- Primal Thesis

- Posts

- Nvidia Earnings & PCE: Key Week Ahead

Nvidia Earnings & PCE: Key Week Ahead

Key Points From Warren Buffet's Annual Letter To Shareholders

Main Takeaways From FOMC Meeting Minutes

Nvidia Earnings and PCE Preview

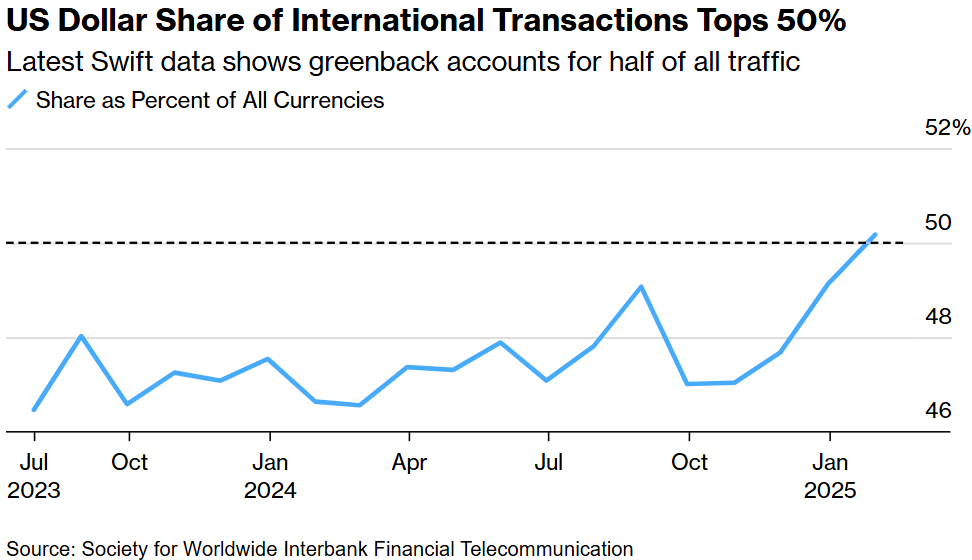

Dollar Dominance

Global Central Bank US Treasury Holding Trends

QUOTE OF THE WEEK:

“A decent batting average in personnel decisions is all that can be hoped for. The cardinal sin is delaying the correction of mistakes or what Charlie Munger called “thumb-sucking.” Problems, he would tell me, cannot be wished away. They require action, however uncomfortable that may be.

Our experience is that a single winning decision can make a breathtaking difference over time. Mistakes fade away; winners can blossom forever.” - Warren Buffet, Letter to Shareholders on 2/22/2025.

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

Good Afternoon. It was a down week for the market, with all major indices recording noticeable losses. Especially on Friday after the flash, US Services PMI reported the lowest reading of the two years. Next week is crucial, with Nvidia earnings on Wednesday and the Fed’s official inflation measure, the PCE, coming on Friday. These two factors will decide the market direction.

Below are the key highlights to note:

Services to Manufacturing: Flash PMI data showed on Friday that the US trend is shifting from services to manufacturing. This is not necessarily bad news, as the services sector has been hot for some time, while manufacturing has been lagging.

PCE Forecast: The FOMC meeting minutes show that the Fed expects headline PCE to be 2.6% and core PCE to be 2.8%. Any reading higher than these in either core or headline PCE will be bad for the markets and highlight that inflation is hotter than the Fed expects or that the restrictive policy needs to be continued. Most institutional forecasts I have seen are also the same as FOMC or lower, which is good.

As I repeatedly said, the CPI numbers are always higher than the PCE due to methodology differences, and PCE is the Fed’s official measure.Nvidia Earnings Next Week: Mag 7’s are underperforming this year after two years of stellar outperformance. Next week is crucial for them as most other Mag 7 companies reported good earnings, and Nvidia is the last to go.

I expect Nvidia's earnings to be good, with decent guidance as:

This is the first quarter with new Blackwell chips in the market. The deep seek effect (if at all any) won't be reflected in these earnings as these for the quarter ended in December.

The capex from hyperscalers shows that they are continuing massive investments in AI, with Nividia being the biggest beneficiary, which should be reflected in the guidance.

What Nvidia says on DeepSeek will be the most critical aspect of the earnings call.

Supreme Dollar: As the dominant reserve currency, the dollar remains the primary driver of Swift transactions, averaging about 48% over the past 18 months. The euro follows at roughly 23%, with the British pound at 7.1%. This is even after sanctions on Russia for the last few years. If these sanctions are lifted as Trump pushes to end the war, the dollar will be more dominant.

For the week:

The S&P 500 is down 1.67%, the Nasdaq is down 2.21%, and the Dow 30 is down 2.87%.

Source: Barchart

CNN's Fear & Greed Index now stands at 35 (Fear) out of 100, down 11 points from last week. Details here

The top five trending stocks on Reddit are SPY, NVDA, HIMS, PLTR, and CELH. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for Mar 19th FOMC Meeting:

CME FedWatch

FRONT PAGES:

Amazon surpassed Walmart in quarterly sales for the first time, reporting $187.8 billion against Walmart’s $180.5 billion. Despite this, Walmart remains ahead in annual revenue, though Amazon continues to close the gap. Read

Alibaba Get $1Bn Investment: Billionaire investor Ryan Cohen has expanded his stake in Alibaba Group to approximately $1 billion in recent months, according to the Wall Street Journal, citing sources familiar with the matter. Read

United Healthcare Troubles: The U.S. Department of Justice is reportedly investigating Unite’s Medicare billing practices. Authorities are assessing whether the insurer manipulated patient diagnoses to unlawfully boost monthly lump-sum payments under the Medicare Advantage program, per the Wall Street Journal. Read

Coinbase’s Legal Win: Coinbase CEO Brian Armstrong stated on CNBC’s Squawk Box that the company will not pay any fine. In 2023, the SEC accused Coinbase of running an unregistered securities exchange and failing to register its crypto-staking program. Read

China Reduce US Treasury Holdings: China’s Treasury holdings have declined by approximately $550bn since their 2011 peak. In 2024, UK holdings rose by $34.2bn, Belgium by $60.2bn, and Luxembourg by $84bn. Japan remains the largest holder, exceeding $1tn. One reason why Gold has been in demand in the last few years 😃 Read

EARNINGS UPDATE:

Walmart Beat: Walmart exceeded earnings and revenue forecasts for its fiscal Q4 but expects profit growth to slow this year. CFO John David Rainey cautioned that the company won’t be “immune” to impending tariffs on Mexico and Canada. E-commerce and membership programs saw strong gains. Read

Arista Networks Beat: ANET projected first-quarter revenue above Wall Street expectations, driven by rising demand for its cloud networking gear amid the AI boom. The results highlight the increasing need for advanced networking infrastructure to support complex AI workloads. Read

Booking Holdings Beat: Booking Holdings beat fourth-quarter profit and revenue estimates, driven by strong international travel demand. European leisure travel remained robust, fueled by domestic trips and affluent U.S. tourists. Asia-Pacific also saw strong demand, with Southeast Asian destinations benefiting from high-income Chinese travelers after eased visa rules. Read

Medtronic Miss: Medtronic missed Wall Street's Q3 revenue estimates as distributors scaled back purchases of its surgical devices and warned of continued challenges this quarter. Read

Analog Devices Beat: ADI surpassed analyst expectations for its fiscal first quarter and projected a return to growth beginning this quarter. Read

Berkshire Record Earnings: Berkshire Hathaway reported a third consecutive record annual operating profit, driven by higher underwriting earnings and investment income. Its cash reserves soared to $334.2 billion by year-end 2024, doubling from the prior year. In his annual letter, Warren Buffett reaffirmed Berkshire’s preference for investing in businesses over holding cash. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

25-Feb | HD | Home Depot | Before Open |

25-Feb | INTU | Intuit Inc | After Close |

26-Feb | CRM | Salesforce Inc | After Close |

26-Feb | LOW | Lowe's Companies | Before Open |

26-Feb | NVDA | Nvidia Corp | After Close |

26-Feb | TJX | TJX Companies | Before Open |

27-Feb | KOF | Coca Cola Femsa S.A.B. DE C.V. ADR | -- |

27-Feb | RY | Royal Bank of Canada | Before Open |

27-Feb | TD | Toronto Dominion Bank | Before Open |

28-Feb | BRK.B | Berkshire Hathaway Cl B | -- |

4-Mar | CRWD | Crowdstrike Holdings Inc | After Close |

CURATED INSIGHTS & ANALYSIS:

Warren Buffet’s Shareholder Letter:

Warren Buffet released his annual shareholder letter yesterday. Below are the words of wisdom from his latest letter:Owning Mistakes: Mistakes are unavoidable, but it’s essential to acknowledge them. The cardinal sin is to delay corrective actions, however uncomfortable it may be. A decent batting average of personal decisions is all that can be hoped for. Mistakes fade away; winners can blossom forever.

Lifelong Learning: I never look at where the candidate has gone to school. Great managers can be from the most famous or less prestigious schools. For example, Bill Gates decided to drop out to get underway into the exploding industry. I was lucky enough to get an education at three fine universities. And I avidly believe in lifelong learning.

Taxes: Berkshire's tax payment is 5% of what corporate America paid in total, more than the tech giants, which have trillions of dollars in valuation.

Long-Term Investing: Our investment horizon is far longer than a year. The YoY numbers can swing wildly. These long-termers are the purchases that sometimes make the cash register ring like church bells.

Reinvesting: From 1965-2024, Berkshire shareholders received dividends only once. Berkshire shareholders endorsed continuous reinvestment for sixty years, enabling the company to build its taxable income.

Equity over Cash: Berkshire shareholders can rest assured that we will forever deploy a substantial majority of their money in equities

Capitalism: Capitalism has flaws but can make wonders unmatched by any other economic system.

American Miracle: Charlie and I have always acknowledged that Berkshire would not have achieved its results in any locale except America, whereas America would have been every bit the success it has been if Berkshire had never existed.

Stable Currency: Uncle Sam should spend tax dollars wisely and make sure we maintain a stable currency.

Japanese Investments: Berkshire increased long-term holdings in five great large Japanese businesses.

New Book: In this year’s annual gathering in Omaha, investors can purchase a special edition of “60 Years of Berkshire Hathway,” honoring Charlie Munger.

The letter is attached below:WF_2024_Letter.pdf63.34 KB • PDF File

FOMC Meeting Minutes

Below are the key takeaways from the FOMC meeting minutes released earlier this week:

Monetary Framework Review: The Fed began the review of its monetary policy framework. The last review was conducted before the COVID-19 pandemic; the current review is critical. The context of pre- to post-pandemic is very different. The Fed expected its monetary framework to be reviewed by late summer.

Term Premium: Much of the rise in real yields stemmed from higher real-term premiums, likely driven by uncertainty over the policy rate path and other factors. Inflation compensation measures increased slightly, but survey-based inflation expectations and TIPS pricing remained aligned with expectations that inflation would return to the Fed’s 2% target.

Reserves: The range of indicators suggests that reserves are abundant.

Inflation Forecast: Staff projected total PCE inflation at 2.6% for the 12 months ending in December, with core PCE inflation at 2.8%. Minutes note that some members pointed out that the relatively higher inflation in early 2024 is impacting the 12-month average to go up. More downward pressure on inflation is expected due to the current relatively restrictive policy, slow wage growth, etc.

Strong Economy: The real private domestic final purchases, which comprise PCE and private fixed investment and which often provide a better signal than GDP of underlying economic momentum, appeared to have risen faster than real GDP in the fourth quarter, led by continued strength in consumer spending.

Inflation: All major economies notice lower inflation, which is mainly driven by lower energy prices.

Policy Rates: Many central banks eased policy except Japan, where rates increased.

VIDEO’s OF THE WEEK:

The gold standard of business news

Morning Brew is transforming the way working professionals consume business news.

They skip the jargon and lengthy stories, and instead serve up the news impacting your life and career with a hint of wit and humor. This way, you’ll actually enjoy reading the news—and the information sticks.

Best part? Morning Brew’s newsletter is completely free. Sign up in just 10 seconds and if you realize that you prefer long, dense, and boring business news—you can always go back to it.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.