- Primal Thesis

- Posts

- 2026 Opens Strong: AI, Debt, Tech

2026 Opens Strong: AI, Debt, Tech

📈 Good First Full Week Of Trading In 2026

💳 Record Corporate Debt Issuance

🤖 AI Investments Continue

🏦 Banking Reserves Cross $3 Trillion

💻 Big Tech Stocks Are More Attractive Now

📊 What Earnings Explain?

📉 Lowest Monthly Deficit Since June 2009

QUOTE OF THE WEEK:

“I think it's a little too early to call a peak in AI capex. Obviously, there's a reaction function shifting in the market — that capex is no longer being rewarded. But this isn’t the first time the market has pushed back on capex; we saw that in 2024 too. I think this is an AI arms race. Cutting capex is the last thing hyperscalers are going to do, and I believe AI capex is going to continue.” - Ohsung Kwon, Chief Equity Strategist - Wells Fargo

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

WEEKLY MARKET WRAP:

Good Afternoon. Good start to the year, with all major indices posting gains in the first full trading week of the year. Macro data was mixed, with good news on the unemployment rate and deficit numbers.

Below are the key things to note this week:Record Corporate Debt Issuance:

FT reported that the U.S. companies are tapping the bond market at the fastest pace since the Covid era, as AI investment and merger financing drive what’s shaping up to be a record year for debt issuance. More than $95bn was raised across 55 investment-grade deals in the first full week of January—the largest weekly total since May 2020 and the strongest start to any year on record, per LSEG data.

Source: Financial Times

Exactly a year ago, we had similar news, which I covered here. Back then, there was also a record in IG debt issuance, and I wrote that it was a positive sign that IG corporates with strong management were raising funds, indicating they believe good times are ahead.

Supreme Court Holds Tariff Decision:

The Supreme Court did not rule Friday on the legality of President Trump’s broad tariffs, leaving markets in limbo over a decision with significant trade and fiscal implications. Expectations for a Friday ruling proved premature, as the Court issued only one unrelated opinion. Timing remains uncertain, with the next rulings due on Wednesday.

Meanwhile, the U.S. trade deficit in goods and services narrowed sharply to $29.4B in October from $48.1B the prior month, as tariffs continued to reshape global trade, according to Commerce Department data. This marked the lowest monthly deficit since June 2009, driven by weaker imports and resilient exports, aligning with a key Trump administration objective.

AI Investments Continue:Elon Musk’s xAI raised $20 billion, surpassing its earlier $15 billion target. CNBC reported in November that the funding would value the AI startup at roughly $230 billion.

Anthropic has signed a term sheet for a $10B funding round at a $350B valuation, CNBC confirmed Wednesday. The round is being led by Coatue and Singapore sovereign wealth fund GIC, according to a source familiar with the confidential discussions.

For the week:

The S&P 500 is up 1.57%, the Nasdaq is up 1.88%, and the Dow 30 is up 2.32%.

barchart

CNN's Fear & Greed Index now stands at 51 (Neutral) out of 100, up 7 points from last week. Details here

The top five trending stocks on Reddit are SPY, Nvidia, Oklo, DTE Energy, and Tesla. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain at approximately $3 trillion. ON RRP balance remains immaterial.

Standing Repo Operations: The SRF balance as of Jan 9th is $3.75 billion.

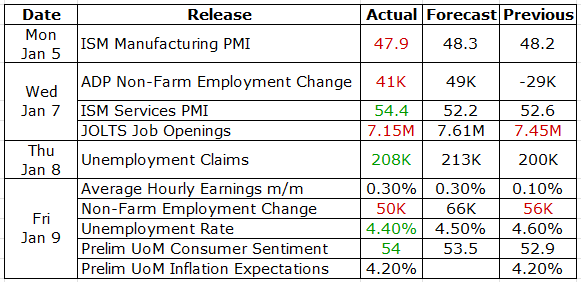

Here is a summary of this week’s key economic releases:

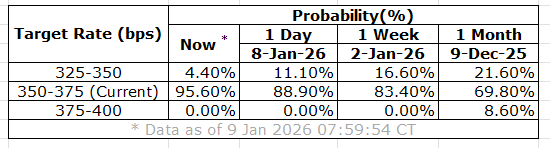

Target Rate Probabilities for Jan 28th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Big Tech Stocks More Attractive:

Since late October, the information technology sector’s weighted forward P/E has compressed to 26 from 31.8, while the S&P 500’s forward P/E fell to 21.9 from 23.3. The IT sector declined 4.1% ex-dividends since October, even as the S&P 500 rose 1.5%.

The primary driver of the IT sector’s P/E compression has been upward revisions to analysts’ EPS estimates.

LSEG

What Earnings Explain:

A recent blog by the CFA Institute provides data on the correlation between earnings and prices and also if the break in corelation in the short term help time the market.

Over 150+ years of Robert Shiller's S&P Composite data (1871–December 2024), corporate earnings maintain an extraordinarily strong static correlation with stock prices, with an R² of 0.95 across the full period—meaning earnings explain about 95% of long-term price variation. This powerful relationship endures remarkably well in more recent fixed windows, remaining near 0.97 over the last 100 years and post-1940 era, 0.963 over the past 50 years, 0.925 over 20 years, 0.905 over 10 years, and a still-solid 0.79 even in the most recent 5 years. These high static correlations affirm that earnings are the fundamental driver of equity market trends over any reasonably extended horizon, especially in the modern era of improved disclosure and investor safeguards. However, as the CFA Institute analysis emphasizes, this reliability fades in shorter rolling windows due to noise from wars, inflation shocks, and regime shifts—offering only modest predictive power for future returns at 50 years (R²=0.53) and virtually none at 10 years or less.

The timeless lesson for investors: trust earnings to illuminate true long-term value and guide strategic allocation, but recognize that short- to medium-term market movements are dominated by other forces beyond fundamentals.

FRONT PAGES:

Walmart-backed app valued at $4bn: OnePay, the Walmart-backed fintech building the retailer’s customer-facing super app, repurchased employee shares in a recent transaction that values the closely held company at over $4 billion, according to a person familiar with the matter. Read

Walmart to join Nasdaq 100: Walmart Inc. will join the Nasdaq 100 Index, replacing AstraZeneca Plc, Nasdaq Global Indexes announced Friday. The change takes effect before markets open on Jan. 20, following the Jan. 19 U.S. market holiday. The inclusion follows Walmart’s shift last year from the NYSE to Nasdaq, the largest exchange transfer on record. Read

JPMorgan to take over Apple Card: JPMorgan Chase will take over as issuer of Apple’s credit card under a deal announced Wednesday, with the card staying on Mastercard as Goldman Sachs exits consumer lending. The roughly $20 billion portfolio pairs Apple’s massive device user base with the largest U.S. bank’s scale and expertise in consumer lending. Read

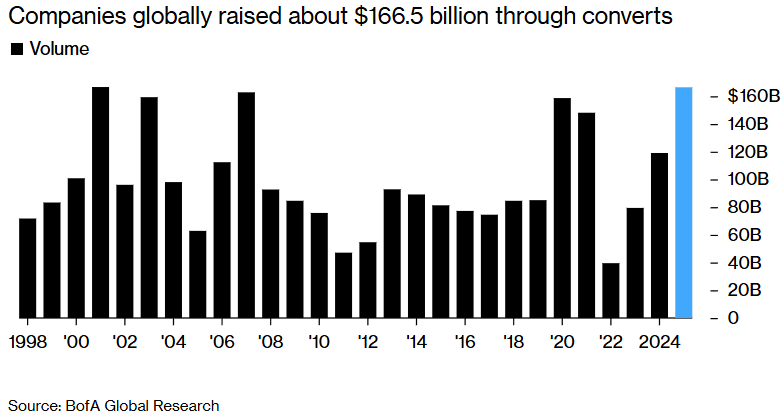

Record Convertible Bond Issuance: Global convertible bond issuance is at a 24-year high, fueled by accelerating AI investment. Issuance reached about $166.5 billion in 2025, with AI-linked companies accounting for roughly 40% of benchmark convertible bond returns last year. Strong refinancing needs and higher equity prices are expected to keep the market robust into 2026. Read

Barclays invests in crypto startup: Barclays, one of the UK’s Big Four banks, has taken a stake in U.S. stablecoin settlement startup Ubyx. Ryan Hayward, Head of Digital Assets and Strategic Investments, said interoperability is critical to unlocking the full potential of digital assets. Financial terms were not disclosed. Read

Saks closes on bankruptcy financing: The parent of Saks Fifth Avenue and Neiman Marcus is nearing a ~$1.25B bankruptcy financing package as it prepares to file for Chapter 11 in the coming days, according to people familiar with the matter. A bondholder group led by Bracebridge Capital and Pentwater Capital has proposed a $1.25B debtor-in-possession loan, expects to take control, and requires the termination of Saks Global’s management team. Read

EARNINGS UPDATE:

Constellation Brands: Reported EPS came in at $2.88, with comparable EPS of $3.06. The Beer business gained both dollar and volume share across U.S. tracked channels, while Wine & Spirits outperformed the higher-end wine segment. YTD operating cash flow totaled $2.1B, with free cash flow of $1.45B. FY2026 EPS is guided to $9.72–$10.02 reported and $11.30–$11.60 comparable, with FCF of $1.3–$1.4B. The company repurchased $824M of shares YTD and declared a $1.02 quarterly dividend.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

13-Jan | JPM | JP Morgan Chase & Company | Before Open |

14-Jan | BAC | Bank of America Corp | Before Open |

14-Jan | C | Citigroup Inc | Before Open |

14-Jan | WFC | Wells Fargo & Company | Before Open |

15-Jan | BLK | Blackrock Inc | Before Open |

15-Jan | GS | Goldman Sachs Group | Before Open |

15-Jan | MS | Morgan Stanley | Before Open |

VIDEO’s OF THE WEEK:

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.