- Primal Thesis

- Posts

- Nvidia, Bitcoin Hit Record Highs

Nvidia, Bitcoin Hit Record Highs

💰 Nvidia Hits $4 Trillion Market Cap

📄 Key Points From FOMC Minutes

₿ Bitcoin Hits All-Time High

🏦 JP Morgan Goes On Defense Against Fintech

📊 Earnings Season Kick-Off Next Week

🏃♂️ The Rise In Deposit Flightiness

QUOTE OF THE WEEK:

“There's unrelenting demand from corporations and institutional investors, and that's colliding with severely limited supply. You know the Bitcoin network only produces 450 Bitcoins per day. Yesterday alone, Bitcoin ETFs bought 10,000 Bitcoin. This institutional investment into Bitcoin is a one-time event. It's going to take years to play out. But I think over the course of those years, there's going to be this persistent bid where there's more demand than there is supply. And the natural response to that is what we're seeing in the market, which is Bitcoin's price goes higher.” - Matt Hougan, CEO - BitWise

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC - EOD July 11th

WEEKLY MARKET WRAP:

Good Afternoon. A negative week for the markets with major milestones for Nvidia and Bitcoin. It was a quiet week with no significant earnings or macro data to report. Only the key macro data of unemployment claims was better than expected.

Below are the key things to note this week:

Nvidia Hits $4 Trillion Market Cap:

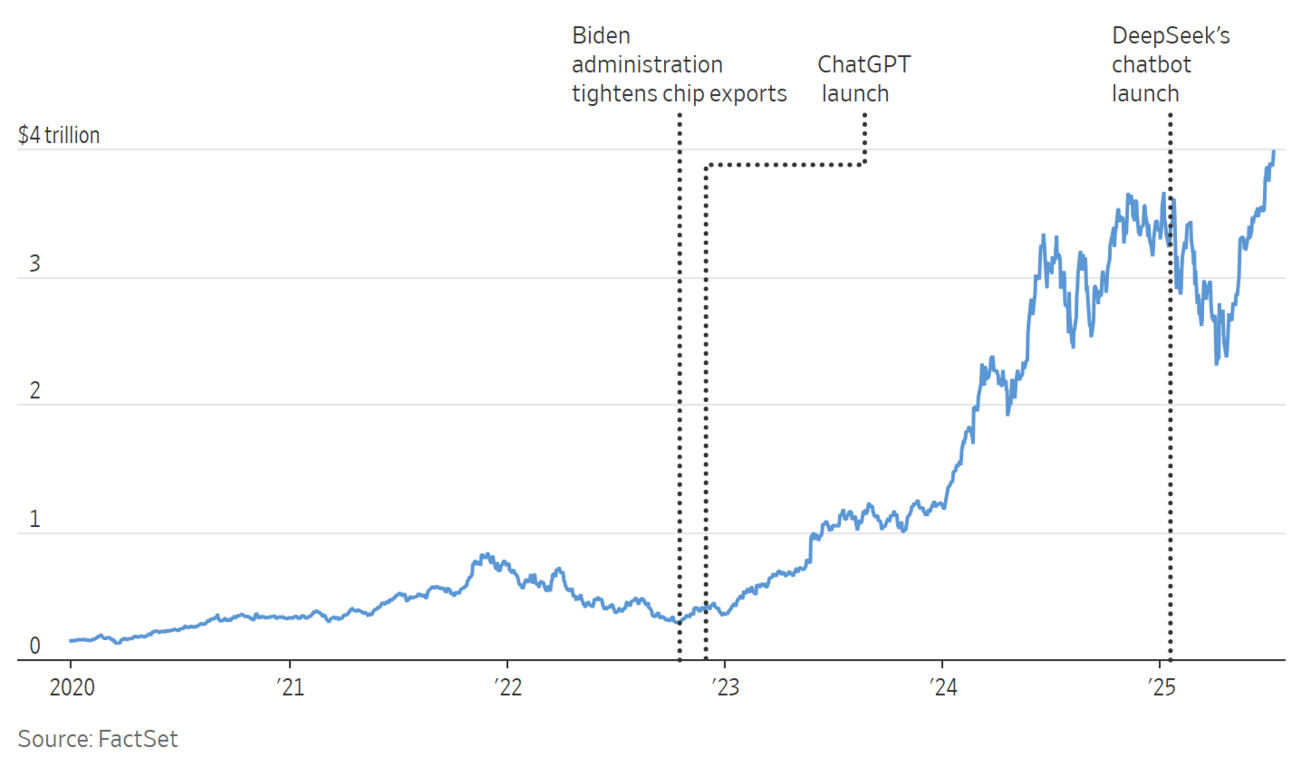

Nvidia became the first company to reach $4 trillion market cap. I'm not surprised by the unique position it holds in the AI revolution story. When the DeepSeek incident occurred earlier this year, I wrote in this newsletter that it would not have a severe impact on OpenAI or Nvidia. Computing power has no alternative, and Nvidia is not trading at an insane valuation, so $5 trillion is the next stop. Read my analysis of the DeepSeek here.

Source: WSJ

Bitcoin Hits All-Time High:

Another excellent week for the crypto industry, with Bitcoin hitting another all-time high. Institutions are piling on Bitcoin and driving the demand. Read my analysis on why Bitcoin is here to stay.More Good News Next Week:

Banks will kick off the earnings season next week and are expected to beat expectations. In addition, the guidance and commentary will be positive, based on the recent success of the stress tests and the proposed relief on the Supplemental Leverage Ratio (SLR).

In addition to the banks, Netflix is also expected to report next week, and based on historical trends, there is a strong possibility that Netflix will report stellar earnings.

The only potential risk next week is if the CPI report is released on Tuesday. As I have covered multiple times in this newsletter, inflation is expected to continue falling. Unless we have a surprise increase in CPI due to the tariff impact, but I don’t think it’s a high possibility. So, if the CPI also improves, the market should continue to move higher.

Validation of FinTechs:

In a defensive move, JPM moved to charge fintechs fees to access customer data. This shows that fintech firms, such as Affirm and Chime, are having a significant impact on major banks. It will be interesting to see if there is any real impact due to this, but many experts believe it to be unlikely.For the week:

The S&P 500 is down 0.31%, the Nasdaq is down 0.08%, and the Dow 30 is down 1.02%.

Barchart

CNN's Fear & Greed Index now stands at 75 (Extreme Greed) out of 100, down 3 points from last week. Details here

The top five trending stocks on Reddit are SPY, Nvidia, Tesla, Microstrategy, and Google. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for July 30th FOMC Meeting:

CURATED INSIGHTS & ANALYSIS:

The Fed on Deposit Flightness:

The Fed blog this week provided great insights into deposit flightiness. The analysis shows that deposit sensitivity increases after Quantitative Easing.

QE expands reserves and creates new deposits, but these deposits are not like the ones that came before. The key mechanism: deposit growth from QE disproportionately attracts depositors who are more sensitive to interest rate changes. Compared to traditional retail depositors, these new entrants—such as institutional investors—are quicker to reallocate funds when yields shift. As a result, the average deposit in the system becomes more flighty. Put differently, the marginal depositor has changed and become more responsive to rate differentials.

Full blog here: The Rise in Deposit Flightiness.

Key Points from FOMC Minutes:

Participants acknowledged persistent uncertainty in economic conditions, which complicates both the design and communication of monetary policy.

Treasury market liquidity improved as volatility declined; auction demand remained strong despite concerns in April’s fiscal outlook.

Treasury auction performance rose modestly, aligning with longer-term averages, which suggests that investor confidence remained intact.

With the debt ceiling resolved, rebuilding the Treasury General Account (TGA) is expected to rapidly drain system liquidity, pressuring ON RRP and reserve balances.

Real private domestic final purchases—often a better growth gauge than GDP—rose strongly in Q1 and continued expanding in Q2.

Consumer spending and business investment remained solid, supporting broad-based economic momentum.

Inflation moderated but remained above target; services inflation eased while goods inflation rebounded. Risks of persistence remain.

Most participants flagged tariffs as a potential source of sustained inflationary pressure, which could impact expectations if price effects persist.

Long-term inflation expectations remained anchored; however, short-term expectations stayed elevated and could influence price/wage dynamics.

The labor market stayed solid with low unemployment; however, some firms paused hiring due to policy uncertainty and weak sentiment.

Participants judged the policy to be moderately restrictive and favored a wait-and-see approach for greater inflation clarity.

Most participants supported rate cuts later this year, assuming inflation pressures from tariffs prove temporary and the labor market stays resilient.

A minority cautioned against easing, citing upside inflation risks, particularly from elevated short-term expectations and external shocks.

FRONT PAGES:

Goldman Tests AI Software Engineer: Goldman is testing Devin, an AI software engineer from Cognition, which may soon join its 12,000 human developers, per tech chief Marco Argenti. Cognition made headlines last year, claiming Devin as the world’s first AI engineer. It’s another indication of how rapidly AI is transforming corporate technology. Read

Good Banks Earnings Next Week: America’s biggest banks are set to report sharply higher Q2 profits as clients rushed to reposition amid Trump’s shifting trade policies. JPMorgan, Citi, Goldman, and BofA are expected to post $26.4B in trading revenues—up 11% YoY, per FactSet. Read

Nvidia’s Achievement: Nvidia became the first company to reach a $4 trillion market cap, surpassing Apple and Microsoft in Wednesday morning trading on the Nasdaq. Read

JP Morgan Goes Defensive: JPMorgan will begin charging fintech firms hefty fees—potentially worth hundreds of millions—for access to customer bank data. This upends a core pillar of platforms like Venmo, Coinbase, and Robinhood, which have long relied on free access to enable money transfers and trading. Read

Bitcoin Hits All-Time High: Bitcoin topped $118K as institutions poured into ETFs. Thursday saw $1.18B in bitcoin ETF inflows—2025’s highest. Ether ETFs added $383.1 million, their second-best day ever. Bitcoin is up nearly 10% this week; ether has surged over 21%, pacing its best week since May 9. Read

EARNINGS UPDATE:

No major earnings reported this week.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

15-Jul | WFC | Wells Fargo & Company | Before Open |

15-Jul | JPM | JP Morgan Chase & Company | Before Open |

16-Jul | ASML | Asml Holdings NY Reg ADR | Before Open |

16-Jul | MS | Morgan Stanley | Before Open |

16-Jul | JNJ | Johnson & Johnson | Before Open |

16-Jul | GS | Goldman Sachs Group | Before Open |

16-Jul | BAC | Bank of America Corp | Before Open |

17-Jul | NFLX | Netflix Inc | After Close |

17-Jul | GE | GE Aerospace | Before Open |

17-Jul | TSM | Taiwan Semiconductor ADR | -- |

17-Jul | NVS | Novartis Ag ADR | Before Open |

17-Jul | ABT | Abbott Laboratories | Before Open |

18-Jul | AXP | American Express Company | Before Open |

VIDEO’s OF THE WEEK:

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.