- Primal Thesis

- Posts

- Softer Inflation and the Labor Market

Softer Inflation and the Labor Market

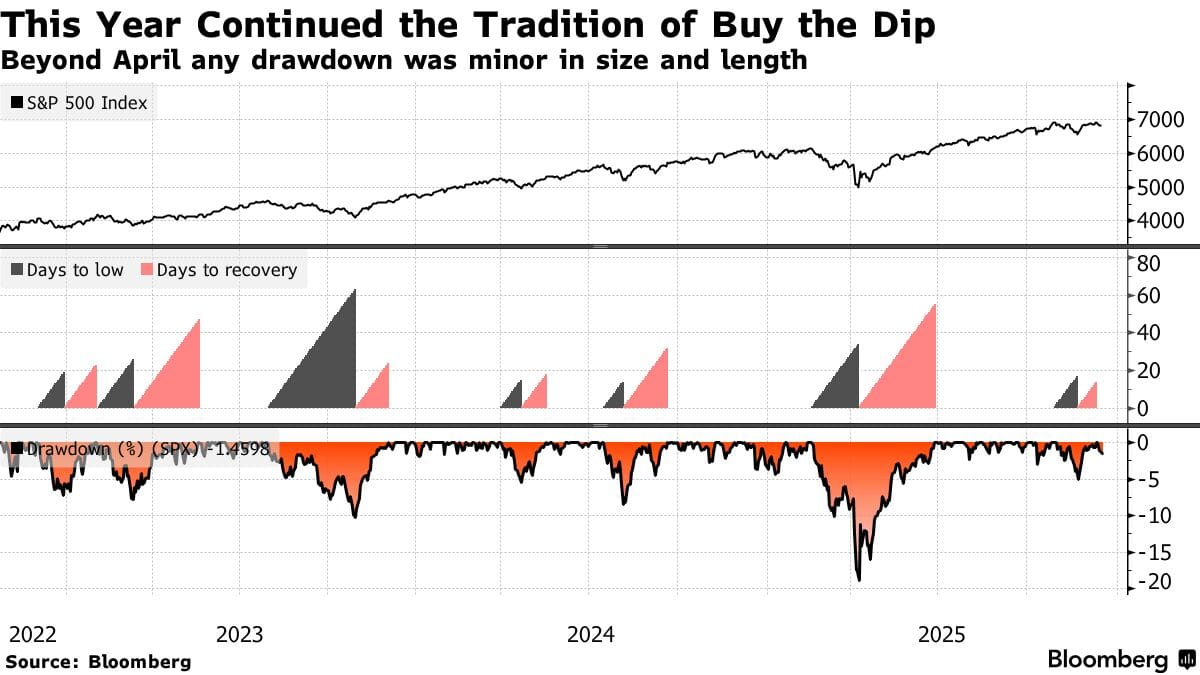

📉 Buy The Dip Tradition Continues

🧠 Future Challenges To NVIDIA’s Dominance

🏦 Regulatory Relief For Banks

📊 Technical Factors Behind Softer-Than-Expected CPI

💰 Strong Earnings Conclude Earnings Season

🌏 Japan Raises Rates To 3-Decade High

QUOTE OF THE WEEK:

“Recession probabilities are low, and the Fed is still easing, and fiscal policy is still stimulative. So things are looking pretty good. I actually think the rotation we've seen in the AI complex has been healthy. We're seeing that there are winners and losers. This is a sign of a healthy market. So I think things are looking pretty good.” - Ahmed Riesgo - Chief Investment Officer at Insigneo

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC EOD 12/20

WEEKLY MARKET WRAP:

Good Afternoon. A volatile but essentially flat week for the markets, driven by mixed macroeconomic data. Especially the softer-than-expected CPI numbers helped stocks rally last two days of the week. This, coupled with a weakening labor market and an unemployment rate of 4.6%, raises hopes for two rate cuts (instead of one per dot plot) next year. More on this below —

Below are the key things to note this week:Softer than expected CPI:

Consumer prices rose 2.7% over the 12 months ending in November, materially below our 3.1% expectation. Core inflation also undershot, rising 2.6% year over year versus our 2.9% forecast. However, several technical factors affected this data release, so we need to exercise caution. Below are some of the factors impacting November CPI numbers:Delayed & incomplete data distorted the CPI, with October prices missing and November filling gaps.

Timing bias from late-November data capture coincided with widespread discounts, pulling prices lower.

Holiday sales effects likely exaggerated short-term disinflation.

Shelter and rent issues artificially softened a key component of the CPI.

Unemployment Rate Up:

Unemployment continues to trend higher, reinforcing signs of a cooling labor market rather than a sudden break. While month-to-month data remains noisy, the broader signal is one of easing labor tightness and fading wage pressure.

Unemployment rate has risen to ~4.6%, the highest since the post-pandemic recovery.

Job gains remain weak on a trend basis, with the 3-month average near stall speed.

Wage growth has slowed to ~3.5% YoY, easing labor-driven inflation risks.

Job creation remains narrowly concentrated, with cyclical sectors under pressure.

Recent prints likely distorted by survey disruptions, butthe directional signal is clear.

Buy the dip:

This year saw the continuation of buy the dip mentality with any drawdowns since April were short lived.

This is not surprising as the double-digit gains for the year were supported by strong earnings instead of multiple expansion:

JP Morgan Asset Management

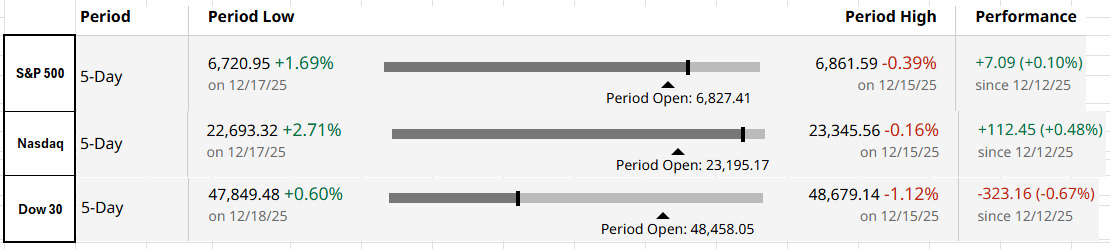

For the week:

The S&P 500 is up 0.10%, the Nasdaq is up 0.48%, and the Dow 30 is down 0.67%.

Barchart

CNN's Fear & Greed Index now stands at 45 (Neutral) out of 100, up 3 points from last week. Details here

The top five trending stocks on Reddit are SPY, Rocket Lab, Nvidia, Tesla, and Intuitive Machines. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Facility (SRF): The SRF balance as of Dec 12 is almost zero.

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for Jan 28th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

NVIDIA’s Dominance to Face Challenges In 2026:

NVIDIA’s decade-long stranglehold on AI compute — powered by its CUDA-centric ecosystem and surging demand for Blackwell GPUs — is facing a meaningful shift. While NVIDIA still commands the lion’s share of high-end AI training workloads, the market is increasingly bifurcating as customers and hyperscalers pivot toward specialized, cost-effective silicon optimized for inference and operational scale. Cloud giants like Google and AWS are doubling down on their custom Tensor Processing Units (e.g., Google’s TPU v7 “Ironwood”) and Trainium chips, respectively, to reduce per-unit costs and data center power draw. Even Microsoft and Meta are investing in bespoke accelerators to offload routine AI tasks, undercutting what was once a single-vendor default. As TSMC expands wafer capacity — alleviating one of the chokepoints that favored NVIDIA’s supply concentration — AMD’s MI300 series and other alternatives are also gaining traction, especially as cross-platform compilers like OpenAI’s Triton reduce the friction of moving away from CUDA.At the same time, competitive pressures extend beyond Western cloud players. An autonomous silicon ecosystem is gaining footing in China, with domestic chips such as Huawei’s Ascend series narrowing performance gaps on select workloads under export-control constraints. This emergent fragmentation — where hyperscalers’ custom ASICs, open-compatibility stacks, and regional champions chip away at previously monolithic GPU demand — marks a structural evolution in the AI hardware landscape. The consequence is twofold: NVIDIA’s long-term market dominance is less assured, and enterprises are increasingly evaluating AI compute portfolios across multiple vendors and architectures to balance cost, performance, and supply-chain risks.

Primal Thesis

The table below summarizes the competitive themes NVIDIA is expected to face in the coming years. NVIDIA will still continue to do well, but I expect the likes of Google and Broadcom to excel in the coming years as hyperscalers move from initial AI builtout to efficiency improvement for which they will need ASICs or TPUs:

Primal Thesis

The Bloomberg visual below shows that discussion remains focused on AI adoption across most corporates, and NVIDIA will continue to attract strong demand for its GPUs as firms adopt AI. However, most of these corporates won’t have deep pockets like hyperscalers, which will put pressure on NVIDIA’s margins and help other players like AMD. In addition, TSMC is expected to increase its production capacity which will reduce the supply contrains and also increase the competition:

FRONT PAGES:

The Fed’s relief for Goldman: The Federal Reserve has terminated consent orders against Goldman Sachs and Metropolitan Commercial Bank, closing enforcement actions tied to Goldman’s alleged involvement in the 1MDB scandal and MCB’s MovoCash prepaid card program, which was alleged to be fraud-ridden. Read

Japan raises rates to 3 decade high: Japan’s central bank raised short-term rates to a three-decade high, triggering a sell-off in government bonds, while signaling readiness to tighten further as policy normalization continues. The Bank of Japan lifted benchmark rates by 25 basis points to 0.75%, the highest since 1995, and in line with economists’ expectations. Read

TikTok’s US JV: TikTok CEO Shou Zi Chew told employees that the company’s U.S. operations will be placed under a newly formed joint venture. The entity, TikTok USDS Joint Venture LLC, has signed agreements with managing investors Oracle, Silver Lake, and Abu Dhabi-based MGX, with the transaction set to close on January 22. Read

The OCC relief for Citi: The Office of the Comptroller of the Currency lifted part of Citi’s compliance burden tied to long-standing deficiencies in data quality, risk management, and internal controls. The agency withdrew a 2024 amendment to the consent order that had required Citi to submit a resource review plan detailing financial, human, and technology commitments toward the 2020 consent order and identifying remediation shortfalls. Read

Treasuries Gain: US Treasuries posted their first weekly gain since late November, as softer inflation and rising jobless claims reinforced expectations of at least two Federal Reserve rate cuts next year. Despite a Friday uptick in yields, the 10-year fell four basis points on the week, while the policy-sensitive two-year dropped by a similar margin as markets priced a more dovish 2026 path. Read

EARNINGS UPDATE:

Micron Beat: For the period ending Nov. 27, Micron reported adjusted EPS of $4.78 on revenue of $14.34B, up 57% year over year. Adjusted operating income totaled $6.42B, while operating cash flow reached $8.41B, versus $3.24B a year ago. Consensus estimates had called for $3.95 in EPS on $12.95B of revenue.

Accenture Beat: For fiscal Q1 ended Nov. 30, revenue rose 6% Y/Y to $18.74B (5% in local currency), while GAAP EPS increased ~10% Y/Y to $3.94, with both exceeding expectations. New bookings for fiscal Q1 2026 totaled $20.94B, up 12% in U.S. dollars and 10% in local currency versus fiscal Q1 2025.

Cintas Beat: Q2 GAAP EPS came in at $1.21, beating estimates by $0.02. Revenue reached $2.8B, up 9.4% Y/Y, exceeding expectations by $30M. Full-year revenue guidance was raised to $11.15B–$11.22B from $11.06B–$11.18B, while diluted EPS guidance was lifted to $4.81–$4.88 from $4.74–$4.86.

Nike Beat: Q2 GAAP EPS came in at $0.53, beating estimates by $0.16. Revenue totaled $12.4B, up 0.4% Y/Y and $190M ahead of expectations. Wholesale revenue rose 8% to $7.5B on both reported and currency-neutral bases, while NIKE Direct fell to $4.6B, down 8% reported and 9% currency-neutral. Gross margin declined 300 bps to 40.6%.

EARNINGS PREVIEW:

No major earnings are scheduled for the next week

VIDEO’s OF THE WEEK:

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.