- Primal Thesis

- Posts

- Rate Cut Worries, GPU Risks, AI Spending

Rate Cut Worries, GPU Risks, AI Spending

📈 Nvidia Earnings Next Week

💸 Reduced Fed Rate Cut Hopes

🪙 Bitcoin Falls To Lowest Level Since May

🏛️ Longest US Government Shutdown Over

🔧 GPU Depreciation Concerns

🤖 Why AI Capex Fears Are Overstated

🏦 Banking System Vulnerability

QUOTE OF THE WEEK:

“For us, the visibility and the spending are still very strong. And names like Nvidia are still reasonably priced. Nvidia, you know, at 28 times forward earnings, is still less expensive than buying Walmart or Costco — Costco is almost 50 times forward earnings.” - Thomas Lee, Managing Director and Head of Research at Fundstrat Global Advisors.

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC - EOD 11/14

WEEKLY MARKET WRAP:

Good Afternoon. It was a volatile week due to the busy news flow on the shutdown, the tariff deal, the possible December rate cut pause, and AI GPU depreciation. Markets ended almost flat for the week. Detailed analysis of these themes below -

Below are the key things to note this week:

How long before the GPU depreciates? Michael Burry raised concerns about the GPU depreciation timeline, which helped spook AI enthusiasm in recent days. Hyperscalers are extending GPU useful lives from 2-3 years to 5-6+ years, understating depreciation by ~$176B from 2026-2028 and inflating profits by 20%+. This is "one of the most common frauds in the modern era," per Burry—akin to Enron-style accounting.

Even though this is a valid point, I don’t think Michael Burry is in any position to cast doubt on the hyperscalers, which have, over decades, demonstrated respected management. If these companies are extending depreciation cycles, I will trust their judgment much more than M. Burry, who has no direct insight or knowledge of these conclusions. He was right on subprime, but that was a completely different issue than this, which I don’t think Mr. Burry has enough knowledge to comment on. Stating that not one or two, but all, highly respected hyperscalers are indulging in an Enron-like scam is bizarre. Yes, new chips are faster every year, and there will be a need to replace them, but that doesn’t mean Nvidia and others won't give customers credit for old GPUs, etc., and control the actual depreciation impact.

Longest US Shutdown is Over: The Longest US Government shutdown is finally over. Now we can start having more macro data releases each week, which will help markets and the Fed build a clearer picture of the economy.

NVIDIA Earnings Next Week: Nvidia reports earnings next week, and the stakes are unusually high: investors want clarity on Blackwell shipment timing, near-term data-center demand, and whether AI capex remains on a sustainable path rather than a circular spending loop. The market will focus on three pressure points—order visibility into 2025, any signs of digestion among hyperscalers, and updates on supply constraints.

No Rate Cut In December? One of the primary reasons for the volatility this week is that the Fed may pause its rate-cutting cycle in December. The signals coming from the Fed indicate that the FOMC is split, and anything can happen. The CME FedWatch probabilities are also almost 50-50%.For the week:

The S&P 500 is up 0.08%, the Nasdaq is down 0.45%, and the Dow 30 is up 0.34%.

Barchart

CNN's Fear & Greed Index now stands at 22 (Extreme Fear) out of 100, up 1 point from last week. Details here

The top five trending stocks on Reddit are SPY, Nvidia, Nebius Group, MicroStrategy, and Meta. Read More

Liquidity: No material change in reserve balance from last week. Still ~$2.8 trillion. ON RRP is also almost 0 @ ~$1.5 billion.

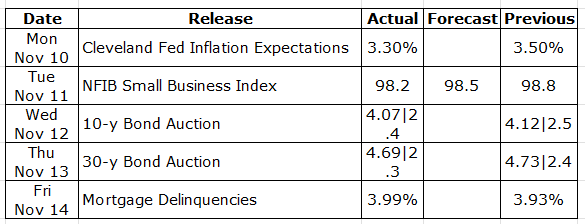

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for December 10th FOMC Meeting:

CURATED INSIGHTS & ANALYSIS:

Banking System Vulnerabilities:

U.S. Banking Vulnerability Hits 2025 Lows: NY Fed’s annual update shows all four stress indexes—capital, fire-sale, liquidity, and run—remain well below 2008 peaks and have either stabilized or improved since 2024:Q2, driven by record-high capital ratios and shrinking unrealized securities losses.

Capital Gap Shrinks Dramatically: Under a “2008 redux” stress scenario, aggregate capital shortfall fell to just $1.92B (from $5.1B a year ago); even in a “2022 redux” rate-shock replay, the gap dropped to $161.3B (down from $260.5B), thanks to stronger Tier 1 ratios and fading HTM/AFS markdowns.

Fire-Sale Risk Retraces Half Its 2022 Spike: Index peaked at 2009 levels in 2022:Q3 amid rate-driven leverage surge; now down >50% from that high and trending lower, with fair-value leverage (not size or connectedness) explaining both the rise and fall.

Liquidity Stress Ratio Back to Pre-Pandemic Norms: Ratio sits at ~0.4—half its 2007:Q3 record but above 2020–21 lows—lifted by declining liquid assets and rising unstable funding/off-balance-sheet exposures since early 2022.

Run Vulnerability Stable & Moderate: Index hovers near 2024 levels after 2022:Q1–Q3 jump; leverage remains the primary driver, but illiquid assets and unstable funding have also edged higher—still far from crisis thresholds.

Bottom Line from the Fed: System is “uniformly lower than 2008” but some metrics exceed 2015–2020 troughs—watch leverage and funding mix as rates stabilize.

FRB NY

AI spend headlines are commitments, not obligations:

The trillion-dollar AI capex fears are overstated. Most of the headline figures—whether OpenAI’s $100 billion buildout with NVIDIA or hyperscaler budgets from Microsoft, Amazon, Google, and Meta—are commitments, not binding obligations. These investments are phased, usage-linked, and demand-adjustable, giving companies the flexibility to pause or reallocate capital if monetization lags.While circular financing between AI startups and chip suppliers adds opacity, the broader reality is that this is strategic infrastructure spending with optionality, not reckless, irreversible burn.

Company | Capex / Funding | Nature | Purpose | Flexibility | Risk Theme |

|---|---|---|---|---|---|

OpenAI × NVIDIA | “Up to $100 B” for 10 GW data centers | Staged commitments | Compute + chips | Deployment-linked | Circular financing risk |

Microsoft | ≈ $80 B FY25 | Annual plan | AI data centers | Scalable by year | Utilization risk |

Alphabet / Google | $75 – 93 B | Guidance | Infra + servers | Revisable | ROI timing risk |

Amazon (AWS) | ≈ $125 B | Corporate guide | Cloud + AI infra | Phased build | ROI lag risk |

Meta | $60 – 72 B | Range guidance | GPUs + R&D | Defer per quarter | Model efficiency |

TSMC | $40 – 42 B | Fab plan | AI chips | Project staging | Cycle risk |

CoreWeave | $20 – 23 B | Company plan | GPU DCs | Pacing control | Funding match |

Anthropic | $13 B Series F | Equity + cloud credits | R&D + compute | Usage-linked | Monetization risk |

FRONT PAGES:

Good News on Tariff: The U.S. and Switzerland have finalized a trade deal, U.S. Trade Representative Jamieson Greer told CNBC. Tariffs will be lowered to 15%. Swiss firms will invest about $200 billion in the U.S. by 2028, including funding for education and training. Read

Buffett Buys Google: Berkshire Hathaway disclosed a new $4.3 billion stake in Alphabet while trimming its Apple position, marking the final portfolio update before Warren Buffett steps down as CEO after 60 years. The filing showed Berkshire held 17.85 million Alphabet shares as of September 30. Read

Win for Circle: Circle launched a test version of its Arc blockchain, with Goldman Sachs, BlackRock, Apollo, Anthropic, and ICE participating in the trial. Read

Shutdown Over: President Donald Trump signed a bill late Wednesday to end the 43-day government shutdown, pushing the next funding deadline into late January. Read

EARNINGS UPDATE:

Cisco Beat: Cisco reported fiscal Q1 adjusted earnings of $1 per share on revenue of $14.88 billion, exceeding expectations of $0.98 per share and $14.78 billion. Networking revenue, its largest segment, including AI data center equipment, reached $7.77 billion versus estimates of $7.45 billion.

Applied Materials Beat: Applied Materials’ Q4 FY25 results beat expectations, with strength building ahead of expected demand in the back half of 2026. Adjusted EPS came in at $2.17 vs. $2.10 expected, and GAAP EPS was $2.38 vs. $2.06. Revenue was $6.8B, with $4.76B from Semiconductor Systems and $1.63B from Global Services, down 3% YoY. Adjusted gross margin held at 48.1%, in line with estimates

Disney Miss: Q4 Non-GAAP EPS came in at $1.11, beating estimates by $0.09, while revenue slipped 0.5% to $22.46B, missing by $320M. Subscriptions ended the quarter at 196M across Disney+ and Hulu, up 12.4M from Q3, with Disney+ alone reaching 132M, a 3.8M increase.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

18-Nov | HD | Home Depot | Before Open |

18-Nov | PDD | Pdd Holdings Inc | Before Open |

19-Nov | NVDA | Nvidia Corp | After Close |

19-Nov | TJX | TJX Companies | Before Open |

20-Nov | INTU | Intuit Inc | After Close |

20-Nov | WMT | Walmart Inc | Before Open |

25-Nov | BABA | Alibaba Group Holding ADR | Before Open |

VIDEO’s OF THE WEEK:

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to get the coverage you actually need.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.