- Primal Thesis

- Posts

- Sam Bankman-Fried Was Right

Sam Bankman-Fried Was Right

💵 US Banks Explore Joint Stablecoin

🤝 Potential Trade Deals In Two Weeks

📉 Weak Japanese and US Bond Auctions

📊 Expected Supplemental Leverage Ratio Relief

🪙 Stablecoin Regulation Passes Major Hurdle

🏦 Analysis of Bank-Fueled Private Credit

🛍️ Retail Earnings Insights

QUOTE OF THE WEEK:

“Banks are being penalized for holding Treasury. You know there's a large supplementary leverage charge, so I think for holding the risk-free asset, we can reduce that. And you know, I've seen estimates that it could bring yields down by tens of basis points. Certainly, during the COVID crisis, it was temporarily taken off and it had a big effect.” - Treasury Secretary Scott Bessent.

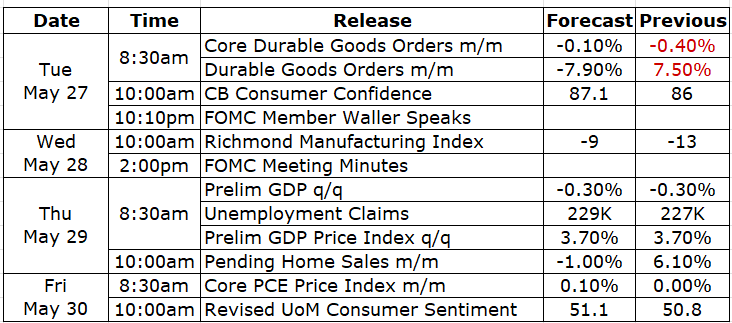

KEY US ECONOMIC EVENTS NEXT WEEK:

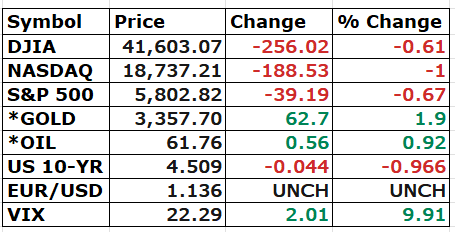

MARKET CLOSE:

CNBC EOD May 23rd

WEEKLY MARKET WRAP:

Good Afternoon. Markets gave back some of the gains this week, with all major indices down ~2.5%. The macro data was a relatively quiet week, with only three key releases. Again, the hard macro data was strong and still does not reflect any concerns seen in the survey-based data.

Below are the key things to note from this week:

Potential Trade Deals in Two Weeks:

US Treasury Secretary Scott Bassent mentioned in his Bloomberg interview that he expects multiple trade deals to be announced in the next two weeks. This is a very positive catalyst for the markets. If some deals are announced, especially with one or two major trading partners, it will help markets propel to new highs.

Weak 20-year Japan and US Debt Auctions:This week, weak demand for Japanese and US debt auctions raised concerns about rising bond yields in the future. Some commentators mentioned that the bond markets are trying to enforce fiscal discipline.

Japan's 20-year bond auction drew weak demand. The average yield jumped to 2.555%—the highest since 2000—while the tail spread was the widest since the 1980s.

In the US, the 20-year bond auction was weak, and the yield rose to its highest since the November 2023 post-auction.

Expected SLR Relief:The weak bond auctions are expected to expedite the Supplemental Leverage Ratio relief for the US treasuries. In the same Bloomberg interview, Scott Bassent talked about SLR relief to come in the coming months, where banks will not be asked to hold to capital against the treasuries they hold, and it could help bring down the yields by tens of basis points based on the Covid experience when this relief was last provided.

US Going Big On Digital Assets:Constant positive news flow on crypto has continued from the US since the Trump administration took office.

The GENIUS Act cleared a key procedural vote in the Senate. This act is proposed to regulate the $200 billion rapidly growing stablecoin market.

Scott Bassent mentioned in his Bloomberg interview that the US is going big on digital assets.

In other news, US banks are exploring issuing a joint stablecoin on the Solana network. This proves that Sam Bankman-Fried was right to back Solana from the beginning. If he had controlled his greed, he would be a prominent figure in the crypto world today. Trump's memecoins are also on the Solana network, and Solana is threatening Ethereum’s position as a top smart contract network.

Retail Earnings:

Multiple retailers reported earnings this week. The sentiment differed depending on who depended more on China for its inventory. For example, Home Depot mentioned that it has diversified its sourcing and will not increase prices, whereas Ross Stores withdrew guidance as it sources more than 50% of its goods from China. The China deal is very important in alleviating these pressures in the coming months, and Scott Bassent confirmed this week that the in-person trade talks with China will continue soon.Next Week: The three most important things for the next week to keep track of are:

Nvidia ResultsNvidia reports earnings next week, and I expect them to beat earnings as usual, but the gross margin and the guidance will matter the most. The stock is trading well below the analyst’s target, and it's been a while since it touched an all-time high. NVIDIA's gross margin has declined over the last few quarters. It will be essential to see if the gross margin returns to the mid-70s.

Below is Nvidia's recent gross margin trend:Q1 2025: 78.4%

Q2 2025: 75.1%

Q3 2025: 74.6%

Q4 2025: 73%

Q1 2026 (est.): 70.6% (+/- 50 basis points)

PCE Inflation

Fed’s official measure of inflation, the PCE, is expected on Friday. The CPI data and the Cleveland Fed projections show that the YoY PCE should be closer to ~2.2%, much closer to the Fed average target of 2%. Any upward reading will be perceived negatively.

FOMC Minutes

FOMC minutes are expected mid-next week. They will provide insights into the thinking of FOMC members and commentary on market and economic conditions. I will provide the summary in next week’s newsletter. The market will be keen to gauge any indications of rate cuts.

For the week:

The S&P 500 is down 2.61%, the Nasdaq is down 2.47%, and the Dow 30 is down 2.47%.

Source: Barchart

CNN's Fear & Greed Index now stands at 64 (Greed) out of 100, down 4 points from last week. Details here

The top five trending stocks on Reddit are enCore Energy, SPY, UnitedHealthcare, Nvidia, and Tesla. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for June 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

GENIUS Act of 2025:

Bitcoin hit record highs this week because of the enthusiasm for the GENIUS Act becoming a reality in the US. This act is focused on providing a much-needed regulatory framework for stablecoins. I am impressed with the level of detail in this bill, which lays out what a stablecoin means and who can issue it, etc. One of the concerns I raised recently was about the so-called algorithmic stablecoins, which are not collateralized by USD or US treasuries. This act has precise and stringent collateralization requirements for a coin to qualify as a stablecoin. These requirements will disqualify all algo-based stablecoins and avoid a future Terra (UST) like situation (UST was an algo-based stablecoin which collapsed in May 2022, causing $45bn of market cap wiped out in a week. Check section 4 of this act for the specific requirements to be considered a stablecoin.20-Year Treasury Auction:

Below are the results of this week’s 20-year Treasury bond auction. The debt was sold at a high yield of 5.047%, around one basis point above where it had traded before the sale. It’s a weak auction due to higher yield demanded, but I don’t see any other issues based on the data below. The bid-to-cover ratio was ~2.5%, which is not bad (Bid-to-Cover Ratio = Tendered ÷ Accepted).

Source: Fiscal Data Treasury

The System Open Market Account (SOMA), managed by the New York Fed, receives a non-competitive allocation of Treasury securities in auctions to reinvest proceeds from maturing holdings. The amount allocated to SOMA is not part of the bid-to-cover ratio calculation.Private Credit Fueled By Banks:

Private Credit is a hot topic these days. The Boston Fed published a paper this week analyzing whether the growth in private credit poses a risk to financial stability.

Post-2008 regulations pushed banks away from lending to highly leveraged or cash-flow-constrained firms. Instead, banks turned to financing private credit funds, which filled the gap, accelerating the industry's growth and reshaping credit markets.

According to a report by Fitch Ratings, loans to non-banks reached approximately $1.2 trillion by the end of March. The total private credit lending market is ~$1.6 trillion. So, bank loans amount to ~75% of the total private credit market. Below is the composition of bank loans:

📊 How Much of the $1.2 Trillion in Bank Loans to Private Credit Is Actually Drawn?

Private credit funds have secured $1.2 trillion in bank financing. But how much of that is truly at risk (i.e., already drawn down)?

Here’s the breakdown:🏦 Term Loans: ~$190B (~15%)

🔄 Revolving Credit Lines (LoCs): ~$1.0T (~85%)

✅ Fully Drawn: ~$180B (18%)

❌ Fully Undrawn: ~$300B (30%)

⚖️ Partially Drawn: ~$520B (52%)

→ Assuming 50% utilization: ~$260B drawn

🧮 Total Bank Exposure (Drawn):

✅ Term Loans ($190B) + Drawn LoCs ($180B + $260B) = ~$630BThat means ~53% of total commitments are actively drawn, while the remaining ~$570B is undrawn capacity—a latent liquidity risk if tapped suddenly across funds.

Considering the total size of the Private Credit market of $1.6 trillion, the actual bank-funded drawn exposure seems to be ~40%, which is substantial. In addition, almost the same amount is available to PC firms as LoCs from Banks.

Based on this data, banks are not just playing the role of liquidity providers (even the Boston Fed mentions liquidity provision as the leading role) but also have some direct skin in the game with ~35-40% direct lending exposure to PCs. Banks are playing a key role in driving the growth of the private credit sector.

Conclusion:

🔍 Private credit lenders’ dependence on bank credit lines creates potential systemic liquidity risk, primarily if many BDCs and PC funds draw simultaneously during a broad market shock.

💥 While these bank loans are typically senior and secured, losses could still emerge under extreme stress, such as a prolonged recession.

⚠️ Even in milder downturns, higher-than-expected default correlations across PC portfolios could trigger losses—an underappreciated tail risk.

FRONT PAGES:

Amazon CEO on Tariffs: Amazon CEO Andy Jassy said at the virtual shareholder meeting that the company hasn’t seen any signs of weakening demand or notable price increases despite Trump’s tariffs. “We have not seen any attenuation of demand at this point,” he noted. Read

Stablecoin Regulation Progresses: The GENIUS Act to regulate stablecoins cleared a key Senate hurdle, with 15 Democrats helping it pass the cloture threshold and avoid a filibuster. Read

Tepid Demand for Treasury Auction: The US Treasury's $16bn 20-year bond auction drew weak demand, as rising debt concerns mount amid ongoing tax and spending debates in Congress. Read

Oracle Chip Buying: Oracle plans to spend ~$40B on Nvidia’s top-tier chips for OpenAI’s new data center in Abilene, Texas, part of the U.S. Stargate Project aimed at strengthening America’s AI edge amid rising global competition. Read

Standing Repo Facility: NY Fed’s Roberto Perli urged more use of the Standing Repo Facility, calling it vital for effective policy implementation and market stability. He stressed that counterparties should use it when economically sensible. Read

Banks Mull Joint Stablecoin: Top U.S. banks, including JPM, BofA, Citi, and Wells, are in talks to launch a stablecoin to counter crypto competition jointly. Discussions involve Zelle’s operator and the Clearing House. Read

Potential Deal: Salesforce is back in talks to acquire Informatica, after last year's $10B deal attempt fell through. A transaction could be finalized next week, though talks remain uncertain and rivals may still emerge. Read

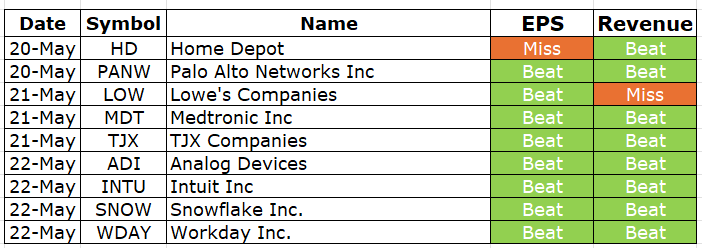

EARNINGS UPDATE:

Home Depot Mixed: Home-improvement retailer missed earnings for the first time in five years. Investors backed its steady guidance and decision to hold prices despite rising tariffs. Read

Source: Bloomberg

Palo Alto Beat: Palo Alto Networks reported higher revenue in Q3, but profit dipped to $262M (37c/share) from $279M (39c) last year due to rising expenses. Read

Lowe’s Mixed: Lowe’s Q1 comparable sales fell 1.7% but beat expectations, signaling resilient home spending despite weak sentiment. It now sees full-year comps flat to up 1%. Read

Medtronic Beat: Medtronic’s Q4 revenue beat estimates at $8.9B, up ~4% YoY, led by its Cardiovascular unit, which posted $3.34B vs. $3.28B consensus, growing ~7% YoY per Bloomberg data. Read

TJX Beat: TJX maintained its annual outlook but flagged U.S. tariff headwinds. Strong demand for off-price goods helped the TJ Maxx parent beat quarterly sales estimates. Read

Snowflake Beat: Snowflake projected Q2 product revenue of up to $1.04B, topping estimates, as momentum builds from last year’s product launches. Read

ADI Beat: Analog Devices beat Q3 revenue estimates but guided lower for automotive, blaming tariff-driven pull-ins. Shares fell 5% as near-term chip demand remains tariff-distorted. Read

Workday Beat: Workday posted higher Q1 revenue and reaffirmed full-year guidance as subscription sales rose. Profit fell to $68M (25c/share) from $107M (40c) a year ago, hit by $166M in restructuring costs. Read

Intuit Beat: Intuit beat expectations in its key tax season quarter, posting Q3 adjusted EPS of $11.65 on revenue of $7.75bn vs. estimates of $10.93 and $7.57bn. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

5/27/2025 | AZO | Autozone | Before Open |

5/27/2025 | BNS | Bank of Nova Scotia | Before Open |

5/27/2025 | PDD | Pdd Holdings Inc | Before Open |

5/28/2025 | BMO | Bank of Montreal | Before Open |

5/28/2025 | CRM | Salesforce Inc | After Close |

5/28/2025 | NVDA | Nvidia Corp | After Close |

5/28/2025 | SNPS | Synopsys Inc | After Close |

5/29/2025 | COST | Costco Wholesale | After Close |

5/29/2025 | DELL | Dell Technologies Inc | After Close |

5/29/2025 | RY | Royal Bank of Canada | Before Open |

6/3/2025 | CRWD | Crowdstrike Holdings Inc | After Close |

VIDEO’s OF THE WEEK:

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.