- Primal Thesis

- Posts

- Small Caps Surge, Inflation Eases

Small Caps Surge, Inflation Eases

📈 Small Cap Stocks Outperform

📉 Better Than Expected CPI Inflation

🏦 Summary Of Bank Earnings

📘 Key Points From The Fed Beige Book

📊 Historically Low Level Of Volatility In The U.S. Treasury Market

QUOTE OF THE WEEK:

“If the first five days are higher like they just were this year, you're up like 85% or so of the time for the full year. And if January's higher—I know January is not over yet—then the next 11 months are higher 87% of the time. So we're not there yet. But listen, a good start to the year likely means this momentum is real.” - Ryan Detrick, Chief Market Strategist - Carson Group

KEY US ECONOMIC EVENTS NEXT WEEK:

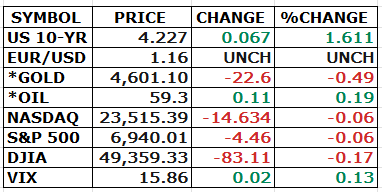

MARKET CLOSE:

CNBC EOD 1/16

WEEKLY MARKET WRAP:

Good Afternoon. Major indices ended slightly negative for the week. CPI inflation was better than expected, but bank earnings were not up to par. The good thing is that the small caps did well this week, which shows the market is broadening. However, it will be interesting to see if this small-cap rally sustains, as in the past, small caps have gained in the short term but failed to sustain momentum.

Below are the key things to note this week:Bank Earnings Disappoint: Major banks reported earnings this week, which failed to meet expectations. Overall, there are no signs of any issues, but the bar was higher for this quarter. More details in the curated insights section below.

Small caps finally shine: Rising confidence in the economic outlook is driving a sharp rotation into small caps. The Russell 2000 has now outperformed the S&P 500 for 11 straight sessions—its longest streak since 2008—and is up 7.9% YTD, far ahead of the sub-2% gains in large-cap benchmarks. Supported by strong GDP growth and solid earnings, investors are rotating out of mega-cap tech and into cyclicals, industrials, energy, and small caps positioned for an economic reacceleration.

WSJ

Inflation under control:

Inflation held steady into the year-end. Headline CPI rose 2.7% year over year in December, unchanged from November. The data is somewhat noisy due to distortions from the recent government shutdown, but price pressures in consumer staples—particularly food and electricity—remain elevated. Based on CPI data, the Fed’s preferred gauge, the PCE, is expected to be ~2.6% and will be released at the end of this month.For the week:

The S&P 500 is down 0.38%, the Nasdaq is down 0.66%, and the Dow 30 is down 0.29%.

barchart

CNN's Fear & Greed Index now stands at 62 (Greed) out of 100, up 11 points from last week. Details here

The top five trending stocks on Reddit are AST Spacemobile, Immunity Bio, SPY, Micron, and Rocket Lab. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $3 trillion. ON RRP balance remains immaterial.

Standing Repo Facility (SRF): The New York Fed’s standing repo operations (primarily reflecting SRF take-up) as of Jan 16 is zero.

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for Jan 28th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Beige Book Summary:

Primal Thesis

Overall: activity up slightly–modest in 8 districts, flat in 3, modest decline in 1; better than prior cycles

Consumers: holiday lift; high-income spend strong; lower/middle-income more price-sensitive; autos little changed to down

Manufacturing: mixed—5 districts up, 6 down; services steady to slightly higher

Housing: residential sales/construction/lending softened in most districts

Banking: conditions stable/improving; more demand for credit cards, HELOCs, and some commercial loans

Agriculture: largely unchanged; Atlanta noted a modest decline; energy flat to slightly down

Outlook: mildly optimistic—most expect slight–modest growth near term

Labor: employment mostly unchanged; more temp hiring; backfilling > expansion; skill gaps persist; fewer job-switchers

Wages: moderate growth; health-insurance costs weighing on labor budgets

Prices: moderate rise; tariff costs increasingly passed through as inventories turn; energy/insurance remain pressure points; firms see some moderation ahead, but elevated levels persist.

Key points from the bank earnings:

Area | Key Metrics & Updates | Status |

|---|---|---|

M&A Volume | Acceleration in activity; GS reported higher completed volumes, MS noted growing backlogs; overall rebound with 7%+ IB fee growth at BoA. | ✅ Healthy |

IPO Calendar | Positive trends: higher underwriting revenues; GS saw significant IPO gains; and a robust 2026 pipeline is anticipated. | ✅ Healthy |

Trading Volume | Strong across equities/FX; STT FX up 14%, JPM Equity Markets up 40%, BoA record Equities; resilient amid volatility. | ✅ Healthy |

Flows into Wealth Management | Record inflows; GS $66B Q4, STT $85B Q4/$181B FY, BoA $115B net flows, JPM AUM up 18%. | ✅ Healthy |

Net Interest Margin | Stable/modest gains; Citi 2.49% (+8bps), PNC 3.69% (+11bps), M&T 3.67% (+9bps); supported by repricing. | ⚖️ Stable |

Loan Growth | Positive 5-8% YoY; WF $956B (+5%), BoA $1.2T (+8%), JPM CCB +1%, broad-based in consumer/commercial. | ✅ Healthy |

Credit Quality | Strong with low NCOs (0.1-0.5%); WF 0.43%, PNC 0.54%; provisions moderated, CRE watch but resilient. | ✅ Healthy |

Historically low level of volatility in the US Treasury market:

Bloomberg reported that U.S. Treasury markets are exhibiting historically low volatility, with the 10-year Treasury yield trading in a narrow band for a fifth consecutive week — its longest stretch of inertia in nearly two decades. Since mid-December, the yield has oscillated roughly between 4.1% and 4.2%, reflecting market expectations of steady monetary policy and scant directional catalysts.

FRONT PAGES:

Boeing outsold Airbus: Boeing logged 1,173 net aircraft orders last year, beating Airbus for the first time since 2018—a clear sign its recovery is gaining traction. December deliveries reached 63 jets, taking full-year deliveries to 600, the highest in seven years, including 44 737 Max aircraft. Read

Banks push back: JPMorgan Chase CFO Jeremy Barnum warned that banks could push back against President Donald Trump’s proposed credit card rate controls. Industry executives argue a 10% cap would shrink card availability and weigh on U.S. consumer spending. Corporate and political leaders began weighing in on the potential fallout this week. Read

Raymond James Acquisition: Raymond James Financial (RJF) has agreed to acquire Philadelphia-based Clark Capital Management, which oversees $46 billion in assets. The transaction is expected to close in the third quarter. Read

Private credit: JPMorgan Chase is building a dedicated team within its investment bank to help companies raise private capital rather than go public, signaling its view that private markets will remain dominant even as some large IPOs return. Public markets have weakened structurally, with fewer IPOs, longer private holding periods, more secondary funds, and greater institutional focus on private capital. JPMorgan sees this as a lasting shift in capital formation, not a cyclical pause. Read

EARNINGS UPDATE:

Primal Thesis

JP Morgan Mixed: Net income totaled $13.0B on a GAAP basis and $14.7B excluding a significant item. Managed revenue was $46.8B, up 7% year over year, with reported revenue of $45.8B. Markets revenue rose 17%, driven by 7% growth in Fixed Income and 40% in Equity. The firm recorded a $2.2B reserve tied to the forward purchase of the Apple credit card portfolio. Credit costs were $4.7B, reflecting $2.5B in net charge-offs and a $2.1B net reserve build. Shareholder returns included $1.50 per share in dividends, totaling $4.1B, and $7.9B in net buybacks.

Bank Of America Beat: 4Q25 net income was $7.6B with EPS of $0.98, up 18% YoY. Revenue reached $28.4B (+7%), driven by Net Interest Income of $15.8B (+10%). Average deposits rose to $2.01T (+3%) and loans to $1.17T (+8%). $8.4B was returned to shareholders. BVPS was $38.44; TBVPS $28.73. Segment income: Consumer $3.3B, GWIM $1.4B, Global Banking $2.1B, Global Markets $1.0B. CET1 stood at 11.4% with average global liquidity sources of $975B.

Citigroup Miss: Revenue was $19.9B, up 2% YoY, or 8% excluding Russia. GAAP EPS was $1.19, while adjusted EPS excluding Russia was $1.81. The firm returned ~$17.6B to shareholders in 2025, a 133% payout ratio. CET1 stood at 13.2%, with TBVPS of $97.06 and BVPS of $110.01. Services rose 15%, Banking surged 78%, USPB grew 3%, and Markets declined 1%. The Q4 2025 effective tax rate was ~34%.

Wells Fargo Mixed: Net income was $5.4B, or $1.62 per share, with non-GAAP net income of $5.8B, or $1.76 per share. Total revenue reached $21.29B, driven by a 4% YoY increase in net interest income and 5% YoY growth in noninterest income. Noninterest expense declined 1% YoY to $13.73B, including $612M in severance. The firm repurchased $5.0B of shares in Q4 2025. CET1 stood at 10.6% and LCR at a preliminary 119%. Average loans were $955.8B and average deposits totaled $1.38T.

Blackrock Beat: AUM reached $14T after record FY net inflows of $698B, including $342B in Q4. Q4 as-adjusted EPS of $13.16 beat estimates by ~10%, with revenue of $7.0B up 23% YoY and ahead of consensus. Organic base fees grew at a 12% annualized pace; the dividend rose 10% to $5.73, with $5B returned to shareholders in 2025. Technology services benefited from Preqin, driving ACV growth of 31% YoY.

Goldman Sachs Miss: Q4 revenue was $13.45B, down 3% YoY and 11% QoQ. Diluted EPS rose to $14.01 from $11.95 last year. Global Banking & Markets revenue increased 22% YoY to $10.41B. Platform Solutions reported a $(1.68)B loss driven by Apple Card markdowns. Credit loss provisions reflected a $2.12B net reserve release. The quarterly dividend was raised to $4.50, payable March 30, 2026.

Morgan Stanley Miss: Q4 net revenues were $17.9B, up 10% year over year from $16.2B. EPS rose to $2.68 versus $2.22 last year. ROTCE was 21.8%, ROE 16.9%, with a 32% pre-tax margin. The firm declared a $1.00 dividend and repurchased $1.5B of common stock in Q4. CET1 stood at 15.0% at year-end.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

20-Jan | NFLX | Netflix Inc | After Close |

21-Jan | JNJ | Johnson & Johnson | Before Open |

22-Jan | ABT | Abbott Laboratories | Before Open |

22-Jan | GE | GE Aerospace | Before Open |

22-Jan | INTC | Intel Corp | After Close |

22-Jan | PG | Procter & Gamble Company | Before Open |

27-Jan | RTX | Rtx Corp | Before Open |

27-Jan | UNH | UnitedHealth Group Inc | Before Open |

28-Jan | IBM | Int. Business Machines | After Close |

28-Jan | LRCX | Lam Research Corp | After Close |

28-Jan | META | Meta Platforms Inc | After Close |

28-Jan | MSFT | Microsoft Corp | After Close |

28-Jan | TSLA | Tesla Inc | After Close |

VIDEO’s OF THE WEEK:

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.