- Primal Thesis

- Posts

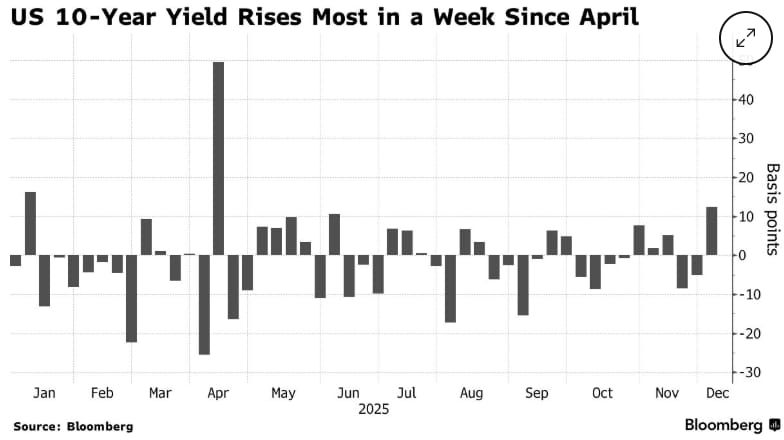

- Worst Week for Treasuries Since April

Worst Week for Treasuries Since April

💧 Dominance Of Liquidity On Stock Prices

⚡ Unexpected Beneficiaries Of The AI/Data-Center Boom

📉 Treasuries’ Worst Week Since April

🏦 Repo Market Size

🎬 Netflix Struck A Deal To Buy Warner Bros

📊 BoE To Launch New Stress Test For Private Equity And Credit Market

QUOTE OF THE WEEK:

“We all understand that the Fed is a consensus institution. So whoever you put in there is going to build consensus. The dot plots aren't promises. And I think that they'll be working towards neutral—towards 3%—over time. And I think that that would be constructive and healthy for the market.” - Andrew Davis, Bryn Mawr Trust Advisors SVP & Head of Macroeconomic Research

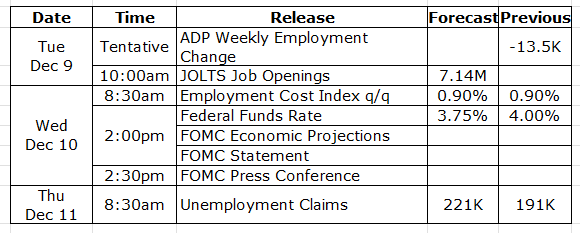

KEY US ECONOMIC EVENTS NEXT WEEK:

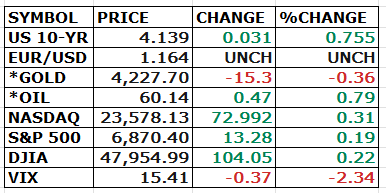

MARKET CLOSE:

CNBC - EOD Dec 5th

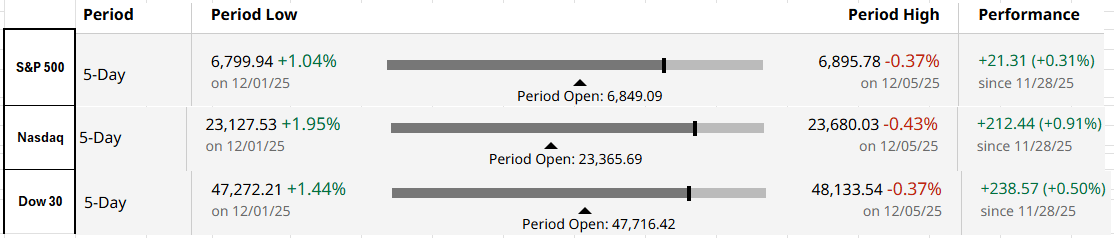

WEEKLY MARKET WRAP:

Good Afternoon. A positive week for markets, with all major indices closing in positive territory. Sentiments improved this week with the CNN Fear and Greed index adding 16 points ahead of the following week’s FOMC meeting. The Fed is expected to cut the rate by 25bps, but it will be more important to see what Chair Powell says in the press conference, which will inform expectations for the next year.

For the week:

The S&P 500 is up 0.31%, the Nasdaq is up 0.91%, and the Dow 30 is up 0.50%.

Barchart

CNN's Fear & Greed Index now stands at 40(Fear) out of 100, up 16 points from last week. Details here

The top five trending stocks on Reddit are UnitedHealthcare, SPY, Nvidia, AAA, and Tesla. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain around ~$2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Facility (SRF): The SRF balance as of Dec 2nd stood at ~$10 billion. The highest point at month-end was ~$24bn, half of the Nov month-end level.

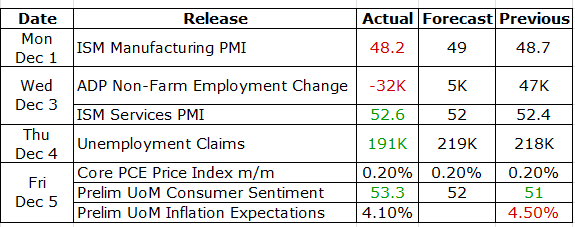

Here is a summary of this week’s key economic releases:

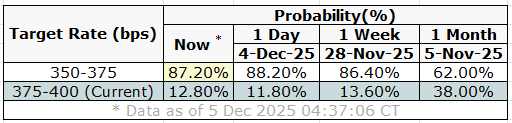

Target Rate Probabilities for December 10th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

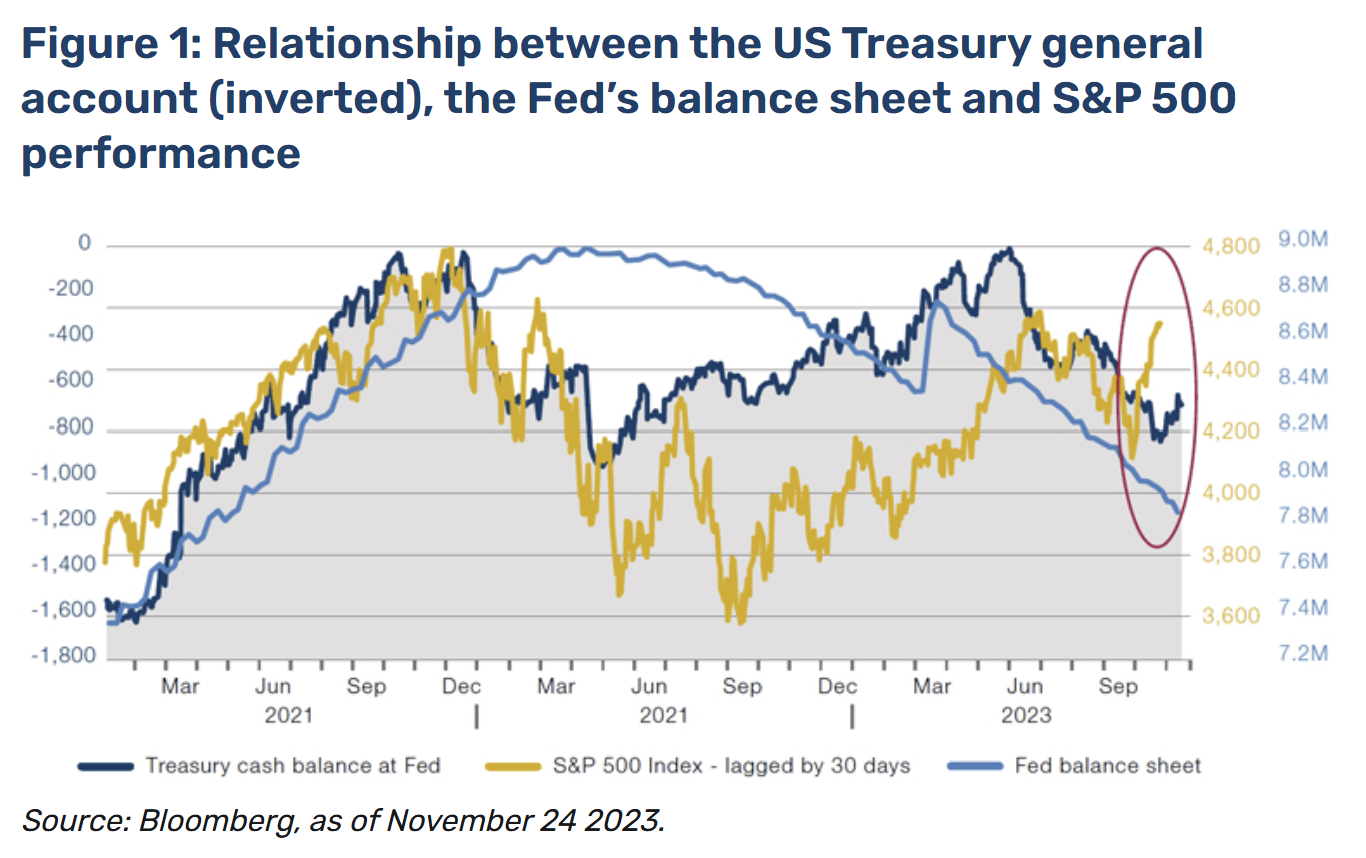

Dominance of Liquidity on Stock Prices:

MAN published an article this week that charts the Treasury’s cash balance (TGA) at the Fed—shown inverted—against the S&P 500. The relationship is striking: across recent debt-ceiling episodes, periods when the TGA falls, typically because issuance stalls at the ceiling, have coincided with stronger equity performance. When the ceiling is lifted and issuance ramps up again, the TGA rebuilds and markets have tended to sell off. The authors describe this as a recurring “rinse and repeat” pattern.

In 2021, the TGA declined by about $1.6 trillion, and the Fed’s balance sheet expanded by a similar amount. Risk assets rose throughout the year. After the debt ceiling reset in early 2022, the Treasury rebuilt its cash position, and the Fed shifted from QE to QT, and equities sold off. The same dynamic appeared again between October 2022 and June 2023, with TGA swings tracking similar moves in the index.

MAN notes that this pattern has now repeated twice in three years, while emphasizing that past relationships do not guarantee future behavior.

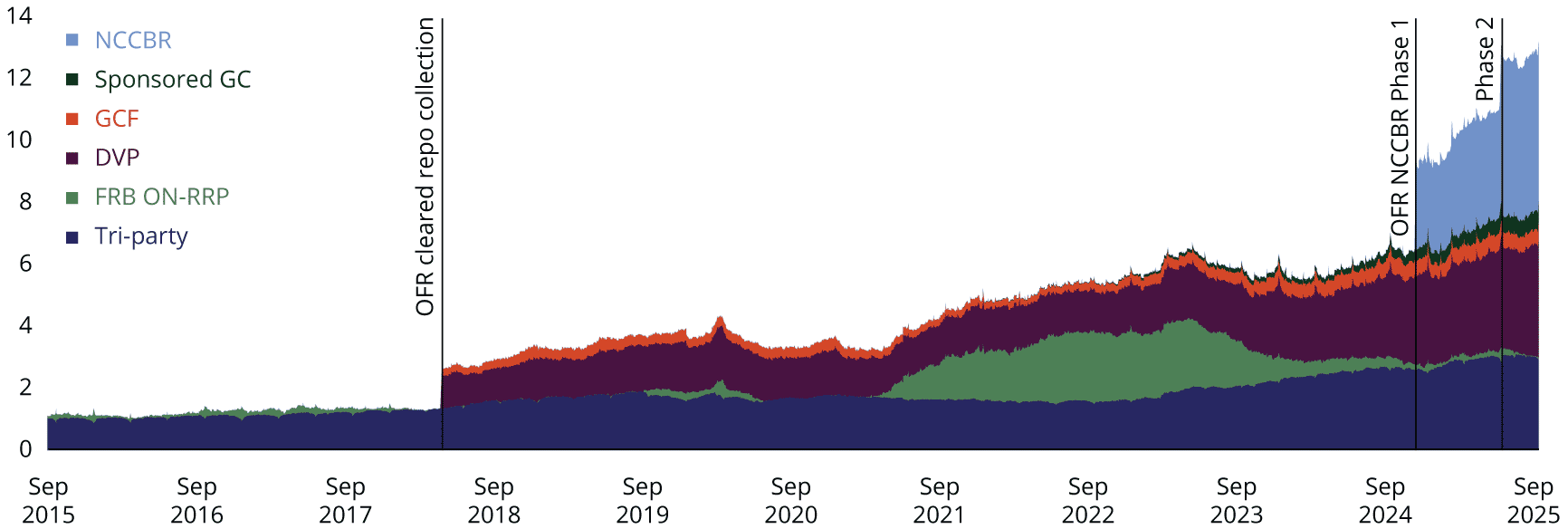

Sizing Repo Market:

According to a December 4, 2025 report from the Office of Financial Research, the U.S. repo market now averages about $12.6 trillion in daily exposures — roughly $700 billion more than prior estimates. The revised figure reflects new transaction-level data for non-centrally cleared bilateral repo (NCCBR), which the OFR began collecting in July 2025. Of the total, about $4.4 trillion is centrally cleared via the Fixed Income Clearing Corporation, $3.1 trillion moves through Bank of New York Mellon’s tri-party platform, and the remaining $5.0 trillion captures the newly visible NCCBR segment — revealing previously unmeasured scale in this part of the market. ~70% of repos are collateralized with US Treasuries.

Unexpected beneficiaries of the AI/data-center boom:

Business Insider reports that Caterpillar and Cummins have emerged as major beneficiaries of the AI-driven data-center buildout. Both companies supply the large generators required to power data centers, and demand has accelerated as AI workloads push energy needs higher.Cummins sold about $2.6 billion in data-center power-generation equipment last year and expects this business to grow 30–35% in 2025. Caterpillar’s power-generation segment has expanded from 8.4% of total sales in 2021 to more than 14% of sales in the first nine months of 2025.

The article notes that shortages in utility-scale power have forced some operators to run natural-gas generators continuously, rather than as backup, to keep data centers online. As a result, both Caterpillar and Cummins have outperformed many of their largest tech-sector customers over the past year.

FRONT PAGES:

BoE’s New Stress Test: The Bank of England will launch a stress test to assess how the $16 trillion global private equity and private credit markets would handle a major financial shock. The system-wide exploratory scenario will deliver a final report in early 2027, focusing on the broader impact on the UK economy rather than firm-level vulnerabilities. Read

Potential S&P 500 Addition: Marvell Technology is now eligible for the S&P 500 after delivering cumulative GAAP profitability over the past four quarters. With a market cap near $84 billion, it is the largest company awaiting inclusion. The S&P Dow Jones Indices committee retains full discretion over additions, and Q4 is typically the quietest period for changes. Read

Netflix to Buy Warner Bros: Netflix struck a deal to acquire key Warner Bros. Discovery assets, ending a competitive bidding race that drew interest from Paramount, Skydance, and Comcast. The purchase covers WBD’s film studio and HBO Max, while WBD will still spin off its TV networks, including TNT and CNN. The deal is expected to close within 12 to 18 months. Read

Treasuries Sell-Off: Treasuries ended their worst week in eight months as mixed data muddied expectations for next year’s Fed cuts. The 10- and 30-year yields climbed four basis points on Friday, capping their sharpest weekly jump since April’s market turmoil triggered by the administration’s tariff agenda. Read

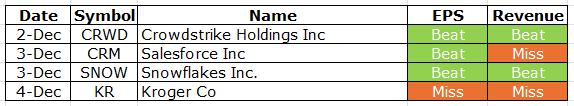

EARNINGS UPDATE:

Crowdstrike Beat: Q3 Non-GAAP EPS came in at $0.96, beating estimates by $0.02. Revenue rose to $1.23B, up 21.8% year over year and ahead by $10M. Subscription revenue reached $1.17B, a 21% increase from $962.7M in the same quarter last year.

Salesforce Mixed: Salesforce posted adjusted earnings of $3.25 per share on $10.26B in revenue, up 8.6% year-over-year. Subscription and support revenue rose 9.5% to $9.73B, driven partly by Agentforce and Data 360. Professional services revenue fell 5.7% to $533M. Analysts had expected $2.86 per share and $10.28B in revenue.

Snowflakes Beat: Q3 non-GAAP EPS came in at $0.35, a $0.04 beat, with revenue rising 28% Y/Y to $1.21B, ahead by $30M. Product revenue reached $1.16B, up 29% Y/Y, and net revenue retention remained strong at 125%.

Kroger Miss: Q3 non-GAAP EPS came in at $1.05, beating estimates by $0.02. Revenue was $33.86B, up 0.7% from a year earlier but below expectations. Excluding fuel and Kroger Specialty Pharmacy, sales rose 2.6%, with identical sales excluding fuel also increasing 2.6%.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

10-Dec | ADBE | Adobe Systems Inc | After Close |

10-Dec | ORCL | Oracle Corp | After Close |

11-Dec | AVGO | Broadcom Ltd | After Close |

11-Dec | COST | Costco Wholesale | After Close |

VIDEO’s OF THE WEEK:

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.