- Primal Thesis

- Posts

- Black Friday Sales Underscore Shoppers' Resilience

Black Friday Sales Underscore Shoppers' Resilience

🛡️ Key Points From Financial Stability Report

🏦 OCC, FDIC, Fed Confirm eSLR Changes

🛍️ Black Friday Sales Rise

🔎 Case For Google’s Dominance

📱 Apple Shipments Beat Samsung In 14 Years

📘 Key Points From The Fed Beige Book

💼 Earnings Season Recap

QUOTE OF THE WEEK:

“If the market believes it needs more rate cuts, it will force it—because we've become so financialized at this point. The Fed is now basically obligated to make sure that we have financial stability to some degree. And they also have an obligation to help Treasury fund the government. So I don't believe the Fed is independent. I believe they're trying to work, you know, in the best interest of Americans. I'm not saying they're dictated by the White House, but they are not independent of the markets. They're not independent of the funding requirements of the U.S. government.” - Mike Wilson, Chief U.S. Equity Strategist and Chief Investment Officer for Morgan Stanley.

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC - EOD 11/28

WEEKLY MARKET WRAP:

Good Afternoon. Markets recovered this week, with all major indices noting robust gains. Some weaker delayed macro data raised hopes of December rate cuts, which helped markets rebound.

Below are the key things to note this week:

Everything Rally:

This week was a recovery week for all risky assets, with one of the strongest weekly gains since April -

Bloomberg

Black Friday Sales Rise:

Black Friday sales rose again this year, signaling that US consumers are still spending through persistent economic uncertainty. Retail sales excluding autos grew 4.1% versus 3.4% last year, based on Mastercard SpendingPulse data covering both online and in-store purchases. The numbers underscore shopper resilience even as higher prices and job-market worries linger, with retailers leaning on broad, though slightly shallower, discounts to draw in cost-conscious buyers. This squashes any remaining fears about the tariff impact and validates my analysis from the April 6th post on tariffs after liberation day.

Case for Google:

A month ago, I talked to a senior executive at Amazon Web Services (AWS). He explained to me that Google, with its full-stack approach, will beat AWS and Microsoft Azure. I missed covering this in this newsletter back then, and thought I would write about it soon. However, I shouldn’t have skipped it. Within a week, Berkshire announced a significant position in Google, and the stock is up ~50% in the last 3 months, while other Mag 7’s are lagging far behind. The recent Gemini updates are also proving far better than the competition:

The two main reasons he had explained to me were - 1. Google is the only major cloud services provider with its own LLM (Gemini), offering clients a seamless full-stack experience. It has a large existing user base that Google can tap into. Both AWS and Microsoft are dependent on OpenAI for their AI offerings. At least Microsoft has some stakes in OpenAI, but the current leader, AWS, is for sure to lose the market to players like Google 2. Currently, cloud is Google's lowest-margin business, whereas for AWS, it’s the highest-margin business. Hence, when Google captures more market share from AWS and others and improves efficiency over time, it has scope to enhance its margin and thereby profits.

For the week:

The S&P 500 is up 4.75%, the Nasdaq is up 5.83%, and the Dow 30 is up 4.29%.

Barchart

CNN's Fear & Greed Index now stands at 24 (Extreme Fear) out of 100, up 16 points from last week. Details here

The top five trending stocks on Reddit are Nvidia, CME Group, SPY, Google, and Meta. Read More

Liquidity:

Banking Reserves + ON RRP: Banking reserves remain around ~$2.9 trillion. ON RRP balance remains immaterial.

Standing Repo Facility (SRF): Steady increase in the SRF balance in last three days with total borrowing at ~$24 billion. At the end of last month, the SRF balance rose to $50 billion, suggesting funding pressure.

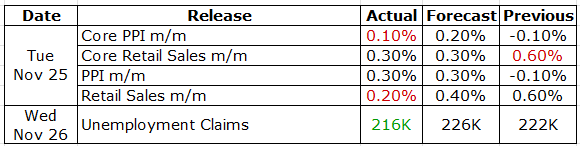

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for December 10th FOMC Meeting:

CURATED INSIGHTS & ANALYSIS:

Earnings Recap:

Below is the QoQ earnings comparison. Earnings were strong in Q3, with YoY growth similar to Q2.

Primal Thesis

Key Points from the Fed Beige Book:

U.S. economic activity was broadly flat in recent weeks, with softer hiring in roughly half the Fed’s districts and a pullback in consumer spending — underscoring growing labor-market concerns ahead of the next rate decision. Below is the table showing the beige book recent trend. Nothing unusual as such to worry about:

Primal Thesis

Little change overall: 2 districts modest decline, one modest growth, most flat/mixed

Consumer spending down; EV sales fell after tax credit expired; luxury travel resilient, international visitors softer

Lower/middle-income households leaned on discounts and promotions; price sensitivity was high

Manufacturing is mixed across districts; tariffs and softer demand are key headwinds

Agriculture, energy, and transportation are generally down to flat

Rate-sensitive sectors (housing, CRE, finance) mixed; some pickup in business lending on lower rates, but activity still muted elsewhere

Employment is largely stable with muted labor demand; more headcount cuts via layoffs/attrition; hours adjusted more than headcount.

Hiring tilted toward temps and part-time; labor supply is tight in hospitality, agriculture, construction, and manufacturing due to immigration changes.

Wages rising modestly to moderately; labor costs up on higher employer health-insurance expenses.

Prices up moderately; input costs faster (imports, insurance, health care, tech); tariff pass-through uneven—some absorb, others pass through fully

Some materials eased on weak demand (e.g., selected steels, lumber)

Outlook split: a few districts expect demand to firm over 6–12 months; many see uncertainty weighing; one highlights government shutdown risk

Key Points from Financial Stability Report:

Key Comparative Takeaways (April 2025 vs November 2025 FSRAsset valuations moved from stressed to elevated again — April highlighted broad price declines after trade-policy shocks, while November noted a complete rebound with valuations back near historical highs and equity risk premia well below average.

Treasury market liquidity improved materially — April liquidity was at historically low levels amid sharp yield volatility; by November, Treasury depth had recovered to or above pre-episode norms across maturities.

Borrowing vulnerabilities eased further — April showed moderate but uneven pressures, especially for high-yield and bank-loan funds; November emphasized business/household debt at 20-year lows relative to GDP.

Household credit quality remained strong in both, but November highlighted rising auto and credit card delinquencies that persist above decade averages.

Financial-sector leverage concerns increased in November — April, with noted vulnerabilities mostly around nonbanks; November explicitly flagged rising hedge-fund leverage across strategies and life-insurer leverage in the top quartile of history.

Funding-risk narrative softened — April stressed elevated outflows in early April and vulnerability from cash-management vehicles; November reported moderate funding risks, declining reliance on uninsured deposits, and a stable MMF composition dominated by government funds.

Stablecoin dynamics diverged sharply — April flagged continued growth and run vulnerability; November highlighted accelerated stablecoin market-cap growth and new regulatory clarity under the GENIUS Act.

Near-term risk perceptions shifted — April’s survey emphasized global trade, policy uncertainty, and fiscal sustainability; November’s respondents focused on policy uncertainty, geopolitics, higher long-term rates, AI-linked asset-price declines, and persistent inflation.

FRONT PAGES:

eSLR Solidified: The FDIC, OCC, and Federal Reserve finalized a rule trimming tier 1 capital requirements for global systemically important banks by less than 2%, or about $13 billion in total. Their depository subsidiaries, however, would see an average 28% reduction in required holdings, per an FDIC memo. The outcome aligns with the Fed’s June proposal, though Tuesday’s changes appear more robust. Read

S&P downgrades USDT: Tether’s ability to hold its dollar peg was cut to S&P Global’s lowest stability rating, with analysts warning that a sharp Bitcoin decline could leave USDT undercollateralized. S&P downgraded the token from “constrained” to “weak,” citing rising exposure to higher-risk assets in its reserves—Bitcoin, gold, secured loans, and corporate bonds—alongside limited disclosure. Read

Apple Beats Samsung: Apple is on track to ship more smartphones than Samsung in 2025 for the first time in 14 years, according to Counterpoint Research. It expects Apple to ship roughly 243 million iPhones versus Samsung’s 235 million, giving Apple a projected 19.4% global market share compared to Samsung’s 18.7%. Read

CME Outage: A data-center fault halted futures and options trading on the Chicago Mercantile Exchange, disrupting activity across equities, FX, bonds, and commodities for hours. The issue stemmed from a cooling system failure at a CyrusOne facility in the Chicago area. Read

EARNINGS UPDATE:

ADI Beat: Q4 EPS came in at $2.26, a slight beat, with revenue up 26% to $3.08B. For fiscal 2025, the company generated $4.8B in operating cash flow and $4.3B in free cash flow—44% and 39% of revenue. It returned 96% of that free cash flow to shareholders, including $2.2B in buybacks and $1.9B in dividends.

Deere & Co Beat: Q4 GAAP EPS came in at $3.93, a $0.10 beat, with revenue at $12.39B, up 11% and ahead by $2.58B. The company guides full-year 2026 earnings between $4.0B and $4.75B.

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

2-Dec | CRWD | Crowdstrike Holdings Inc | After Close |

3-Dec | CRM | Salesforce Inc | After Close |

3-Dec | RY | Royal Bank of Canada | Before Open |

4-Dec | TD | Toronto Dominion Bank | Before Open |

8-Dec | ORCL | Oracle Corp | -- |

VIDEO’s OF THE WEEK:

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.