🔎 Key Points From FOMC Press Conference

🛒 Amazon Surpasses Walmart Revenue

📈 Strong Earnings Continue

⚖️ Impact Of Supreme Court Decision On Tariffs

🏛️ Government Shutdown Impacts QoQ GDP

🚀 NVIDIA Results Next Week

QUOTE OF THE WEEK:

“This has to be baked in and then considered in terms of what will actually happen. As you all mentioned, it will take time for this to take effect, and the response is likely to be that, under the current administration, tariffs remain in place using other tenets of the law. Essentially, this is near-term drama for short-term players—some excitement on the trading floor—and for others, an opportunity to look for any babies that get thrown out with the bathwater.” - John Stoltzfus, Managing Director and Chief Market Strategist - Oppenheimer

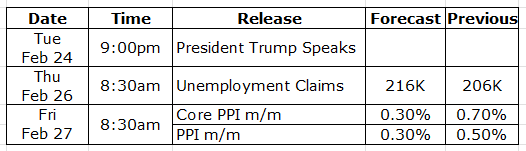

KEY US ECONOMIC EVENTS NEXT WEEK:

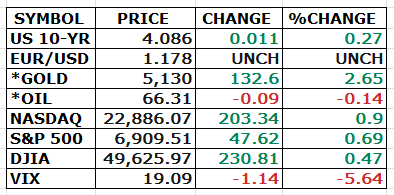

MARKET CLOSE:

CNBC Eod 2/21

WEEKLY MARKET WRAP:

Good Afternoon. A positive week for the market, with all major indices recording gains. Macro data was weak, especially on GDP, but it was blamed on the government shutdown last quarter, and markets shrugged it off. The Supreme Court's ruling on tariffs sparked excitement, but I think the administration will find ways to continue its agenda, and no material policy change should occur. It will increase the volatility in the short term.

NVIDIA is set to report next week, and I have no doubt that earnings and guidance will be great, given that hyperscalers almost doubled their AI capex for 2026. NVIDIA stock hasn’t performed well over the last few quarters, so I expect it to gain momentum and pull markets in its direction.

Below are the key things to note this week:

GDP and PCE: Headline Noise vs Underlying TrendGrowth: Q4 real GDP printed at 1.4% vs 2.8% consensus, triggering slowdown fears. But the 43-day federal shutdown materially distorted the data. Federal outlays alone subtracted 1.15pp from growth; CEA estimates total drag near 2pp. Adjusted for that, growth was likely north of 3%. Expect a 1–1.5pp mechanical rebound in Q1, though some lost activity is permanent.

Inflation: Q4 PCE printed at 2.9% YoY (core 3.0%), with core running 2.7% annualized and December up 0.4% MoM. On the surface, that looks firm.

But context matters:

Lag Effect: PCE typically trails CPI at turning points. With CPI trending softer, pipeline disinflation may not yet be fully reflected in PCE.

Base Effects: Elevated prints from a year ago are still embedded in the YoY comparison. As they roll off, inflation should mechanically ease.

Imputed Components: PCE includes estimated costs (e.g., portfolio management fees) that rise with equity markets, inflating readings without broad consumer price pressure. Market-based PCE is lower.

Bottom line: Growth is stronger than 1.4% suggests. Inflation is cooler than 3% implies.

Primal Thesis

Private Credit Stocks Under Pressure:

Shares of Blue Owl and other alternative asset managers came under pressure after the firm restructured redemptions in one of its retail-focused credit funds. Management pushed back on headlines suggesting “gating,” clarifying that quarterly redemptions are being replaced with episodic payouts — and that capital returns are actually being accelerated.To facilitate this, Blue Owl sold $1.4B of loans across 128 names — roughly 35% of the fund — at 99.7 cents on the dollar. The portfolio slice represented a broad cross-section of sectors and loan types. Management framed the sale at near-par as third-party validation of credit quality and valuation marks.

Investors are set to receive ~30% of their capital back within 45 days — significantly more than a standard 5% tender offer would have delivered.

Some scrutiny emerged around a portion of the sale involving an insurer tied to the firm’s broader business. Blue Owl emphasized that the assets were sold to four institutions at identical prices amid strong demand and argued that the transaction reflects liquidity, not stress.

Income Inequality:Walmart's CEO highlighted on the earnings call that the majority of the revenue-share gains came from households earning more than $100,000. For households earning below $50,000, wallets remain stretched, and in some cases, people are managing spending paycheck to paycheck. Walmart is banking on higher-than-expected tax refunds this year.

For the week:

The S&P 500 is up 1.12%, the Nasdaq is up 1.28%, and the Dow 30 is up 0.35%.

Barchart

CNN's Fear & Greed Index now stands at 43 (Fear) out of 100, up 8 points from last week. Details here

The top five trending stocks on Reddit are SPY, Microsoft, NVIDIA, QQQ, and DTE Energy. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Operations: The New York Fed’s standing repo operation (primarily reflecting SRF take-up) as of Feb 20th is $0.

Here is a summary of this week’s key economic releases:

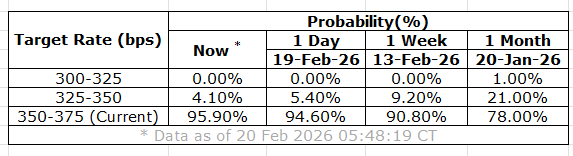

Target Rate Probabilities for March 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

NVIDIA Earnings Next Week:

NVIDIA (NVDA) is set to report fiscal Q4 2026 earnings on February 25, after market close.Consensus estimates

Revenue: $65.0–65.7 billion (company guidance: $65 billion ±2%; +67% YoY)

Adjusted EPS: $1.52–1.53 (+71% YoY)

Data Center segment: Expected to contribute ~$58–59 billion

NVIDIA has beaten consensus estimates for 12 consecutive quarters. The focus will be on forward guidance—particularly Q1 FY2027 (analyst range ~$71–72 billion)—and management commentary on the Blackwell architecture ramp, early Rubin pipeline signals, and the trajectory of hyperscaler capital expenditures.

Additional points of interest:

Sustained validation of AI infrastructure demand, supported by recent hyperscaler commitments (e.g., Meta's expanded GPU orders, OpenAI's planned $30 billion investment).

Potential China-related upside: Guidance incorporated zero Data Center revenue from China.

Gross margins projected to remain near 75% non-GAAP, with operating leverage intact.

Backlog and longer-term pipeline: References to $300 billion+ revenue potential in calendar 2026 if current demand trends persist.

Options markets imply an approximately 7% post-earnings move. A clean beat combined with constructive guidance would likely drive upside. This earnings release will serve as a key reference point for AI spending momentum across the technology sector.

Key points from FOMC minutes:

The Committee held rates steady at 3½–3¾%; two members dissented in favor of a 25 bps cut.

Inflation remains elevated at 2.8–3.0% PCE; core goods inflation is being driven by tariffs, while core services inflation continues to decline.

Most participants judged that downside risks to employment have moderated, though inflation risks remain tilted to the upside.

Labor market conditions show signs of stabilization: unemployment at 4.4%, job gains are low, hiring is subdued, and layoffs are limited.

Real GDP expanded at a solid pace in 2025; Q4 growth slowed partly due to the government shutdown, while PDFP slowed less than headline GDP.

The growth outlook was revised higher, with GDP expected to outpace potential through 2028; unemployment is projected to fall below its natural rate.

The inflation forecast was revised slightly higher; risks to inflation remain skewed upward due to potential persistence and sustained demand pressures.

Financial conditions remain supportive: equity valuations are elevated, credit spreads are tight, and corporate issuance is strong.

Money markets are stable; reserves are expected to fluctuate near $3T as reserve management purchases continue and TGA flows create volatility.

Balance-sheet policy continues with Treasury bill purchases to maintain ample reserves; QT remains ended.

Several participants supported a two-sided risk description, noting rate hikes could be appropriate if inflation remains above target.

Policy remains data-dependent, with no preset path; careful risk balancing is emphasized between persistent inflation and

FRONT PAGES:

Amazon Surpasses Walmart Revenue: For the first time, Amazon has overtaken Walmart as the largest company by annual revenue. Walmart reported $713.2B in revenue for its latest fiscal year, trailing Amazon’s $716.9B. The shift had been building for months, after Amazon first surpassed Walmart in quarterly sales about a year ago. Read

New Tariffs: President Donald Trump said Friday evening he signed an executive order imposing a 15% “global tariff,” after the Supreme Court struck down his sweeping “reciprocal” import duties in a major setback to his trade agenda. The “Section 122” tariffs will take effect almost immediately. Read

Stablecoin Adoption: SEC’s Division of Trading and Markets issued an FAQ clarifying how broker-dealers should treat payment stablecoins under the net capital rule. Commissioner Hester Peirce, chair of the Crypto Task Force, said staff will not object to applying a 2% haircut—rather than a punitive 100%—on proprietary positions in qualifying payment stablecoins when calculating net capital. Read

OpenAI Lowers Compute Spend Estimates: OpenAI is now guiding to ~$600B in total compute spend by 2030, down from the $1.4T infrastructure ambition previously outlined by Sam Altman. The revised target introduces a clearer timeline and a more defined capital plan as investor concerns grow over whether the expansion scale aligns with future revenue potential. Read

NVIDIA-OpenAI Revise Deal: NVIDIA is finalizing a $30bn investment in OpenAI, replacing last year’s $100bn long-term commitment as part of a broader capital raise. The deal could close as soon as this weekend. The $30bn equity check is part of a funding round targeting over $100bn, valuing the ChatGPT maker at $730bn pre-money. Read

More Business for NVIDIA: Meta will deploy millions of Nvidia chips across its AI data centers, including the company’s new standalone CPUs and next-gen Vera Rubin systems, under a broad partnership announced Tuesday. CEO Mark Zuckerberg said the expansion advances Meta’s ambition to deliver “personal superintelligence” globally, a vision unveiled in July. Read

EARNINGS UPDATE:

Primal Thesis

Medtronic Beat: Revenue of $9.0B rose 8.7% reported and 6.0% organic, exceeding Q3 guidance by 50 bps. Cardiac Ablation Solutions surged 80% YoY, with U.S. growth of 137% driven by PFA. CE Mark was received for Sphere-360, and the U.S. pivotal trial was launched. The FDA cleared the Hugo robotic system and the Stealth AXiS for spine applications. Acquisitions include CathWorks and Anteris.

Palo Alto Beat: Fiscal Q2 revenue rose 15% YoY to $2.594B. Next-Generation Security ARR climbed 33% to $6.3B, while RPO increased 23% to $16.0B, signaling strong forward visibility. GAAP EPS was $0.61 and non-GAAP EPS was $1.03, with a 30.3% non-GAAP operating margin. Integration progress continues with Chronosphere and CyberArk.

ADI Beat: Revenue of $3.16B, with growth across all end markets led by Industrial and Communications. TTM operating cash flow reached $5.1B (43% of revenue) and free cash flow $4.6B (39%). Returned $1.0B to shareholders in Q1; dividend raised 11% to $1.10, marking 22 consecutive years of increases. Bookings increased with record Data Center orders. Gross margin was 64.7%, operating margin 31.5%, and adjusted operating margin 45.5%.

Booking Holding Beat: Q4 2025 room nights rose 9% YoY. Gross bookings increased 16% to $43.0B. Net income margin expanded to 22.5% from 19.5%, while adjusted EBITDA margin improved to 34.6% from 33.8%. A 25-for-1 stock split takes effect April 2, 2026. The company repurchased $2.1B of shares, with $21.8B remaining under authorization.

Deere Miss: Worldwide sales rose 13% YoY to $9.61B. Net income was $656M with diluted EPS of $2.42. Segment sales: Production & Precision Ag +3%, Small Ag & Turf +24%, Construction & Forestry +34%. Financial Services net income increased 6% to $244M. FY2026 net income guidance raised to $4.5B–$5.0B. Q1 shipments exceeded plan as order books improved.

Newmont Mining Mixed: Q4 revenue rose 21% YoY to $6.82B. Adjusted EPS of $2.52 missed estimates by $0.21; GAAP EPS was $1.19 with net income of $1.30B. Free cash flow reached $2.81B and operating cash flow totaled $3.62B. The company declared a $0.26 quarterly dividend and ended the year with ~$2.1B in net cash and ~$11.6B in total liquidity.

Southern Company Miss: Q4 2025 operating revenue rose 10.1% YoY to $7.0B (vs. $6.3B). GAAP EPS declined to $0.38 from $0.49, while non-GAAP EPS improved to $0.55 from $0.50. Q4 net income: Traditional Electric $588M, Southern Company Gas $183M, Southern Power $64M. Total regulated utility customers reached 9.005M (4.590M electric; 4.415M gas).

Walmart Beat: Revenue rose 5.6% YoY to $190.7B (cc +4.9%). Operating income increased 10.8%, ahead of sales growth. Global eCommerce surged 24%, driven by pickup, delivery, and marketplace. GAAP EPS was $0.53; adjusted EPS was $0.74. Authorized a new $30B buyback. FY27 guides net sales up 3.5%–4.5% (cc) and adjusted operating income up 6%–8% (cc).

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

24-Feb | HD | Home Depot | Before Open |

24-Feb | MELI | Mercadolibre Inc | After Close |

25-Feb | BMO | Bank of Montreal | Before Open |

25-Feb | CRM | Salesforce Inc | After Close |

25-Feb | LOW | Lowe's Companies | Before Open |

25-Feb | NVDA | Nvidia Corp | After Close |

25-Feb | TJX | TJX Companies | Before Open |

26-Feb | INTU | Intuit Inc | After Close |

26-Feb | RY | Royal Bank of Canada | Before Open |

26-Feb | TD | Toronto Dominion Bank | Before Open |

27-Feb | BRK.B | Berkshire Hathaway Cl B | -- |

3-Mar | CRWD | Crowdstrike Holdings Inc | After Close |

4-Mar | AVGO | Broadcom Ltd | After Close |

VIDEO’s OF THE WEEK:

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.