- Primal Thesis

- Posts

- USDC’s Strategic Advantage in Stablecoins

USDC’s Strategic Advantage in Stablecoins

📉 Better Than Expected CPI

📈 Coincidentally, The Best Day With The Highest Stock Market Returns

🏅 Gold Replaces The Euro As The World's Second-Largest Reserve Asset

💵 Successful Treasury Auctions

🧾 Why Are Tariffs Not Impacting Inflation?

💠 Analysis of USDC’s (Circle) Unique Advantage

QUOTE OF THE WEEK:

“United States is not alone. If China starts to aggressively diffuse its AI technology, so long as all the AI developers are in China, I think China is going to win. So we just have to be mindful of near-term actions on long-term unintended consequences.” - Jensen Huang, Nvidia CEO.

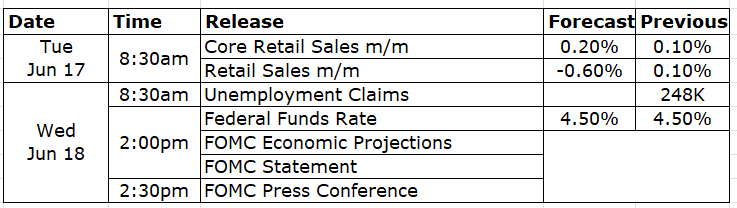

KEY US ECONOMIC EVENTS NEXT WEEK:

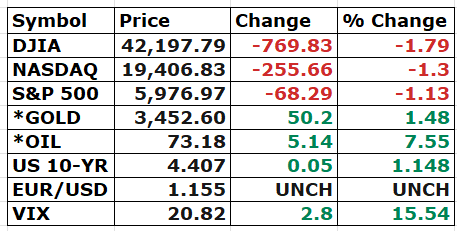

MARKET CLOSE:

CNBC EOD June 13th

WEEKLY MARKET WRAP:

Good Afternoon. A down week for the markets, thanks to the geopolitical risk triggered by Israel-Iran tensions. Markets gave up all gains on Friday as the news of Israel's attack on Iran came. Overall sentiments remain positive, and the macroeconomic data released this week, including the CPI, were also positive.

Below are the key things to note from this week:

Inflation: CPI came at 2.4%, better than the consensus expectation of 2.5%. Not surprisingly, given that you read this newsletter, I provided a detailed analysis last year on why inflation is expected to continue declining. This implies that the Fed's preferred PCE reading, due later this month, will also be favorable. More details on inflation are in the next section.

Labor Market: Initial jobless claims are nearing the 250,000 mark— which is a concern—but the recent uptick still looks like seasonal noise. California and Minnesota, which have experienced similar early-summer spikes in the past, drove most of the rise. That said, the labor market is softer now, hiring is slowing, and continuing claims just hit a post-COVID high.

FOMC Meeting Next Week: The Fed is expected to keep the rates unchanged next week. The CME Fed Watch probabilities indicate an almost 100% chance of this. However, as mentioned above, the softening labor market and cooling inflation in the coming months will make the case for a first rate cut in 2025 in the next couple of meetings.

Chime IPO: Fin tech firm Chime had a successful IPO this week. As mentioned last week, the IPOs are back after a long time, indicating positive confidence in the markets in the near term.

Steel Merger: The Trump administration gave its approval for the merger of Nippon Steel and US Steel this week, which will create one of the world's largest steel companies.

Gold Reserves: The European Central Bank reported this week that Gold has replaced the Euro as the world's second reserve currency. I covered the rise of Gold and the reasons behind it last year. The world is seeking an alternative to the dollar, and Gold has emerged as a strong contender over the last two years. Check this week’s videos, where the Coinbase CEO is hoping that Bitcoin also has the potential to become the world’s reserve currency.

Source: ECB, Financial Times

This week, the US Dollar continued its fall, hitting a three-year low after a renewed tariff threat from Trump.

Source: Financial Times

Treasuries Back In Demand: Treasuries had back-to-back good auctions this week for the 10Y and 30Y maturities. Primary dealers took just 11.4% of the 30-year bonds, which is well below the 14.4% average from the past six auctions, according to BMO Capital Markets. This alleviates the major concerns triggered post-April 2nd tariff announcement about the safest debt asset in the world and shows the world is getting its confidence back in the US.For the week:

The S&P 500 is down 0.39%, the Nasdaq is down 0.63%, and the Dow 30 is down 1.32%.

Source: Barchart

CNN's Fear & Greed Index now stands at 60 (Greed) out of 100, down 3 points from last week. Details here

The top five trending stocks on Reddit are SPY, Tesla, Weight Watchers, Palantir, and UnitedHealth. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for June 18th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Why Tariffs are not Impacting Inflation?

I saw many commentators in mainstream media asking questions as to where the tariff impact is in the inflation. Below are the key reasons why tariffs are not impacting inflation as widely expected:The mainstream media had overestimated the tariff situation and its impact, which should not have been as high as initially thought. Check my detailed analysis in the April 6th issue.

In addition to my analysis on April 6th, there are two more things to note which I haven’t seen mainstream media hilighting:

Tariffs are charged on the import cost and not on the final price. For example, if a merchant is importing an item for $100, the store price may be significantly higher, let’s say $180. So, tariffs are charged on $100, not on $180. The earlier tariff rate was 2%, and now it’s between 10% and 14%. Hence, the tariff on this product will increase from $2 to approximately $12, i.e., a $10 increase.

This $10 tariff in this example has three avenues for absorption: among the importer, exporter, and the consumer. Companies will try to absorb this additional cost as much as possible to minimize its impact on the final consumer, as no one wants to lose market share. So, the bottom line of both corporations in exporting countries and importers in the US will take a hit on earnings. Hence, the net impact of the tariffs will be on corporate earnings rather than on inflation.

Corporate earnings in the US were expected to grow by 12% at the start of this year, but that growth rate is expected to fall. Markets are now realizing that there will be a slowdown in earnings, but no negative growth as such.

There will be some exceptions, such as businesses like Walmart, which operate with lower net profit margins of ~3%. These merchants will increase prices, but they will also try to minimize the impact on the end consumer.

One reason given, and it may be true, is that corporations are still selling inventory acquired before tariffs were implemented.

Overall, inflation is expected to increase by 0.5% by the end of this year, according to most institutional estimates, if the tariff rate remains around 10-14%. I won’t be surprised, though, if the impact is lower than this.

Friday The 13th:

In a unique coincidence, Friday the 13th is reportedly the best day for stock market returns, according to an Axios article.

Source: Axios

Stablecoins Going Mainstream:

The chart below illustrates the growth of the stablecoin market cap over the last five years. With the new administration being highly favorable to crypto and the introduction of the GENIUS Act, stablecoins have arrived. There are two major global players in this race, the USDC (issued by Circle) and USDT (issued by Tether). We can see that the 80% market share is currently captured by these two. The competition is intensifying, with central banks and numerous financial services firms announcing plans to launch their stablecoins, with Société Générale being the first to do so. However, I think USDC (Circle) has a unique advantage, which is discussed further below.

Circle Advantage:

USDC has multiple things going in its favor. Below is my table showing why it will dominate the stablecoin universe in the coming years.Safest among all: USDC is the safest stablecoin among all current players, boasting a straightforward business model. Circle has kept things safe and simple with all of the collateral backing the USDC is either cash or liquid money market funds. With a market cap of approximately $60 billion, it generates around $2.7 billion in interest income from these assets, minus operational costs. The leading competitor, USDT, however, has ~20% invested in other collateral types, which may be of lower quality or illiquid. Additionally, firms like PayPal are heavily reliant on reverse repos, which may create issues for their users in the event of a severe disruption to secured funding markets during times of stress. USDC has no such issues, thanks to its current model.

Source: Financial Times

Bank-issued stablecoins won’t be a threat: If banks proceed with issuing their stablecoins, as recently announced by Société Générale, I don’t think it will pose a real threat to the vanilla stablecoin issuers like Circle. The banks have diverse businesses, which increase risks. Even if banks maintain collateral in accordance with the GENIUS Act requirements, collateral backing stablecoins will still be commingled with the collateral they hold for all other activities. This will make bank-issued stablecoins risky compared to the likes of USDC. In the event of a collapse, a bank-issued stablecoin is likely to fail. Imagine if Silicon Valley Bank had its stablecoin. What would have happened? So I don’t think bank-issued stablecoins will be a real alternative. Only if the Fed issues its stablecoin will it pose a real threat; however, we are uncertain when this will happen. By then, if the USDC is widely adopted, it will be tough for it to be replaced everywhere, from crypto exchanges to De-Fi.Domiciled in the US:

Another significant advantage for USDC is that it is domiciled in the United States. This comes with unique trust that its major competitor, USDT, can’t match. Instead, the Tether CEO has recently stated that they will focus more on foreign markets outside the US, especially if the GENIUS Act is implemented. The ~20% of other types of collateral that USDT holds will likely create issues for it, as the GENIUS Act has strict collateral eligibility rules, which I covered earlier.Conclusion - Double US Market Share with Monopoly:

All the above reasons put USDC in a unique position to dominate at least the US markets, with Tether willing to cede the US markets, according to its CEO’s recent statements, and also the fact that the Trump administration will likely favor a US issuer above all else. USDC is well-positioned to capture the majority of USDT’s US market share, which, according to many estimates, is approximately $60 billion — roughly the same size as USDC’s current market share in the US. So, if all goes well, USDC can easily double its usage in a short time, which would add approximately $2.5 billion in income at current interest rates.

Marketcap and US Footprint

Break-up of USDTs, US market share up for grabs unless USDT changes its model:

USDTs US Market Share

FRONT PAGES:

Gold Replaces Euro: In 2024, gold surpassed the euro as the second-largest global reserve asset, according to a report by the ECB. But analysts warn demand may be peaking. Read

Consumer Sentiment Improves: U.S. consumer sentiment improved in June, as early signs suggest Trump’s trade wars haven’t triggered significant disruption, though views on the economy remain uneasy. The University of Michigan's index rose to 60.5 from May’s 52.2, its first uptick in six months. Read

OpenAI Growth: OpenAI has reached $10B in ARR less than three years after launching ChatGPT, doubling from $5.5B last year. The figure excludes Microsoft licensing and one-time deals. Despite the surge, the company lost about $5B last year. Read

Fintech IPO: Chime Financial jumped 37% on debut, closing at $37.11 and valuing the fintech at over $13B. Another sign of life in the U.S. IPO market. Read

Dollar Sinks: Trump’s renewed tariff threats sent the dollar to a three-year low Thursday, as trade and geopolitical tensions weighed on the currency. The slide followed his plan to notify trading partners of new tariff rates ahead of the 90-day pause ending next month. Read

US Budget Deficit Surge: After a brief surplus in April from tax receipts, the deficit hit $316B for the month, pushing the YTD total to $1.365T. Interest costs on the $36.2T debt topped $92B, once again driving fiscal strain. Read

Soc Gen to Issue Stablecoin: Societe Generale plans to launch a publicly tradable, dollar-backed stablecoin—USD CoinVertible—via its digital asset arm SG-FORGE, becoming the first major bank to enter this space. It will launch on Ethereum and Solana, with trading set to begin in July. Read

Good News on Tariff: Treasury Secretary Scott Bessent said the U.S. may extend Trump’s 90-day tariff pause past July 9 if trading partners show “good faith” in talks. The U.S. is working on deals with 18 key partners, he told the House Ways and Means Committee in Washington. Read

Strong Treasury Auction: Treasury yields fell further after strong demand at a $22B 30-year bond auction, capping a solid week of government sales. The 10-year yield dropped to 4.357% from 4.413% on Wednesday. Read

Source: WSJ

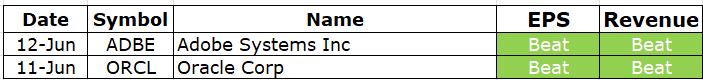

EARNINGS UPDATE:

Adobe Beat: Adobe beat Q2 estimates and raised full-year guidance, citing strong AI-driven demand. Still, shares fell as its Q3 outlook failed to ease concerns about growing competition from AI-native rivals like Canva and Midjourney. Adobe remains at the center of the debate on whether AI will disrupt legacy software leaders. Read

Oracle Beat: Oracle shares jumped 14%, crossing $200 for the first time after raising its annual revenue forecast on strong AI cloud demand. Confidence in software remains firm despite geopolitical risks, though Trump’s tariffs could threaten Big Tech’s AI bets. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

24-Jun | FDX | Fedex Corp | After Close |

25-Jun | MU | Micron Technology | After Close |

25-Jun | PAYX | Paychex Inc | -- |

26-Jun | NKE | Nike Inc | After Close |

VIDEO’s OF THE WEEK:

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.