- Primal Thesis

- Posts

- Strongest GDP In Two Years

Strongest GDP In Two Years

🧠 NVIDIA’s Licensing Agreement With Groq

💸 Record Exodus From Active Funds

📈 U.S. GDP Grew At A Blistering 4.3% In Q3

🏦 PayPal Applies For Banking License

🥇 Gold, Silver, And Platinum Surge To Record Highs

💧 Liquidity Improves In Off-The-Run Treasury Markets

QUOTE OF THE WEEK:

“The whole concept that this is a profitless prosperity around these large language models, I think, continues to be put to rest. We understand, and investors understand, that the pricing of tokens is going to go down — by Sam Altman’s account, 10x per year — but ultimately, the usage is going to increase by more. And I think that is at the center of this big raise.” - Gene Munster, Deepwater Asset Management managing partner.

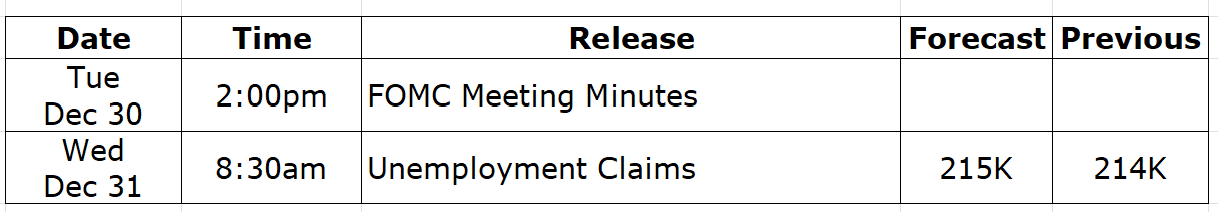

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC EOD 12/26

WEEKLY MARKET WRAP:

Good Afternoon. A good short week for the markets, with all major indices posting decent gains thanks to better-than-expected macro data on GDP and unemployment claims.

Below are the key things to note this week:

Strongest GDP in two years:

U.S. consumers powered a stronger-than-expected economic rebound in Q3, delivering the fastest growth pace in two years. Real GDP rose at a 4.3% annualized rate, up from 3.8% in Q2 and well above the 3.2% consensus forecast, reflecting momentum that was firmly in place before the government shutdown.

Growth was driven primarily by consumer spending, led by healthcare services, international travel, legal services, and tech-related outlays such as PCs and software. AI-linked investment continued to contribute, though at a slower pace than in Q2, as overall business investment decelerated to 2.8% from 7.3%.

Within consumption, services spending accelerated sharply to 3.7%, primarily driven by higher-income households, while durable goods spending cooled to 1.6% from 2.3%. The mix indicates that consumers are still spending, but it is increasingly skewed toward services over goods. High-income consumers, who primarily spend on services, are doing well; lower-income households are struggling.

For the week:

The S&P 500 is up 2.29%, the Nasdaq is up 2.55%, and the Dow 30 is up 1.58%.

Barchart

CNN's Fear & Greed Index now stands at 56 (Greed) out of 100, up 11 points from last week. Details here

The top five trending stocks on Reddit are BlackRock, SPY, Nvidia, Micron, and Tesla. Read More

Here is a summary of this week’s key economic releases:

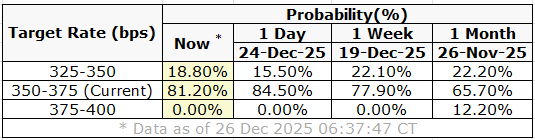

Target Rate Probabilities for Jan 28th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Liquidity in the Off-the-Run Treasuries Market:

Last month, the Fed staff published an article about the off-the-treasury market. Off-the-run Treasuries are seasoned securities, account for about 98 percent of all Treasuries outstanding, and played a central role in the pandemic-fueled dash for cash in March 2020. I wrote about the regulatory initiatives to improve liquidity in the U.S. Treasury market in my blog last year. Below are the key points from the recent Fed analysis and the progress made since last year:98% of Treasuries are off-the-run, making them the real stress point in the $27T Treasury market—not the on-the-run benchmarks. These securities were the primary drivers of liquidity breakdowns in March 2020 and April 2025.

Liquidity deteriorates mechanically as bonds age: trading volumes collapse after the first off-the-run, trade frequency drops, average trade size rises, and bid-ask spreads widen sharply—especially beyond the 2nd off-the-run.

Dealer balance sheets are the binding constraint: Treasury supply has grown from ~$5T in 2007 to ~$28T, while dealer intermediation capacity has not kept pace, making off-the-runs far more vulnerable during volatility.

Off-the-run liquidity is not immutable: securities that become cheapest-to-deliver in futures trade materially more frequently and at lower transaction costs—even when deeply off-the-run—proving that market structure can override age effects.

Buybacks help, but scale remains modest: Treasury’s liquidity-support buybacks are directionally positive and price-sensitive, yet small relative to dealer inventories and overall market volumes.

Central clearing is the most powerful lever: expanded repo and cash clearing can free dealer balance sheets via netting, easing leverage constraints and improving off-the-run liquidity—but benefits will accrue gradually.

All-to-all trading is viable in theory: over 50% of off-the-run trades have same-day offsetting flows, suggesting periodic matching auctions could reduce reliance on dealer inventories if adopted at scale.

Bottom line: No single reform fixes Treasury market resilience. But buybacks + clearing + structural trading changes together can meaningfully improve liquidity where it actually breaks—off-the-run bonds.

NVIDIA - Groq deal structure to avoid regulatory scrutiny:

Primal Thesis

Nvidia’s licensing agreement with Groq is a textbook example of how Big Tech is adapting deal structure to a more challenging antitrust climate. Rather than acquiring Groq or taking an equity stake, Nvidia is licensing Groq’s low-latency inference chip designs while allowing Groq to remain operationally independent, with its data center business intact and a new CEO in place. Key Groq executives, including founder Jonathan Ross, will join Nvidia to help integrate the technology into future products—effectively transferring know-how without triggering the regulatory scrutiny that would accompany a formal takeover.

From a regulatory perspective, the structure matters more than the economics. By keeping the arrangement non-exclusive and framed as a technology licensing arrangement, Nvidia preserves the appearance of competition in AI inference while expanding its “AI factory” architecture to cover real-time and low-latency workloads. This avoids accusations of market foreclosure or vertical integration across the full AI stack at a time when regulators are increasingly focused on talent moves, ecosystem control, and de facto consolidation. Licensing plus selective hiring has become the preferred playbook: expand capabilities, keep competitors nominally alive, and stay ahead of antitrust enforcement.

FRONT PAGES:

NVIDIA-Groq Deal: NVIDIA would spend $20 billion to secure top talent from Groq under what the startup described as a “non-exclusive licensing agreement.” However, clarity remains limited. Despite being the world’s most valuable company, Nvidia has issued no press release or regulatory filing. It is merely confirming the details outlined in Groq’s 90-word blog post published after the close of holiday-shortened trading on Wednesday. Read

Record Metal Rally: Gold, silver, and platinum surged to record highs amid rising geopolitical tensions, a weaker US dollar, and thin market liquidity. Spot gold climbed above $4,540 an ounce, while silver crossed $77, as safe-haven demand intensified. Dollar weakness and year-end liquidity conditions further fueled gains, with gold up ~70% and silver over 150% this year, marking their strongest annual performance since 1979. Read

Record Exodus from Active Funds: A narrow set of mega-cap tech stocks drove a disproportionate share of 2025 returns, reinforcing a trend that has dominated markets for much of the past decade. Nearly $1 trillion exited active equity mutual funds, extending net outflows to an 11th consecutive year, while passive equity ETFs absorbed over $600 billion. This concentration of gains left active managers at a disadvantage, with 73% of equity mutual funds underperforming their benchmarks—one of the worst outcomes since 2007. Read

PayPal Bank: PayPal said Monday it has applied for approval to establish PayPal Bank, which would enable it to offer loans to small businesses. Read

EARNINGS UPDATE:

No major earnings reported this week.

EARNINGS PREVIEW:

No major earnings are scheduled for the next week.

VIDEO’s OF THE WEEK:

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.