

Liquidity issues with JGBs: Just $280 million of trading triggered a breakdown in Japan’s government bond market, erasing $41 billion across the curve. The scale mismatch between minimal traded volume and massive valuation losses underscores how illiquidity has turned JGBs into a growing fault line in the global financial system. Read

JPM’s $2bn AI Budget: The world’s largest bank has moved AI from “discretionary innovation” to core infrastructure, putting it on par with data centers, payment rails, and risk controls. Of its roughly $17 billion annual tech budget, JPMorgan is committing about $2 billion to AI with the same non-negotiable priority as cybersecurity and operational resilience. Read

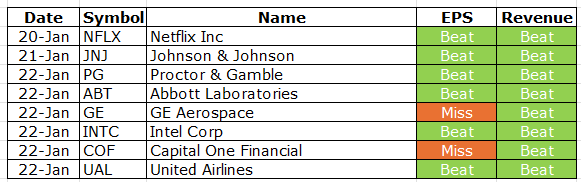

EARNINGS UPDATE:

Primal Thesis

Netflix Beat: Q4 revenue rose 18% YoY to $12.05B; operating income increased 30%. EPS of $0.56 topped consensus, with revenue ahead by ~$82M. 2025 ad revenue exceeded $1.5B, more than 2.5x YoY. Paid memberships surpassed 325M in Q4’25. 2026 guidance calls for $50.7–$51.7B in revenue and a 31.5% operating margin. The Warner Bros. acquisition is advancing under an amended all-cash structure.

JNJ Beat: Q4 sales rose 9.1% YoY to $24.6B. GAAP EPS was $2.10 and adjusted EPS $2.46, both reflecting a $0.10 impact from the Halda acquisition. The quarter saw key approvals for CAPLYTA in MDD and RYBREVANT FASPRO with LAZCLUZE in NSCLC, alongside landmark data for TECVAYLI with DARZALEX FASPRO, and submission of the OTTAVA robotic surgical system to the FDA. Regionally, growth was led by International (+11.3%) versus the U.S. (+7.5%), while Innovative Medicine and MedTech grew 10.0% and 7.5% YoY, respectively.

PG Beat: Net sales rose 1% to $22.2B, with flat organic growth. Diluted EPS was $1.78, down 5%, while Core EPS held steady at $1.88. Gross margin declined 120 bps to 51.2% and operating margin fell 200 bps to 24.2%. Operating cash flow totaled $5.0B, with adjusted FCF productivity at 88%. The company returned $4.8B to shareholders and reaffirmed FY26 sales and Core EPS guidance, updating GAAP EPS to reflect restructuring.

Abbott Labs Beat: Adjusted EPS came in at $1.50, up 12% YoY, with GAAP EPS at $1.01. 4Q25 sales were $11.46B, up 4.4% reported and 3.0% organically. Medical Devices grew 12.3%, driven by EP, HF, Diabetes, and Rhythm Management, while Diagnostics declined 2.5% as COVID testing sales fell to $89M from $176M last year. For 2026, management guides to organic growth of 6.5%–7.5% and adjusted EPS of $5.55–$5.80. The company extended its dividend growth streak to 54 years, with a $0.63 payout scheduled for February 13, 2026.

GE Mixed: Q4 revenue grew 18% to $12.7B, with adjusted revenue up 20%. Adjusted EPS was $1.57 and GAAP EPS $2.31. Orders jumped 74% to $27.0B, lifting backlog to roughly $190B. CFOA reached $2.1B and FCF $1.8B, exceeding 100% conversion. Engine wins hit a record, while full-year services revenue rose 26%.

Intel Beat: Q4 revenue was $13.7B, down 4% YoY. GAAP EPS came in at -$0.12, while non-GAAP EPS was $0.15. Cash from operations totaled $4.3B in the quarter. Intel introduced 18A products and is ramping high-volume manufacturing in Arizona and Oregon. The company announced a partnership with Cisco to develop distributed AI workloads using the Xeon 6 SoC and completed a $5.0B common stock sale to NVIDIA.

Cap One Mixed: Q4 2025 net income was $2.1B, with GAAP EPS of $3.26 and adjusted EPS of $3.86. Total net revenue reached $15.6B, up 1% QoQ. Credit costs remained elevated, with $4.1B in provisions, $3.8B in net charge-offs, and a $302M reserve build. Non-interest expense was $9.3B, driven by a 38% QoQ jump in marketing and 8% higher operating costs. CET1 stood at 14.3% as of December 31, 2025. The firm agreed to acquire Brex Inc. for $5.15B, split evenly between cash and stock.

United Airlines Beat: United delivered record quarterly revenue of $15.4B, the highest in its history. Q4 GAAP EPS was $3.19, with adjusted EPS of $3.10 in line with guidance. The airline carried 181M passengers in 2025, ranking #2 in on-time departures with the lowest seat cancellation rate. A government shutdown cut Q4 pre-tax income by ~$250M, though a customer-friendly refund policy drove record November NPS. Capacity rose 6.5% YoY, supporting the strongest quarterly unit revenue of the year.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

27-Jan | RTX | Rtx Corp | Before Open |

27-Jan | UNH | UnitedHealth Group Inc | Before Open |

28-Jan | IBM | Intl Business Machines | After Close |

28-Jan | LRCX | Lam Research Corp | After Close |

28-Jan | META | Meta Platforms Inc | After Close |

28-Jan | MSFT | Microsoft Corp | After Close |

28-Jan | TSLA | Tesla Inc | After Close |

29-Jan | AAPL | Apple Inc | After Close |

29-Jan | CAT | Caterpillar Inc | Before Open |

29-Jan | MA | Mastercard Inc | Before Open |

29-Jan | TMO | Thermo Fisher Scientific Inc | Before Open |

29-Jan | V | Visa Inc | After Close |

30-Jan | AXP | American Express Company | Before Open |

30-Jan | CVX | Chevron Corp | Before Open |

30-Jan | XOM | Exxon Mobil Corp | Before Open |

VIDEO’s OF THE WEEK:

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.