- Primal Thesis

- Posts

- Stablecoins and Robo Taxis

Stablecoins and Robo Taxis

🟢 The Fed Leaves Rates Unchanged As Expected

🎤 Key Points From The FOMC Press Conference

🏛️ The Senate Passed The GENIUS Act

🤖 AI Story Is Just Starting

💵 Positive Developments For US Treasuries

📉 One Quote Highlighting How Tariff Concerns Are Grossly Exaggerated

QUOTE OF THE WEEK:

“If the effective tariff got down through negotiations to something like 1% or 10%, and considering that imports make up 10% of the price index, then a 10% tariff on 10% of the goods would only cause a 1% increase in the total price level. And that's assuming it's completely passed through. We already know this isn’t the case. As Chair Powell mentioned in his press conference, everyone has to absorb some of the pain from tariffs, so not all of it will be passed on to consumers. As a result, you might see the price level increase by just 0.3% to 0.5%. But that’s it—it’s not going to lead to persistent inflation.” - Federal Reserve Governor Christopher Waller

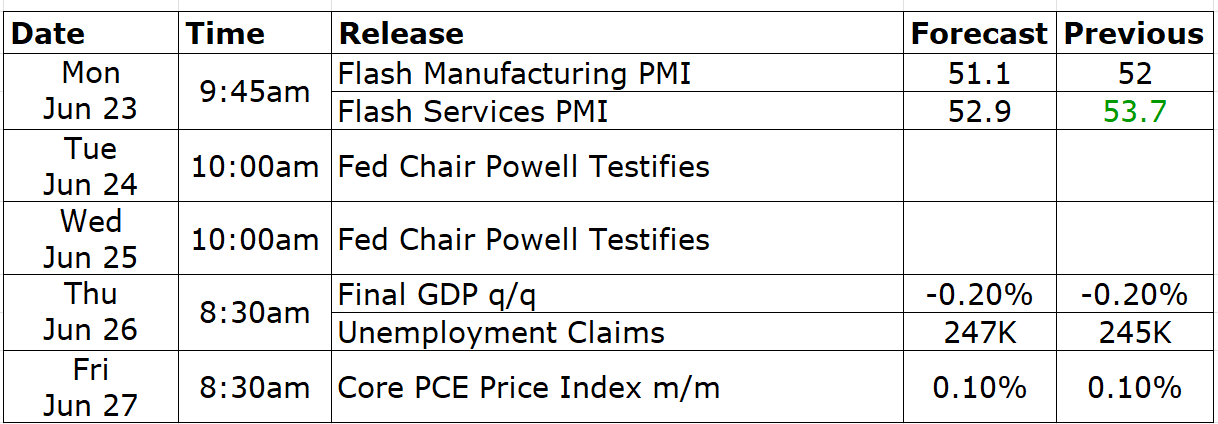

KEY US ECONOMIC EVENTS NEXT WEEK:

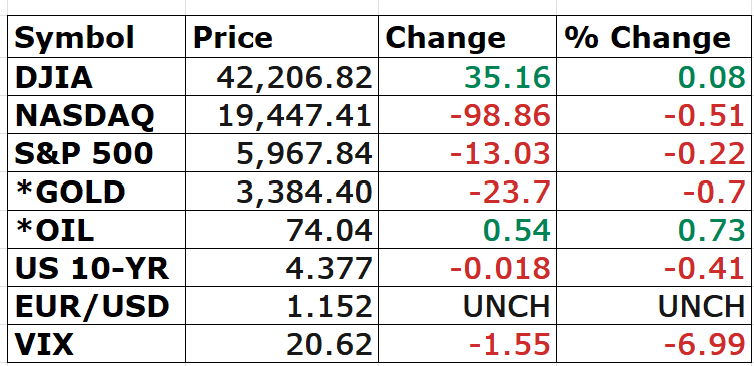

MARKET CLOSE:

CNBC EOD 20th June

WEEKLY MARKET WRAP:

Good Afternoon. Markets cooled off a bit this week, with all major indices down 1%+ for the week. It was a busy week on all fronts, from AI to Robo Taxis to stablecoins to geopolitical events. So much can happen in a week.

Below are the key things to note from the week:

FOMC Decision:

The Fed decided to leave rates unchanged this week. The target range is 4.25%-4.5%, unchanged since December. Below are the key differences between the FOMC statement from last meeting. More details on key points from the FOMC press confernce in next section:

Source: CNBC

Great Week for Stablecoins:

GENIUS Act Passed: The act was passed this week in the Senate with overwhelming bipartisan support. This paves the way for the adoption and growth of stablecoins in the US.

Circle 8X from IPO Price: Last week, I covered the unique proposition of the USDC stablecoin issued by Circle. I am pleased to note that since that post, Circle stock has risen 125% in a week, and it has already increased 8 times from its IPO price. It seems that investors are realizing the potential of stablecoin adoption, and Circle, being the only listed stock, is receiving all the attention. Read last week’s newsletter for details.

AI Story is Validated:

I covered in the past why I will never bet against Mark Zuckerberg. He is a genius who is always ahead of the game and understands the tech landscape better than most. This week, Sam Altman mentioned in one of the podcasts that Meta tried poaching OpenAI employees, offering them $100 million sign-on bonuses with competitive salaries. This demonstrates Mark Zuckerberg's confidence in the future potential of AI and highlights that the AI story is just beginning. Sam also mentioned that none of his employees had left for Meta yet. In an interview on CNBC, Meta CTO Andrew Bosworth was asked about this, and he rightly pointed out that if none of the OpenAI employees left, it shows Sam is paying them to stay with him. You don’t need any other validation to believe that the AI trade is here to stay for quite some time.

US Bombs Iran:

In a major geopolitical news, the US bombed Iran’s nuclear facilities and got directly involved in the Israel vs. Iran war for the first time. If this escalates, it will be detrimental to both the markets and inflation, as oil prices are likely to rise further. Volatility and uncertainty are here to stay.For the week:

The S&P 500 is down 1.28%, the Nasdaq is down 1.09%, and the Dow 30 is down 1.77%.

Source: Barchart

CNN's Fear & Greed Index now stands at 55 (Neutral) out of 100, down 5 points from last week. Details here

The top five trending stocks on Reddit are SPY, Circle, Tesla, Google, and AST Spacemobile. Read More

Here is a summary of this week’s key economic releases:

Target Rate Probabilities for July 30th FOMC Meeting:

CME FedWatch

CURATED INSIGHTS & ANALYSIS:

Good News For Treasuries:

The graph below shows the foreign holdings of US treasuries after the April tariff sell-off. Treasury Secretary Scott Bassent also mentioned that the data he has access to indicates that the April sell-off was due to the deleveraging of a particular type of investor, rather than foreign central banks selling U.S. debt. This in itself is excellent news and shows that the concerns around foreigners ditching US debt were exaggerated. Additionally, there are a couple of positive developments for the $29 trillion US Treasury market. More on it below.

The upward pressure on interest rates in recent times, due to increased term premium and fears of lack of demand for US debt, has raised some concerns. However, the passage of the Genius Act and potential relief in the US Supplemental Ratio requirements for banks are expected to create an additional $4.5 trillion in demand for the US Treasuries. This should help yields go down.Supplemental Leverage Ratio: Bloomberg provided an analysis of the potential impact of SLR relief on the largest banks, including an additional balance sheet capacity of approximately $3.7 trillion.

Stablecoins: According to some institutional estimates, Stablecoin adoption is expected to result in an additional $1 trillion in treasury purchases by 2030. This is a long-term benefit.

Key Points from FOMC Press Conference:

Inflation:

The pass-through of tariffs to consumers is uncertain and difficult to predict.

There are many parties involved, and each one will try to avoid paying tariff costs; however, together they will ultimately pay. — This is what I also mentioned in my tariff analysis on April 6th, and I even went ahead and said that all these parties will try not to pass on costs to consumers. Hence, the inflation impact will be less than the impact on corporate earnings.

Looking ahead, there may be meaningful inflation due to tariffs; therefore, it is advisable to wait for more data to understand the impact better.

Labor Market:

There is a very slow cooling in the job market, but nothing troubling at this time.

Labor supply and demand are diminishing at the same rate. That means if you are out of a job, it's challenging to find a new job, but there are no significant layoffs either.

We have a solid economy with decent growth, and real wages are going up.

The current stance of monetary policy leaves the Fed well-positioned to respond in a timely way to economic developments.

Recent weak housing data does not suggest broader economic weakness. We have a long-run shortage of housing, and rates are also high now. The best thing we can do for the housing market is to restore price stability sustainably and create a strong labor market.

Business sentiments are very different than two months ago, and the general sense is that we will get through this.

The Fed will implement a 10% reduction in headcount through a careful and professional process. This will roll back the headcount growth the Fed had over the last 10 years.

We will continue to determine the appropriate stance of monetary policy based on the incoming data, the evolving outlook, and the balance of risks. We are always forward-looking.

FRONT PAGES:

Rates Unchanged: The Fed held rates steady Wednesday, signaling two cuts later this year despite rising inflation and slowing growth. The FOMC kept its target range at 4.25%-4.5%, unchanged since December. Read

GENIUS Act Passed: The Senate passed the GENIUS Act on Tuesday, setting federal guardrails for U.S. dollar-pegged stablecoins and allowing private firms to issue regulated digital dollars with federal approval. Read

Coinbase - Circle Deal: Coinbase struck a deal to use USDC—the world’s second-largest stablecoin—as collateral for US futures trading. It’s also expanding payments, including USDC integration on e-commerce sites. Read

Tesla Robo-taxi Launch: Tesla’s long-awaited robotaxi hits the streets this weekend, starting in Austin on June 22. The first driverless trip—from factory to customer—is set for Musk’s birthday, June 28. Read

AI Talent War: Meta offered OpenAI staff signing bonuses of up to $100M, along with even larger compensation packages, Altman said. Despite aggressive hiring attempts, none of OpenAI’s top talent has left the company. Read

Perplexity in Demand: Apple has internally discussed a potential acquisition of Perplexity AI, aiming to bolster its AI talent and technology. Read

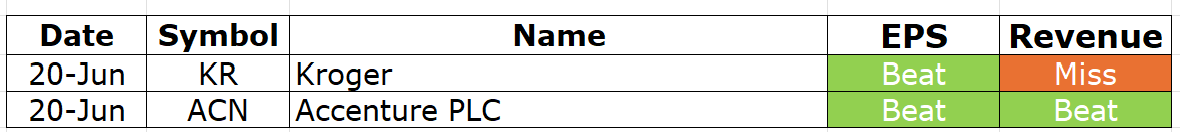

EARNINGS UPDATE:

Accenture Beat: Accenture beat earnings estimates for Q3, but the stock fell as bookings declined again and leadership changes were announced. Read

Kroger Mixed: With economic uncertainty and tariff concerns weighing on consumers, more are dining at home—boosting Kroger’s Q1 profit and sales. Shares posted their biggest gain in over a year as cautious spending drives demand for groceries, said interim CEO Ron Sargent. Read

EARNINGS PREVIEW:

Date | Symbol | Name | Time |

24-Jun | FDX | Fedex Corp | After Close |

25-Jun | MU | Micron Technology | After Close |

25-Jun | PAYX | Paychex Inc | -- |

26-Jun | NKE | Nike Inc | After Close |

VIDEO’s OF THE WEEK:

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Please Share This Newsletter With Your Friends.

Also, check my blog here.

This newsletter's content is for informational and educational purposes only and should not be considered trading or investment recommendations. All the opinions in this newsletter are personal and do not belong to any organization.