- Primal Thesis

- Posts

- Zuckerberg Eyes Superintelligence

Zuckerberg Eyes Superintelligence

📉 The FOMC Keeps Rates On Hold As Expected

💻 Microsoft Joins $4 Trillion Club

📈 Strong Earnings Continue

🧠 Why The FOMC Decision Makes Sense

⭐ Terrific 2 Of Mag 7

🎙️ Key Points From The FOMC Press Conference

QUOTE OF THE WEEK:

“Over the last few months, we've begun to see glimpses of our AI systems improving themselves. And the improvement is slow for now, but undeniable and developing superintelligence, which we define as AI that surpasses human intelligence in every way, we think, is now in sight.” - Mark Zuckerberg, CEO, Meta.

KEY US ECONOMIC EVENTS NEXT WEEK:

MARKET CLOSE:

CNBC EOD Aug 2nd

WEEKLY MARKET WRAP:

Good Afternoon. It's a down week for the markets, with all major indices dropping more than 2%. The majority of the losses came after Friday’s weak job report and the fact that the June data was also revised materially down.

Below are the key things to note this week:

FOMC Decision:As expected, the FOMC decided to leave the rates unchanged. The two FOMC members dissented as they wanted a 25-bps rate cut in this meeting. Below is what changed in the Fed statement:

CNBC

Weak Jobs Numbers:The July non-farm payroll data came out significantly weaker than expected (73k vs. a consensus estimate of 106k). May and June figures were also revised lower by over 200,000 jobs. It’s ironic that two days before this data release, FOMC press conference, Jerome Powell mentioned that labor market data is the best data we have on the economy than GDP data (as GDP gets revised). Doesn’t this age well 😃

Unreliable Data:

I talked about the unreliable macro data as a key issue in this newsletter on January 12th - check here. It’s not good to have these large swings, and it looks like President Trump took note this time and ordered the firing of the head of the Bureau of Labor Statistics. At least this will prompt efforts to improve the process to make this data more reliable.

Strong Earnings:

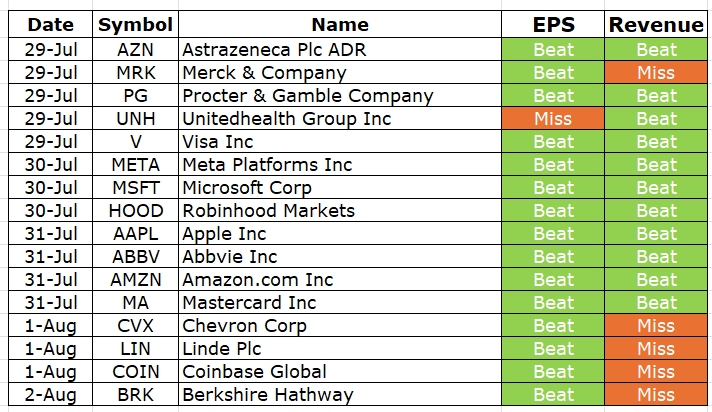

As I mentioned last week, companies continued to report good earnings, including key mag 7s. You will see the sea of green in the earnings dashboard below.

Figma IPO:

Figma, which was supposed to be acquired by Adobe last year, had a stellar IPO this week. The share price surged three times the IPO price. Adobe was initially expected to acquire Figma for $20 billion; however, Figma now boasts a market capitalization of approximately $60 billion. The transaction with Adobe was cancelled due to regulatory non-approvals.Microsoft Hit $4 Trillion:

The second member to join the $4 trillion club

Mag 7 or Terriffic 2?

The Financial Times reported this week that Nvidia and Meta are massively outperforming the Mag 7 group. Time to repost my newsletter, where I covered: Why I will never bet against Mark Zuckerberg 😃. Meta crushed earnings this week, and the stock is up 5.24% for the week. Zuckerberg discussed the development of superintelligence, and Meta has now established “Meta Superintelligence Labs” to focus on developing the next generation of models. As I mentioned in my newsletter on Sept. 19th, Zuckerberg always manages to stay ahead of the competition.

Source: FT

For the week:

The S&P 500 is down 2.36%, the Nasdaq is down 2.17%, and the Dow 30 is down 2.92%.

Source: Barchart

CNN's Fear & Greed Index now stands at 50 (Neutral) out of 100, down 24 points from last week. Details here

The top five trending stocks on Reddit are UnitedHealthcare, SPY, Reddit, Opendoor, and Nvidia. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for September 17th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Why does it make sense for the Fed not to cut rates?

Earlier this week, a publication reached out to me to write an article about why it would be correct for the Fed to keep rates on hold. I wrote below, but I was late in submitting it within the timeline, so it did not get published. Thought of including it here, but note it’s written on Wednesday morning (and not today), so keep that in mind while reading -The FOMC is expected to keep rates steady in today’s meeting. There are three main reasons why keeping rates steady makes sense –

Strong Economy with Jobs: The US economy remains robust based on key macroeconomic data released in recent weeks. Additionally, the ADP non-farm payroll numbers released today exceeded the consensus estimates with 104,000 job gains. The ADP payroll data show job growth in three out of four US regions and across small, mid-sized, and large-sized firms. In addition, according to the advanced estimates of real GDP released today, the US economy grew by 3%, significantly better than expected. It’s clear by now that the tariff impact was exaggerated post-liberation day.

Inflation is still above the Fed target: The Fed’s preferred inflation gauge, the PCE, is set to be released tomorrow, so FOMC won’t have the latest inflation figures when they make their rate decision today. The projections from institutions and the Cleveland Fed expect the core PCE to be ~2.7% (core PCE matters most to the Fed) and the headline number to be ~2.5%, which is still 0.5% over the Fed’s 2% target. However, the Fed follows an average targeting inflation framework, and hence it can allow inflation to fall even further before taking any action. Most of the institutional projections before Liberation Day anticipated the PCE to reach 3% by the end of the year, with the assumption of a 10-12% net tariff rate. Even though the initially announced tariff rate was ~24%, the actual rate post negotiations is expected to be in the range of the initially assumed 10-12%. I believe the PCE will remain between 2.5% and 3% from now until the end of the year and is expected to fall in 2026 after a one-time tariff shock.

Strong corporate earnings and tariff clarity: The latest earnings season kicked off a couple of weeks ago and the companies have reported strong earnings barring few exceptions.

I believe it will be prudent for the Fed to wait till the September meeting so it can assess the impact of tariffs on earnings, inflation, and employment. The economy is performing well and does not require immediate stimulus. There are signs of weakness in the housing market, with home prices falling in one-third of the 100 major markets. I think the Fed chair will keep the rate steady but may discuss this at the FOMC press conference, setting the stage for potential rate cuts in September. The CME FedWatch shows a probability of ~97% that the Fed will keep rates on hold.

Generally, the Fed does not like to surprise the markets and maintain its credibility. Especially now, the FOMC will not take the risk of cutting rates to stay ahead of the curve, fearing it may be labeled as succumbing to political pressure or compromising its independence. President Trump’s criticism of the Fed initially shook markets, but now markets have realized that Trump is not going as far as to sack Powell, or it’s not possible constitutionally. Hence, as long as the Fed chair maintains a positive tone and gives a clear hint of rate cuts in September, markets and Trump both will like it. Two of the FOMC members, Chris Waller and Michelle Bowman, have indicated that they will support a rate cut in today’s meeting. However, I think they remain in the minority, but if they dissent, it will add to the positivity about the September rate cut.Key points from FOMC press conference:

The economy is in a solid position. Both Gross Domestic Product (GDP) and Private Domestic Final Purchase (PDFP) data came as expected. They both have come down significantly, but the labor market remains strong.

Unemployment:

Unemployment has been low for a year, at around 4.1%, and it remains in a narrow range.

Both demand and supply of jobs are going down, and hence the labor market is in balance.

Labor data is of better quality than the GDP data. The primary metric to consider is the Unemployment Rate.

Inflation:

Inflation eased significantly but is above the Fed’s 2% target.

Services inflation eased, but tariffs are now pushing up goods inflation.

Longer-term inflation expectations remain anchored to 2%.

The Fed expects a one-time shift in inflation due to tariffs and will use all available tools from its toolkit to prevent it from having a sustained impact. The overall impact of the tariffs is still unknown.

Even after excluding the tariffs, inflation remains high.

The current policy stance is well-suited to learn more and then take appropriate action.

A substantial amount of macroeconomic data will be released before the next meeting, when the Fed is expected to make a decision.

FRONT PAGES:

Another Crypto Win: The SEC Is Accelerating Crypto’s Path to the Mainstream. This week, it approved two key changes—easing crypto fund trading and expanding investor access. The agency, once skeptical, is now building the rails for Wall Street adoption. Read

Unreliable Macro Data: BLS revised down May and June payrolls by 260K, citing seasonal issues and low survey response rates. Trump called it a “major mistake” and claimed to fire BLS chief Erika McEntarfer. Read

Capital Rules Update: The Fed is drafting a lighter risk-capital rule for big banks, replacing the 1,087-page plan from the Biden era, Bloomberg reports. A new version may be out by early 2026. Read

US Economy Growth: GDP rose 3% in Q2, beating the 2.3% estimate and rebounding from a 0.5% drop in Q1. Consumer spending climbed 1.4%, up from 0.5%. Exports dipped 1.8%, but imports plunged 30.3%, reversing a 37.9% Q1 spike. Read

US-China Possible Truce: The US and China discussed extending their trade war ceasefire, but Treasury Secretary Steven Mnuchin said any decision rests with President Trump. He denied reports of a 90-day extension, calling it just one option on the table. Read

EARNINGS UPDATE:

AstraZeneca Beat: AstraZeneca beat estimates with record $14.46B revenue and $2.17 EPS, driven by oncology, biopharma, and strong U.S. sales. 2025 outlook unchanged: high single-digit revenue growth, low double-digit EPS gain. Read

Merck Mixed: Merck fell Tuesday as earnings did little to calm concerns over Keytruda’s looming patent expiry. It announced $3 billion in annual cost cuts—via job cuts and real estate reductions—to fund new launches and pipeline bets. Read

Procter & Gamble Beat: Procter & Gamble beat quarterly estimates but warned of a $1B pretax hit in fiscal 2026 from higher tariff costs. Read

United Healthcare Mixed: UnitedHealth warns of below-expectation 2025 earnings amid rising costs and operational challenges. CEO Hemsley targets a turnaround with growth on the horizon. The firm battles rising healthcare costs, regulatory heat, and DOJ scrutiny. Read

Visa Beat: Visa beat Q3 estimates but kept its full-year outlook unchanged—EPS growth in low teens, revenue in low double digits. Read

Meta Beat: Meta forecast Q3 revenue well above estimates, with AI once again boosting its core ad business. Shares jumped 11% after hours. Read

Apple Beat: iPhone sales jumped 13% on tariff-driven demand and popular models. However, with tariff costs set to reach $1.1 billion, investor focus has shifted to Apple’s AI roadmap and antitrust risks—despite margin gains and rising service revenue. Read

Microsoft Beat: Microsoft projected record $30B capex for the quarter, signaling strong AI-driven cloud momentum. Azure sales topped $75B annual run rate, beating expectations. Read

Abbvie Beat: AbbVie raised its full-year outlook after reporting better-than-expected earnings, pushing the stock higher in premarket trading. Read

Amazon Beat: Amazon forecast strong Q3 sales but fell short on AWS growth, missing the high bar set by rivals who surpassed Wall Street estimates. Read

Mastercard Beat: Mastercard beat estimates and raised its 2025 revenue outlook, now guiding for growth at the high end of mid-teens vs. prior low-teens forecast. Read

Chevron Mixed: Chevron’s Q2 results reflect years of investment paying off, with record production and Permian output surpassing 1M bpd. It raised its 2026 free cash flow target by $ 2.5 billion. Read

Linde Mixed: Linde beat earnings estimates and plans to expand its commercial space business. It already supplies industrial gases to over 80% of U.S. space launches, including liquid hydrogen for NASA cryogenic engines, CEO Sanjiv Lamba said. Read

Robinhood Beat: Robinhood crushed Q2 estimates, extending its run as the best-performing large-cap U.S. tech stock this year. Revenue surged 45% to $989 million, and net income soared 105% to $386 million. Read

Coinbase Mixed: Coinbase shares fell as Q2 revenue missed estimates, with subscription gains unable to offset weak trading volumes. Net income surged to $1.43 billion, or $5.14/share, aided by a $1.5 billion gain tied to its Circle stake and $362 million from its crypto portfolio. Read

Berkshire Hathaway Mixed: Berkshire Hathaway reported a slight drop in Q2 operating earnings, citing negative impacts from sharp U.S. tariffs. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

2-Aug | BRK.B | Berkshire Hathaway Cl B | Before Open |

4-Aug | PLTR | Palantir Technologies Inc Cl A | After Close |

5-Aug | AMD | Adv Micro Devices | After Close |

5-Aug | AMGN | Amgen Inc | After Close |

5-Aug | ANET | Arista Networks Inc | After Close |

5-Aug | CAT | Caterpillar Inc | Before Open |

5-Aug | ETN | Eaton Corp | Before Open |

6-Aug | DIS | Walt Disney Company | Before Open |

6-Aug | MCD | McDonald's Corp | Before Open |

6-Aug | SHOP | Shopify Inc | Before Open |

6-Aug | UBER | Uber Technologies Inc | Before Open |

7-Aug | LLY | Eli Lilly and Company | Before Open |

7-Aug | TM | Toyota Motor Corp Ltd Ord ADR | -- |

VIDEO’s OF THE WEEK:

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.