- Primal Thesis

- Posts

- The Transition from Generative to Agentic AI

The Transition from Generative to Agentic AI

📈 Nvidia Earnings Continue to Eclipse Estimates

🤖 Transition from Generative to Agentic AI

🇪🇺 EU Plans Non-Bank Stress Test

🪙 Impact of Stablecoin Adoption

🌍 Real World AI Success Stories

📊 Key Points from FOMC Meeting Minutes

🏦 Factor Driving Bank Valuations

QUOTE OF THE WEEK:

“AI trade is only beginning—the implementation and utilization of AI. I see it in my own company. We are on our front foot, leading the way in incredibly innovative ways in terms of deploying AI, and it's only starting to impact us in positive ways. So I think the benefits of AI are going to be unprecedented—it’s all still in front of us. And Nvidia is the key supplier of critical chip componentry underlying that trend, which is an unappreciated investment opportunity. - John Porter, CIO, Newton Investment Management.

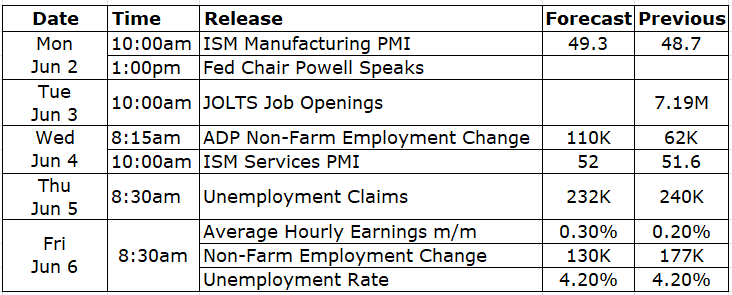

KEY US ECONOMIC EVENTS NEXT WEEK:

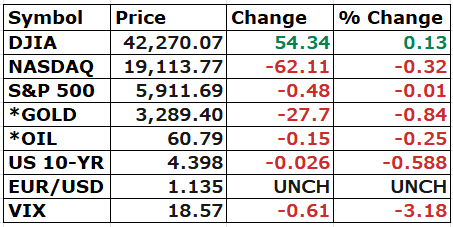

MARKET CLOSE:

CNBC EOD 30th May

WEEKLY MARKET WRAP:

Good Afternoon. Positive week for the markets, with all major indices gaining ~1%. It was a busy week with positive developments for AI and Crypto. All major tech firms beat earnings, driven by the AI business, and positive newsflow in crypto continues with the SEC dropping its major case against Binance.

Below are the key things to note from the week:

Inflation:

As expected, the Fed's preferred inflation measure, the PCE, dropped to 2.1%, much closer to the Fed’s 2% average target. Last year (September 22nd newsletter), I provided three key reasons as to why inflation would continue to fall, contrary to the headlines at the time 😃

Nvidia Results:

Nvidia reported another stellar quarter, despite being impacted by the export controls on China and incurring a $4.5 billion write-off. As usual, it eclipsed the consensus estimates. Check the detailed analysis in the next section.

Generative to Agentic AI:

The Nvidia conference call, as well as the Future of Finance report released by the Boston Consulting Group this week, highlighted the rise of Agentic AI. The AI transformation is rapidly evolving, and the next phase, expected in a year or two, will be Machine Voice.

Source: BCG

In the table below, I am summarizing the differences between Generative vs. Agentic or Agent-based AI:

Feature | Generative AI (Gen AI) | Agentic AI |

|---|---|---|

Core Function | Generates content (text, image, code, etc.) | Performs goal-directed tasks autonomously |

Examples | ChatGPT, DALL·E, Midjourney | AI agents managing workflows and decisions |

Capabilities | One-shot responses, basic interaction | Reasoning, Planning, Acting |

Token Use | Lower token usage per task | Massively higher token usage per task |

Use Cases | Content creation, answering queries | Complex task automation, enterprise agents |

Infrastructure Need | High compute, but manageable | Exponential inference demand (step-jump) |

For the week:

The S&P 500 is up 1.19%, the Nasdaq is up 0.99%, and the Dow 30 is up 0.98%.

Source: Barchart

CNN's Fear & Greed Index now stands at 63 (Greed) out of 100, down 1 point from last week. Details here

The top five trending stocks on Reddit are SPY, Nvidia, Tesla, UnitedHealth Group, and Palantir. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for June 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Key Points from Nvidia Results:

YoY revenue growth is 69%. The data center's year-over-year (YoY) revenue growth is 73%.

The company believes that the transformation from generative to agentic AI will change every industry.

The company took a $4.5 billion write-off on inventory that can not be sold or repurposed due to the impact of export controls on China.

The CEO, Jensen Huang, stated in no uncertain terms that the US policy to ban exports to China is based on an incorrect assumption that they cannot manufacture chips.

The company mentioned that the export controls have closed the $50 billion China market for the firm and are driving the AI talent to rivals.

The company highlighted multiple AI success stories from its clients to demonstrate that the capital expenditures firms were making were starting to pay off.

Below is the overall list of -🏦 Capital One

Reduced chatbot latency by 5x using NVIDIA Dynamo on Blackwell, improving real-time customer response.

🍔 Yum! Brands

Deploying NVIDIA AI across 500 restaurants, expanding to 61,000+, to automate ordering, optimize operations, and enhance service quality.

🛡️ CrowdStrike

Achieved 2x faster threat detection with 50% lower compute cost using NVIDIA’s AI security stack.

💡 Cisco

Boosted code assistant accuracy by 40% and speed by 10x using NVIDIA NeMo.

📊 NASDAQ

Improved AI search performance with 30% gains in both accuracy and response time.

⛽ Shell

Raised custom LLM accuracy by 30% through training with NeMo.

🏭 TSMC, Foxconn, Pegatron

Using NVIDIA Omniverse for industrial digital twins:

• TSMC cut fab design time by months

• Foxconn accelerated thermal simulations by 150x

• Pegatron reduced assembly defects by 67%

🚗 Mercedes-Benz, GM

Leveraging NVIDIA’s full-stack AI platform for next-gen vehicle and factory systems.

🤖 Agility Robotics, Boston Dynamics, XPENG Robotics

Using:

• Isaac – Robotics simulation and autonomy

• Omniverse – 3D digital environments

• Cosmos – Synthetic data and model training

🧠 OpenAI, Perplexity, DeepSeek

Running next-gen reasoning models with up to 30x throughput gains using Blackwell + NVIDIA Dynamo.

🌍 Saudi Arabia, UAE, Taiwan, Sweden, India, and others

Building sovereign AI infrastructure on NVIDIA’s platform to support national digital capabilities.

🧬 GE Healthcare

Developing robotic surgery and imaging systems using NVIDIA Isaac, Omniverse, and Cosmos.

Key Points - FOMC Meeting Minutes:

Average inflation targeting or flexible inflation targeting is a more robust policy strategy capable of correcting persistent deviations.

The Treasury yield curve steepened materially, as short-term Treasury yields declined about 20 basis points over the intermeeting period while longer-term yields increased on net.

The dollar depreciated substantially. Decline was attributed to increased foreign exchange hedging prompted by heightened policy uncertainty.

No evidence indicated that foreign investors had sold material amounts of U.S. assets. Available data indicated modest outflows from fixed-income securities, which were primarily offset by inflows into equity securities.

The drop in GDP in the first quarter was due to measurement issues. Real private domestic final purchases (PDFP)—which comprise PCE and private fixed investment and often provide a better signal than GDP of underlying economic momentum—posted a solid gain.

Stablecoins Impact:

A rise in stablecoin issuance and use is expected to drive the demand for the US Treasuries. Issuers will have to back stablecoins with high-quality and liquid collateral, and US treasuries will be an obvious choice. This is a good development for the US, as it will help fund the Government and support the dollar. According to major institutional projections, the demand for US treasuries is expected to be between $600 billion and $1 trillion over the next few years.

I believe this is the primary reason for the significant push from this administration to expedite stablecoin regulation, specifically the GENIUS Act, so that the US can take the lead.

BCG - The Future of Finance Report:

BCG published its Future of Finance report this week. The report contains a wealth of valuable information. Below are some of the most critical insights:Success is not just about being the largest, but also about achieving scale in specific areas. Banks with scale and concentration in digitizable products have an edge. Banks with leadership in deposits lead the valuations. Deposit leadership is a direct reflection of a bank’s share of valuable primary client relationships and provides several advantages, including lower funding costs, enhanced cross-selling opportunities, and greater resilience. During periods of market turmoil, clients consider the leading players a haven, moving their deposits to these institutions and widening the gap.

Source: BCG

Four key operating levers for banks are:

Front-to-Back Digitization

Offshore Capability and Innovation Hubs Customer Centricity From Service to Multiproduct Digital Sales

Focused Business Models

M&A at Speed: Digitization Makes the Difference

FRONT PAGES:

Revised US GDP Data: The US economy contracted at an annualized rate of 0.2% in Q1, slightly better than the initial estimate of -0.3%. Still, it marked the first decline since 2022, reflecting the toll of President Trump’s aggressive tariff policy on consumers and businesses. Read

SEC Drops Binance Lawsuit: The SEC has dropped its case against Binance, two years after accusing it of serving U.S. users illegally and misusing customer funds. This follows a $4.3B U.S. settlement and Zhao’s guilty plea. Binance is now taking a $2B investment from Emirati state fund MGX, in USD1, a new stablecoin launched by the Trump-backed World Liberty team. Read

Another Crypto Positive: VP Vance Backs Crypto at Bitcoin 2025, Calling It Key to Tech and Inflation Hedging. He said Trump would sign the Genesis Act to support stablecoins. Meanwhile, the Labor Department eased rules on crypto in retirement plans by reversing its 2022 guidance. Read

NYT-Amazon AI Deal: The New York Times has struck a deal with Amazon to license its content for AI use, including real-time summaries on Alexa and training Amazon’s models. More news outlets are signing similar AI licensing agreements. Read

EU Plans Non-Bank Stress Test: EU regulators will launch their first stress test of non-bank financial players, amid concerns over the fast growth of hedge funds and private equity. The test will assess how a market shock could impact the broader system, including insurers and pension funds, mirroring the Bank of England’s approach last year. Read

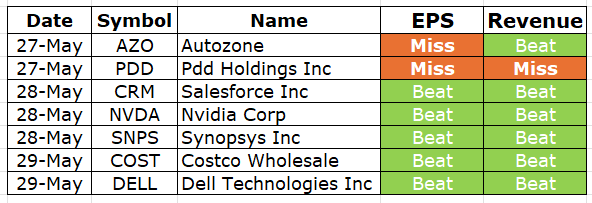

EARNINGS UPDATE:

Autozone Mixed: AutoZone reported a 6.6% drop in quarterly profit, hit by weaker demand and currency headwinds. Consumer pullback on select parts continued to put pressure on margins. Read

PDD Holdings Miss: PDD Holdings reported a 47% drop in Q1 net profit to 14.74B yuan ($2.05B), pressured by fierce domestic competition and global trade uncertainty impacting its international arm. Read

Salesforce Beat: Salesforce raised its full-year revenue forecast after beating Q1 estimates, driven by AI momentum. Subscription growth in AI more than doubled, and SMB bookings saw double-digit gains. Q2 guidance came in ahead of Wall Street expectations. Read

Nvidia Beat: Nvidia beat earnings expectations with the $4.5B hit from US export controls coming in lower than feared. CFO Colette Kress warned the impact could swell to $8B this quarter. Read

Synopsis Beat: Synopsys beat estimates with Q2 revenue of $1.604B and adjusted EPS of $3.67, up from $1.455B and ahead of forecasts of $1.6B and $3.39, respectively. Read

Costco Beat: Costco Wholesale beat Q4 sales and earnings estimates, reinforcing its reputation as a safe haven in uncertain times. Read

Dell Beat: Dell raised its full-year profit forecast and reported a sharp jump in server orders driven by AI demand. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

3-Jun | CRWD | Crowdstrike Holdings Inc | After Close |

4-Jun | HLN | Haleon Plc | -- |

5-Jun | AVGO | Broadcom Ltd | After Close |

10-Jun | ORCL | Oracle Corp | -- |

VIDEO’s OF THE WEEK:

The key to a $1.3T opportunity

A new trend in real estate is making the most expensive properties obtainable. It’s called co-ownership, and it’s revolutionizing the $1.3T vacation home market.

The company leading the trend? Pacaso. Created by the founder of Zillow, Pacaso turns underutilized luxury properties into fully-managed assets and makes them accessible to the broadest possible market.

The result? More than $1b in transactions, 2,000+ happy homeowners, and over $110m in gross profits for Pacaso.

With rapid international growth and 41% gross profit growth last year, Pacaso is ready for what’s next. They even recently reserved the Nasdaq ticker PCSO.

But the real opportunity is now, before public markets. Until 5/29, you can join leading investors like SoftBank and Maveron for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.