- Primal Thesis

- Posts

- Ravenous Whirlwind of AI Adoption

Ravenous Whirlwind of AI Adoption

📈 Palantir Joins Top 10 Tech Stocks

🏦 FOMC Keeps Rates Unchanged

🌏 The US and China Discuss Trade Issues

📊 Gross Domestic Product (GDP) vs Private Domestic Final Purchase (PDFP)

⏳ The Cost of Timing the Market

📝 Key Points from The FOMC Statement & Press Conference

QUOTE OF THE WEEK:

“The US consumer never lets us down. I mean, really, without a lot of predictions of weakness. Back in 2022, when we were raising rates quickly, many expected the consumer would finally balk and slow down, but consumer spending continued to be good. Clearly, this is the line between the hard data and the soft data. Actual consumer spending has held up pretty well.” - Federal Reserve Bank of New York President John Williams.

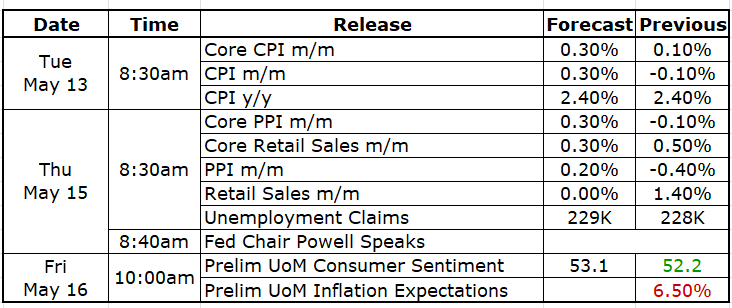

KEY US ECONOMIC EVENTS NEXT WEEK:

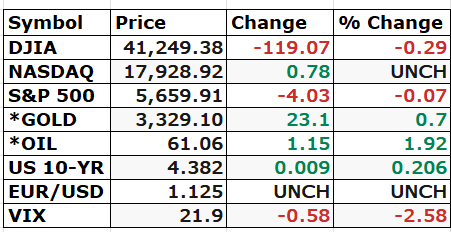

MARKET CLOSE:

CNBC EOD 10th May

WEEKLY MARKET WRAP:

Good Afternoon. The markets had almost a flat week, with major indices closing with minor losses. Earnings continued to be strong, and so did the macro data. The unemployment claims came lower than the forecast, and the services PMI also beat expectations, highlighting the economy's underlying strength.

Next week will be crucial with the CPI inflation and other key macro data releases.

Below are the key highlights for the week:

Palantir Joins Top 10 Tech Stocks:

This week, Palantir surpassed Salesforce to join the top 10 tech stocks list. I covered Palantir in detail in early February this year (here). In his shareholder newsletter, CEO Alan Karp talked about the “ravenous whirlwind” of AI adoption and how fast Palantir is growing compared to its size. This is the company to watch for the next decade. Palantir keeps hitting out of the park regarding the key metric - the rule of 40 (a software company's combined revenue growth rate and profit margin should equal or exceed 40%).

US-China Started Talking:

The two largest economies started discussions in Switzerland this week to resolve trade issues. The latest update is that the meetings will continue over the weekend. This is very positive news. If these two major sparring nations strike a deal, it will largely resolve the tariff-related concerns, as most other major US trading partners are expected to be less challenging to negotiate than China.The FOMC Decision:

As expected, the FOMC kept rates unchanged at 4.25–4.50%. The main change in the official statement was that the FOMC judges that the risk to its dual mandate, i.e., higher unemployment and inflation risks, has risen.For the week:

The S&P 500 is down 0.47%, the Nasdaq is down 0.27%, and the Dow 30 is down 0.16%.

Barchart

CNN's Fear & Greed Index now stands at 62 (Greed) out of 100, up 8 points from last week. Details here

The top five trending stocks on Reddit are SPY, Tesla, DTE Energy, Nvidia, and Palantir. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for Mar 19th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Gross Domestic Product (GDP) vs Private Domestic Final Purchase (PDFP):

One of the most critical metrics Chair Powell mentioned during the FOMC press conference was PDFP, i.e., private domestic final purchases. PGDF excludes the volatile components of the GDP calculations, such as Government Spending and Net Exports. As I mentioned recently, the significant import activity (to avoid tariffs) impacted the recent GDP data, making it less reliable for the Fed to use for decision-making. The PGDF grew by 3%, which shows that the economy is still doing great.

💡 Why PDFP MattersLess volatile as it filters out swings from trade and government activity.

Better reflects household and business spending decisions.

Used by the Fed and market economists to gauge the true health of the private economy.

📈 If GDP is weak but PDFP is strong, the economy may be more resilient than it looks, with temporary drags from inventories or trade.

Metric | Includes | Excludes | Purpose |

|---|---|---|---|

GDP | C + I (incl. inventories) + G + (X − M) | — | Captures total output from all sectors |

PDFP | C + Private Fixed I (excl. inventories) | Government spending, Net exports, Inventories | Tracks sustainable domestic private demand |

Importance of Staying Invested:

The chart below shows the futility of timing the markets. I mentioned dollar cost averaging a few times in this newsletter, and also the Peter Lynch philosophy of investing in companies you understand, and not panic selling. The cost of sitting on cash is just too much. No one can time the market - it's just not humanly possible.

Key Points from The FOMC Statement & Press Conference:

Despite uncertainty, the economy is in solid condition.

Risks of higher unemployment and inflation are higher.

The import activity in anticipation of the tariffs complicated the GDP calculation. The PDFP (covered above in detail), which excludes net exports, grew by 3% and shows a solid underlying economy.

The new administration’s policies are still evolving. We are in a good position to wait and let things evolve.

US Debt is on an unsustainable path (but not at an unsustainable level) and is a concern. However, the Fed does not give Congress fiscal advice.

The link between sentimental data (soft data) and consumer spending is weak, and hence, the Fed will wait to see hard data before making further policy decisions.

Important Fact Related to Tariff:

In addition to the detailed analysis I did on the tariff earlier, I missed mentioning that tariffs are charged on the value at the port. This means that, generally, the cost of import at the ports or entry into any country is much lower than by the time it reaches the stores.

For example, if the import cost of a shirt is $10, but by the time it reaches the store, it’s priced at $30. In this case, the tariffs are charged on $10. Hence, the real impact on the consumer may not be significant, considering that companies can absorb some of these higher costs. On average, if net tariff rates remain between 10%-15%, companies can absorb this and take a hit on the margin. So in this example, the shirt will attract a tariff of ~$1-$1.5, which is not bad compared to the final selling price.

At the start of this year, US corporate earnings were supposed to grow by ~12%. The tariff impact will lower these estimates. However, it still does not point to serious concerns— one more positive reason to be positive.

FRONT PAGES:

Palantir Joins Top 10: Palantir jumped 8% to break into the top 10 U.S. tech firms by market cap, overtaking Salesforce despite having just a tenth of its revenue. The stock trades at a steep 520x trailing earnings, reflecting investor enthusiasm for AI upside. Read

FOMC Keeps Rates Unchanged: Fed officials warned that Trump’s tariffs could reignite inflation and strain the labor market, even as they held rates steady for the third straight meeting. Read

Push for Financial Deregulation: Treasury Secretary Scott Bessent said Monday that the Trump administration will push for financial deregulation, citing the rise of private credit as evidence that banks have been overburdened in recent years. Read

US-China Trade Talks Continue: Sensitive U.S.-China tariff talks, critical to global economic stability, ended after a full day of negotiations and will resume Sunday, per AP. Read

Record Buybacks: S&P 500 companies announced $192bn in buybacks last week—the highest weekly total since 1995, per Deutsche Bank. Over the past three months, announced buybacks have hit a record $518bn. Read

Source: Bloomberg

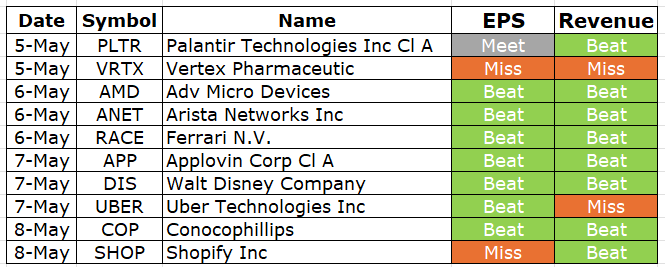

EARNINGS UPDATE:

Earnings Expectations

Palantir Mixed: Adjusted EPS matched consensus at 13¢, up from 8¢ last year. Revenue rose 39% to $884M, beating estimates by 3%. The company cited “ravenous” AI demand and raised its 2025 revenue forecast by 4%. Read. Read

Vertex Miss: Vertex fell 2.5% after hours as Trikafta sales came in below expectations. Despite the miss, the company raised the lower end of its revenue outlook, banking on newer CF therapies and acute pain drug Journavx to drive growth. Read

AMD Beat: AMD issued a strong revenue forecast for the current quarter, though it cautioned that US export restrictions will dent sales. Read

Arista Network Beat: Arista Networks' revenue rose 28% YoY, topping $2bn for the first time and beating expectations. Adjusted net income jumped 30%, also ahead of estimates. CEO Ullal cited strong demand from AI, cloud, and enterprise customers, noting continued momentum despite tariff uncertainties. Read

Ferrari Beat: Ferrari posted a 15% jump in Q1 core earnings and reaffirmed its full-year guidance, beating Wall Street estimates. Its CEO confirmed the first fully electric model will launch in October 2026, underscoring why Ferrari may weather tariffs better than peers. Read

Applovin Beat: AppLovin showed that ad spend is alive in parts of tech, with advertising revenue surging 71% in Q1, 10% above its guidance. Read

Walt Disney Beat: Disney beat fiscal Q2 estimates and raised its full-year outlook, driven by strong gains in theme parks and streaming. Read

Uber Mixed: Uber swung to a Q1 profit from a loss last year, but shares fell as 17% revenue growth missed estimates. The company guided to 2–5% growth in Q2 gross bookings. Read

ConocoPhillips Beat: ConocoPhillips’ Q1 earnings rose 1.3%, but the company lowered its capex forecast amid a volatile economic backdrop. Read

Shopify Mixed: ConocoPhillips posted a 1.3% gain as Q1 earnings edged higher. Shopify slid after guiding to slower profit growth this quarter, with management reaffirming plans to increase spending to drive sales. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

14-May | CSCO | Cisco Systems Inc | After Close |

15-May | AMAT | Applied Materials | After Close |

15-May | BABA | Alibaba Group Holding ADR | Before Open |

15-May | DE | Deere & Company | Before Open |

15-May | WMT | Walmart Inc | Before Open |

20-May | HD | Home Depot | Before Open |

20-May | PANW | Palo Alto Networks Inc | After Close |

21-May | LOW | Lowe's Companies | Before Open |

21-May | MDT | Medtronic Inc | Before Open |

21-May | TJX | TJX Companies | Before Open |

VIDEO’s OF THE WEEK:

Get Over $6K of Notion Free with Unlimited AI

Startups move fast. That's why thousands of startups worldwide trust Notion as their connected, customizable workspace. In one place, you can organize, plan, and execute—whether you're managing investor outreach, documenting key decisions, or scaling operations.

Apply now to get up to 6 months of Notion with unlimited AI free, a $6,000+ value. Access AI's limitless potential right inside Notion and build your company with one powerful tool.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.